Asia Morning: S&P 500 and Nasdaq 100 at Record Highs Again

On Wednesday, U.S. stocks extended their rally. Nasdaq 100 advanced for a fourth straight session, adding 127 points (+1.0%) to 12420, and S&P 500 jumped 54 points (+1.5%) to 3580, both hitting fresh records. The Dow Jones Industrial Average surged 454 points (+1.6%) to 29100.

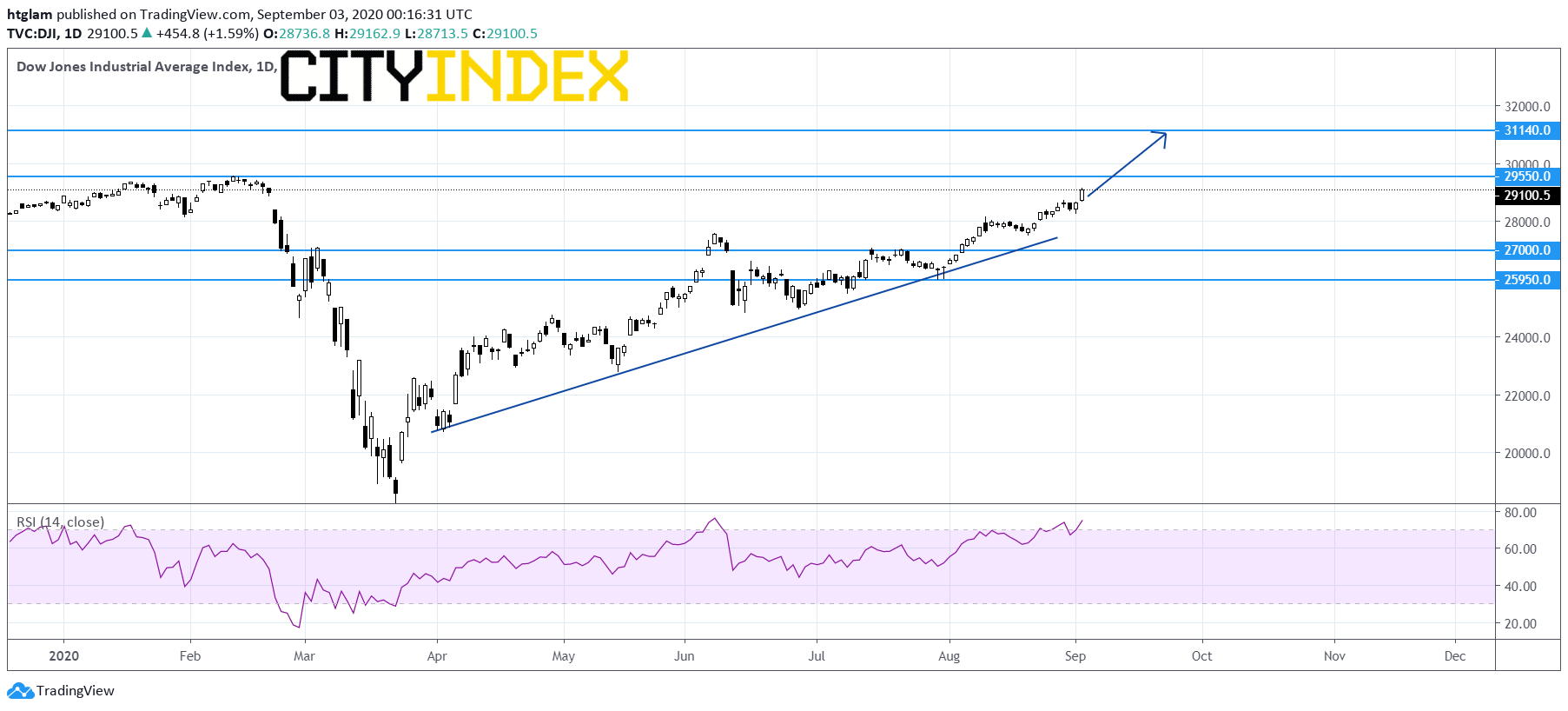

Dow Jones Industrial Average daily chart:

Source: Gain Capital, TradingView

Automobiles & Components (+3.14%), Utilities (+3.12%) and Semiconductors & Semiconductor Equipment (+2.87%) sectors led the rally. Approximately 62.2% of stocks in the S&P 500 Index were trading above their 200-day moving average and 61.2% were trading above their 20-day moving average.

Regarding U.S. economic data, ADP private jobs increased 428,000 in August (+1 million expected) and factory orders grew 6.4% on month in July (+6.1% expected).

Later today, investors will focus on the Institute for Supply Management's Services PMI for August (57.0 expected) and initial jobless claims for the week ending August 29 (0.95 million expected).

European stocks were broadly higher. The Stoxx Europe 600 Index rallied 1.8%, Germany's DAX 30 rose 2.1%, France's CAC 40 gained 1.9% and the U.K.'s FTSE 100 was up 1.4%.

The benchmark U.S. 10-year Treasury yield fell to 0.6477% from 0.6689% Tuesday, posting a four-day decline.

WTI crude oil futures (October) slid 2.9% to $41.51 a barrel, pressured by the rebound in U.S. dollar. Meanwhile, the U.S. Energy Information Administration (EIA) reported that crude oil inventories dropped 9.36M barrels in the week ending August 28 (-2.14 million barrels expected).

Spot gold sank 1.4% to $1,943 an ounce, as the U.S. dollar gained strength.

On the forex front, the U.S. dollar strengthened for a second straight session, with the ICE Dollar Index gaining 0.4% on day to 92.65.

EUR/USD dropped 0.5% to 1.1854. Official data showed that German retail sales declined 0.9% on month in July (+0.5% expected). Later today, the eurozone's retail sales data for July will be released (+1.0% on month expected).

GBP/USD slipped 0.2% to 1.3354. European Union's chief negotiator Michel Barnier said he was "worried and disappointed" about the lack of concessions from the British government.

USD/JPY climbed 0.3% to 106.22, posting a three-day rally.

AUD/USD slid 0.5% to 0.7336. Government data showed that the Australian economy contracted 6.3% on year in the second quarter (-5.1% expected).

Other commodity-linked currencies were broadly higher against the greenback. NZD/USD edged up 0.2% to 0.6769, while USD/CAD fell 0.1% to 1.3045.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM