Asia Morning: US Stocks Rally, ADP Jobs in Focus

On Tuesday, U.S. stocks closed higher. S&P 500 rose 26 points (+0.8%) to 3526 and Nasdaq 100 climbed 182 points (+1.5%) to 12292, both at fresh records. The Dow Jones Industrial Average gained 215 points (+0.8%) to 28645.

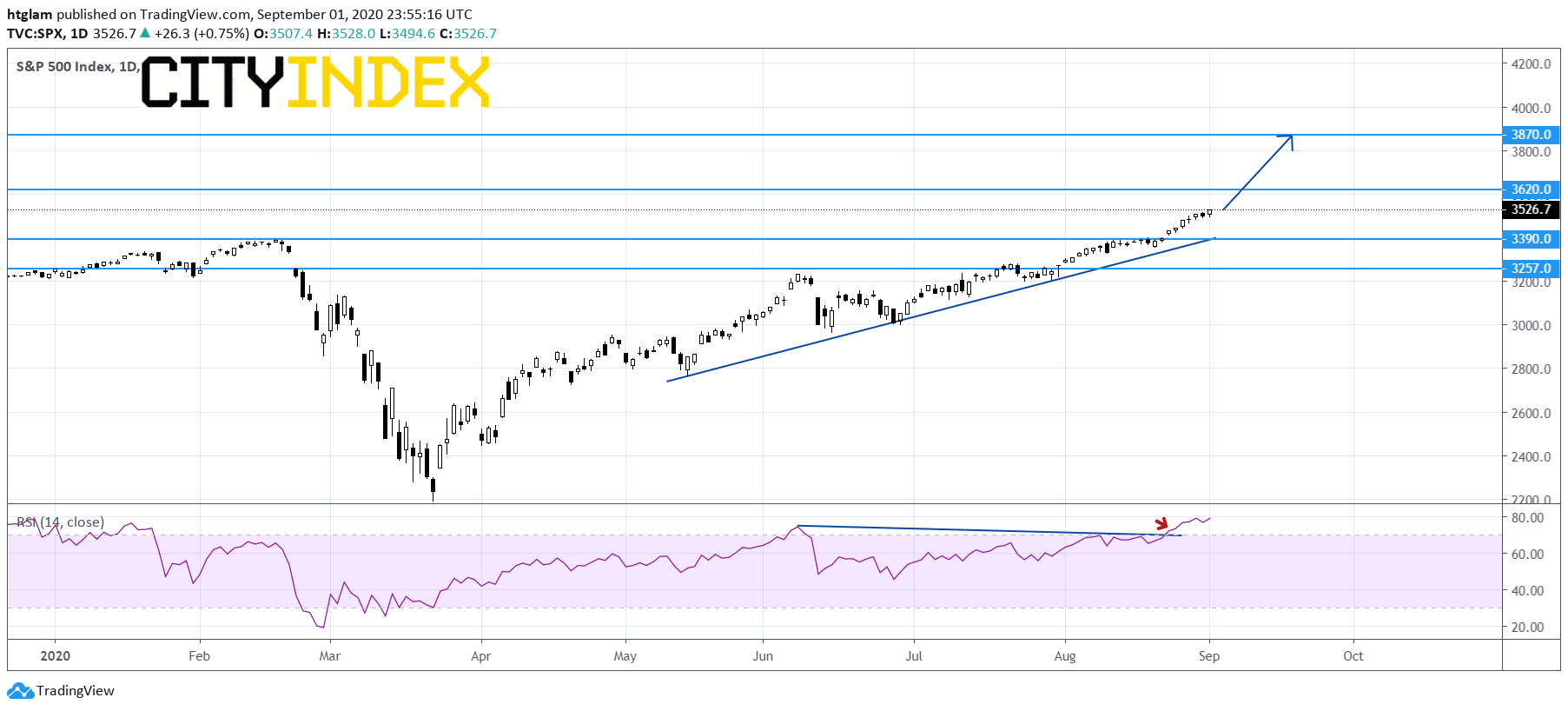

S&P 500 daily chart:

Source: Gain Capital, TradingView

Technology Hardware & Equipment (+3.22%), Food & Staples Retailing (+2.94%) and Materials (+2.75%) sectors led the rally. Approximately 62.4% of stocks in the S&P 500 Index were trading above their 200-day moving average and 61.4% were trading above their 20-day moving average.

Regarding U.S. economic data, ISM Manufacturing PMI rose to 56.0 in August (54.8 expected) from 54.2 in July, and construction spending grew 0.1% on month in July (+1.0% expected).

U.S. ADP private jobs report for August will be today's focus (+1 million expected). Meanwhile, July factory orders (+6.1% on month expected) and the Federal Reserve's Beige Book will also be released.

European stocks were mixed. The Stoxx Europe 600 Index advanced 0.2% and Germany's DAX 30 added 0.2%, while France's CAC 40 fell 0.2% and the U.K.'s FTSE 100 sank 1.7%.

The benchmark U.S. 10-year Treasury yield slid to 0.6689% from 0.7048% Tuesday, down for a third straight session.

WTI crude oil futures (October) advanced 0.4% to $42.76 a barrel. The American Petroleum Institute (API) reported that U.S. crude-oil inventories dropped 6.36 million barrels in week ending August 28 (-1.89 million barrels expected).

Spot gold edged up 0.1% to $1,970 an ounce.

On the forex front, the ICE U.S. Dollar Index marked a day-low of 91.75 before closing up 0.1% to 92.31.

EUR/USD slipped 0.1% to 1.1919, after briefly breaking above the 1.2000 level. European Central Bank Executive Board member Philip Lane said "the euro-dollar rate does matter". On the other hand, official data showed that the eurozone's CPI fell 0.2% on year in August (+0.2% expected), while jobless rate climbed to 7.9% in July (8.0% expected) from 7.7% in June.

GBP/USD gained 0.2% to 1.3393.

USD/JPY was little changed at 105.93.

AUD/USD was broadly flat at 0.7375. The Reserve Bank of Australia kept its benchmark rate unchanged at 0.25% as expected.

USD/CAD edged up 0.1% to 1.3062, snapping a five-day decline. The Markit Canada Manufacturing PMI advanced to 55.1 in August from 52.9 in July.

Meanwhile, NZD/USD climbed 0.4% to 0.6761. New Zealand's second quarter Terms of Trade Index rose 2.5% on quarter (+0.6% expected), according to the government.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM