Asia Morning: U.S. Dollar, Stocks Ease Before Presidential Debate

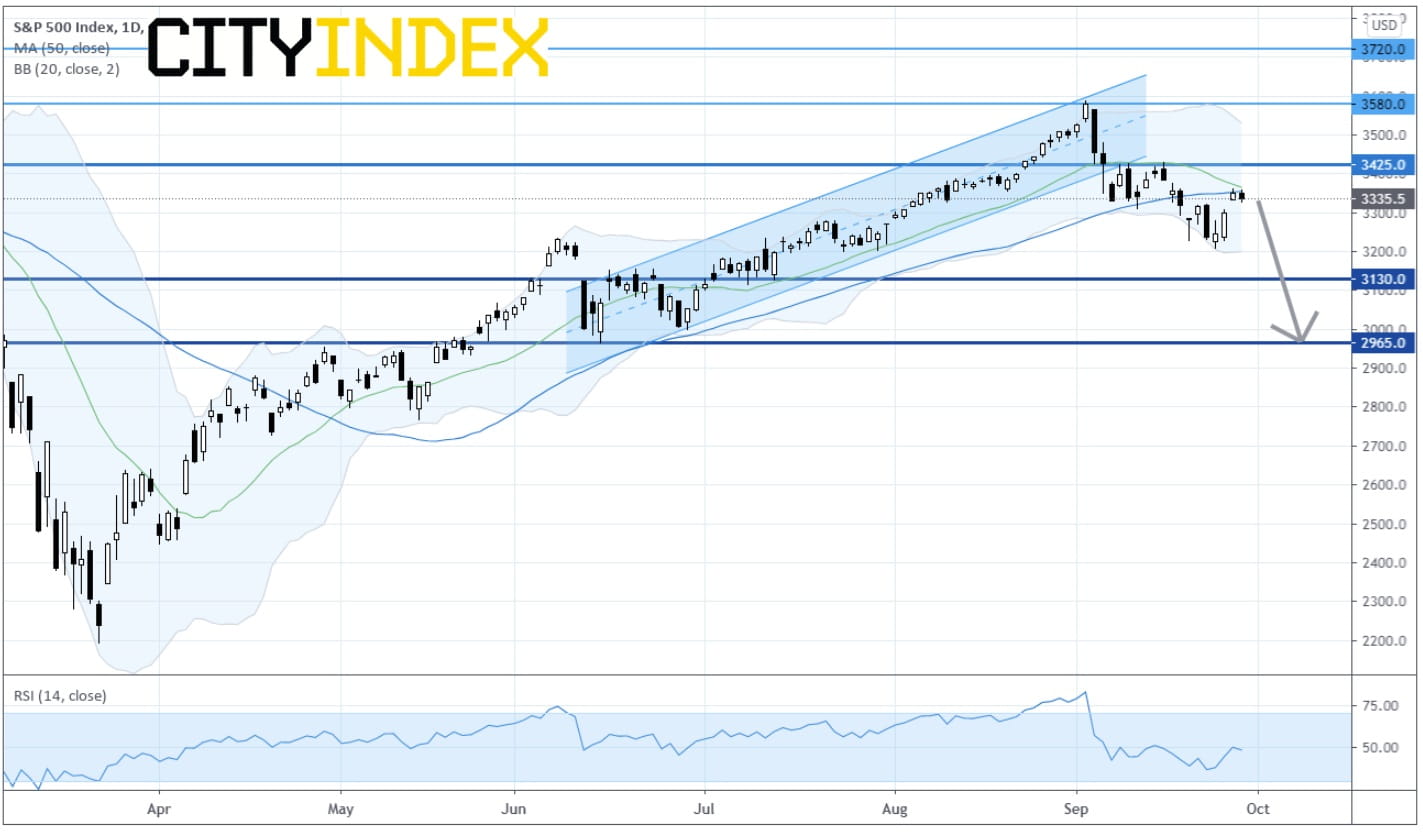

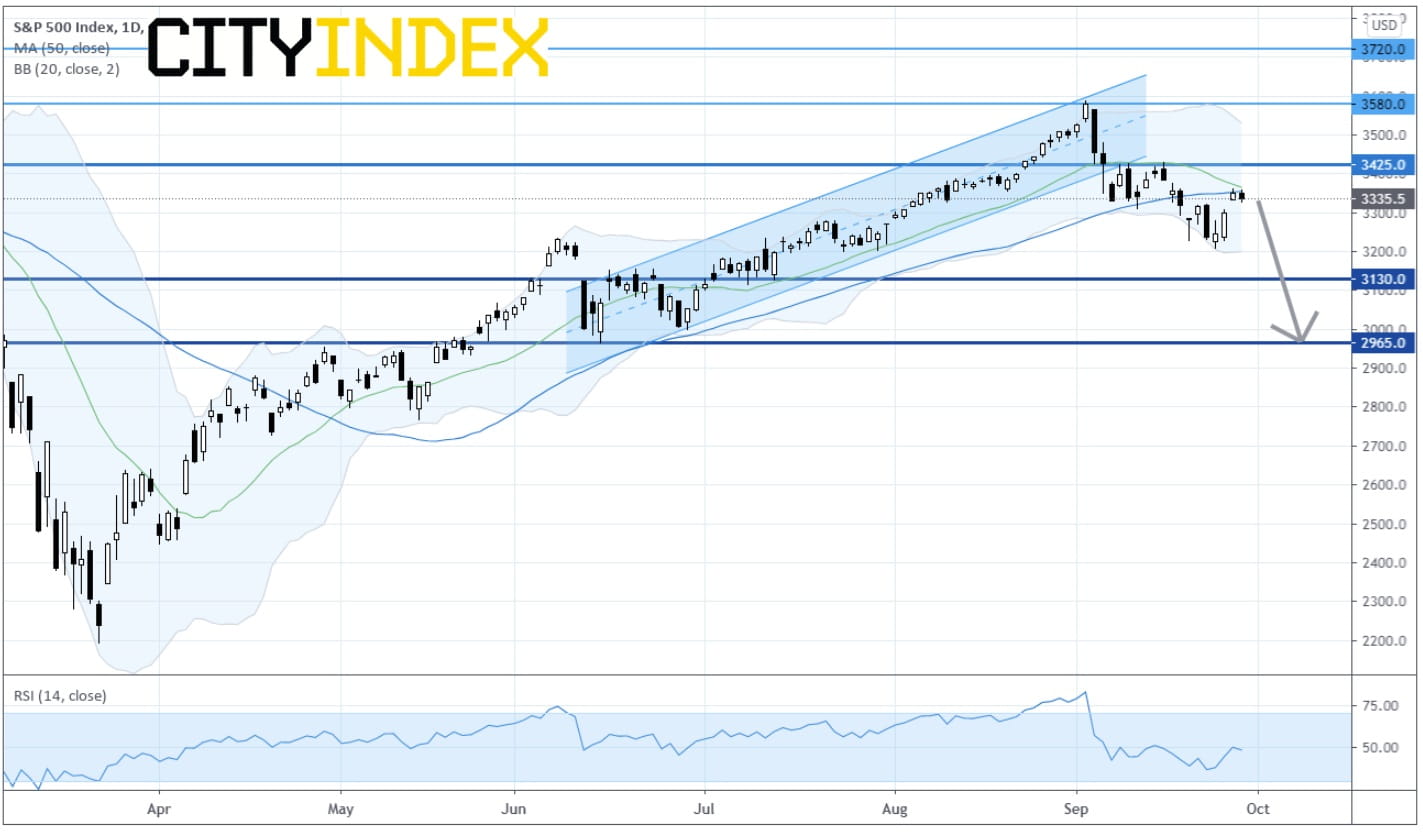

On Tuesday, U.S. stocks paused a three-day rally. The Dow Jones Industrial Average slipped 131 points (-0.48%) to 27452, the S&P 500 dropped 16 points (-0.48%) to 3335, and the Nasdaq 100 was down 41 points (-0.37%) to 11322.

Sources: GAIN Capital, TradingView

Trading in the session was choppy as investors awaited the first presidential debate, to be held later today, between Donald Trump and Joe Biden.

Energy (-2.73%), Banks (-1.4%) and Consumer Services (-1.24%) sectors lost the most. Energy and related stocks, such as Apache (APA -7.11%), National Oilwell Varco (NOV -6.02%) and Halliburton (HAL -5.41%), were among the top losers.

Approximately 61% (57% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average and 42% (21% in the prior session) were trading above their 20-day moving average.

Regarding U.S. economic data, the Conference Board Consumer Confidence Index spiked to 101.8 in September (90.0 expected) from 86.3 in August, the biggest jump since April 2003.

European stocks ended in negative territory. The Stoxx Europe 600 Index declined 0.52%, Germany's DAX 30 dropped 0.35%, France's CAC 40 slipped 0.23%, and the U.K.'s FTSE 100 was down 0.51%.

U.S. Treasury prices was steady, as the benchmark 10-year Treasury yield was down to 0.645%.

Spot gold rebounded for a second day adding $16.00 to $1,898 an ounce.

Oil prices were pressured by downbeat oil demand predictions by various oil-industry participants. U.S. WTI crude oil futures (November) shed 3.2% to $39.29 a barrel, the lowest level in two weeks.

On the forex front, the U.S. dollar eased further against other major currencies, as the ICE Dollar Index fell 0.42% to 93.87.

EUR/USD rebounded for a second session jumping 0.66% to 1.1743. The pair's failure to break below the key 1.1600 level should have trigger some short covering.

GBP/USD climbed 0.22% to 1.2863. Bank of England Governor Andrew Bailey pointed out that policy makers have not reached any judgment on whether to introduce negative interest rates.

USD/JPY gained 0.15% to 105.65.

The Australian dollar outperformed its G10 currency peers, as AUD/USD advanced 0.84% to 0.7130.

The Canadian dollar was pressured by tumbling oil prices, as USD/CAD was up 0.13% to 1.3387.

The S&P 500 Index: Daily Chart

Sources: GAIN Capital, TradingView

Trading in the session was choppy as investors awaited the first presidential debate, to be held later today, between Donald Trump and Joe Biden.

Energy (-2.73%), Banks (-1.4%) and Consumer Services (-1.24%) sectors lost the most. Energy and related stocks, such as Apache (APA -7.11%), National Oilwell Varco (NOV -6.02%) and Halliburton (HAL -5.41%), were among the top losers.

Approximately 61% (57% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average and 42% (21% in the prior session) were trading above their 20-day moving average.

Regarding U.S. economic data, the Conference Board Consumer Confidence Index spiked to 101.8 in September (90.0 expected) from 86.3 in August, the biggest jump since April 2003.

European stocks ended in negative territory. The Stoxx Europe 600 Index declined 0.52%, Germany's DAX 30 dropped 0.35%, France's CAC 40 slipped 0.23%, and the U.K.'s FTSE 100 was down 0.51%.

U.S. Treasury prices was steady, as the benchmark 10-year Treasury yield was down to 0.645%.

Spot gold rebounded for a second day adding $16.00 to $1,898 an ounce.

Oil prices were pressured by downbeat oil demand predictions by various oil-industry participants. U.S. WTI crude oil futures (November) shed 3.2% to $39.29 a barrel, the lowest level in two weeks.

On the forex front, the U.S. dollar eased further against other major currencies, as the ICE Dollar Index fell 0.42% to 93.87.

EUR/USD rebounded for a second session jumping 0.66% to 1.1743. The pair's failure to break below the key 1.1600 level should have trigger some short covering.

GBP/USD climbed 0.22% to 1.2863. Bank of England Governor Andrew Bailey pointed out that policy makers have not reached any judgment on whether to introduce negative interest rates.

USD/JPY gained 0.15% to 105.65.

The Australian dollar outperformed its G10 currency peers, as AUD/USD advanced 0.84% to 0.7130.

The Canadian dollar was pressured by tumbling oil prices, as USD/CAD was up 0.13% to 1.3387.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM