On Wednesday, the three major U.S. stock indices rebounded after a three-day decline. The Dow Jones Industrial Average rose 439 points (+1.6%) to 27940 and S&P 500 climbed 67 points (+2.0%) to 3398 and Nasdaq 100 gained 293 points (+2.7%) to 11141.

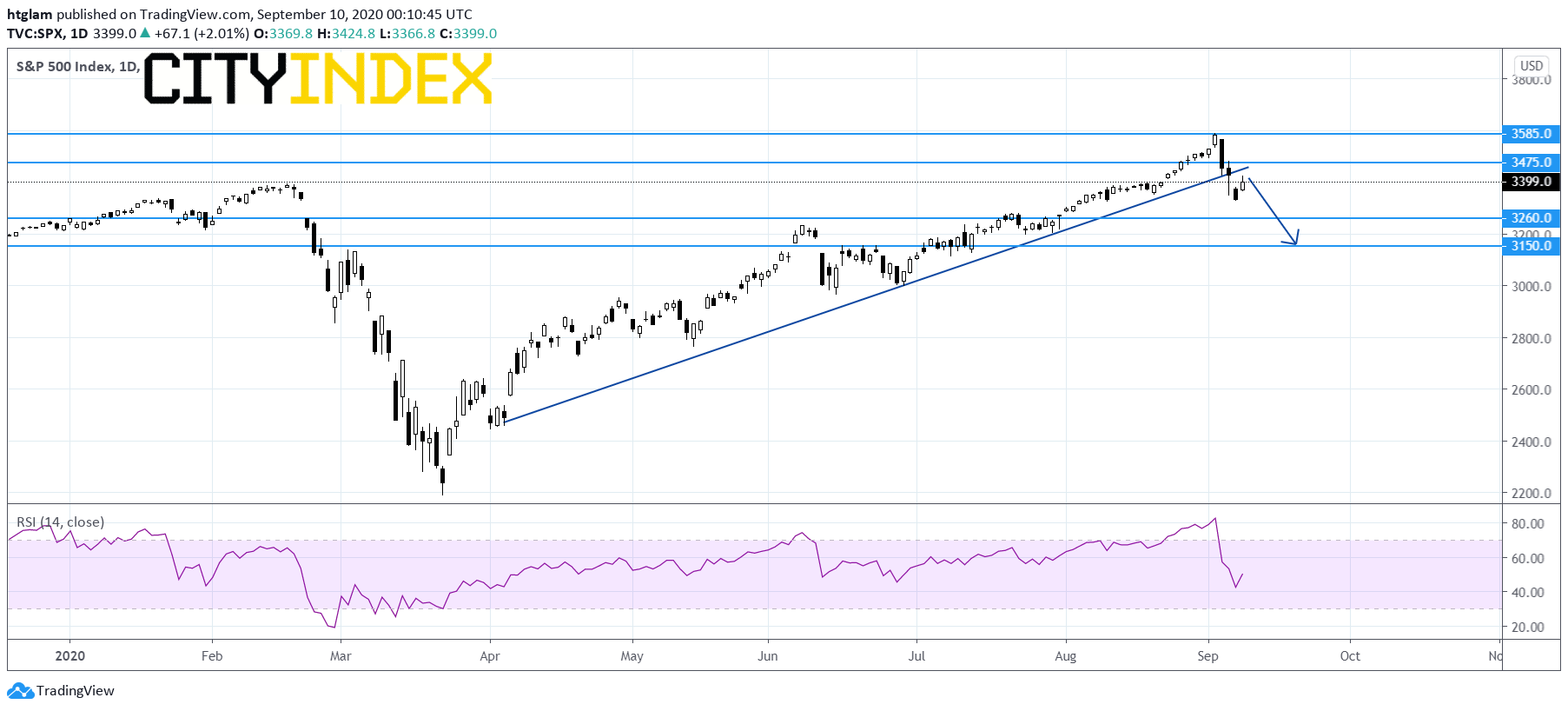

S&P 500 daily chart:

Source: Gain Capital, TradingView

Source: Gain Capital, TradingView

Technology Hardware & Equipment (+3.42%), Software & Services (+3.35%) and Semiconductors & Semiconductor Equipment (+3.22%) sectors gained the most. Approximately 59.4% of stocks in the S&P 500 Index were trading above their 200-day moving average and 27.3% were trading above their 20-day moving average.

Later today, European Central Bank's interest rates decision will be the key focus (expected to be unchanged). Meanwhile, the U.S. Labor Department will report July PPI (-0.3% on year expected) and initial jobless claims in the week ending September 5 (0.85 million expected).

European stocks were broadly higher. The Stoxx Europe 600 Index advanced 1.8%, Germany's DAX 30 jumped 2.1%, France's CAC 40 and U.K.'s FTSE 100 were up 1.4%.

The benchmark U.S. 10-year Treasury yield bounced to 0.7001% from 0.6788% Tuesday.

WTI crude oil futures (October) rebounded 3.5% to $38.05 a barrel, following a 7.6% decline in the prior session. The American Petroleum Institute (API) reported that U.S. crude-oil inventories increased 2.97 million barrels in the week ending September 4 (-1.89 million barrels expected).

Spot gold gained 0.8% to $1,947 an ounce.

On the forex front, the U.S. dollar eased against its major peers, with the ICE Dollar Index slipping 0.3% on day to 93.24.

EUR/USD rose 0.2% to 1.1806. The European Central Bank is expected to hold its key rates unchanged later in the day, while it is reported that some policy makers have gained more confidence in the bloc's economic outlook.

GBP/USD marked a day-low of 1.2886 before closing 0.1% higher at 1.3003.

USD/JPY gained 0.2% to 106.20. This morning, official data showed that Japan's core machine orders grew 6.3% on month in July (+2.0% expected).

USD/CAD retreated 0.6% to 1.3151. The Bank of Canada kept its benchmark rate unchanged at 0.25% as expected and maintained its large-scale asset purchases of at least 5 billion Canadian dollars per week of government bonds.

Other commodity-linked currencies were broadly higher against the greenback, AUD/USD rebounded 0.9% to 0.7279 and NZD/USD bounced 1.0% to 0.6684.