Asia Morning: U.S. Stocks Post Modest Losses

On Wednesday, U.S. stocks posted modest losses after a choppy session. The Dow Jones Industrial Average fell 98 points (-0.35%) to 28210, the S&P 500 dropped 7 points (-0.22%) to 3435, and the Nasdaq 100 eased 12 points (-0.11%) 11665.

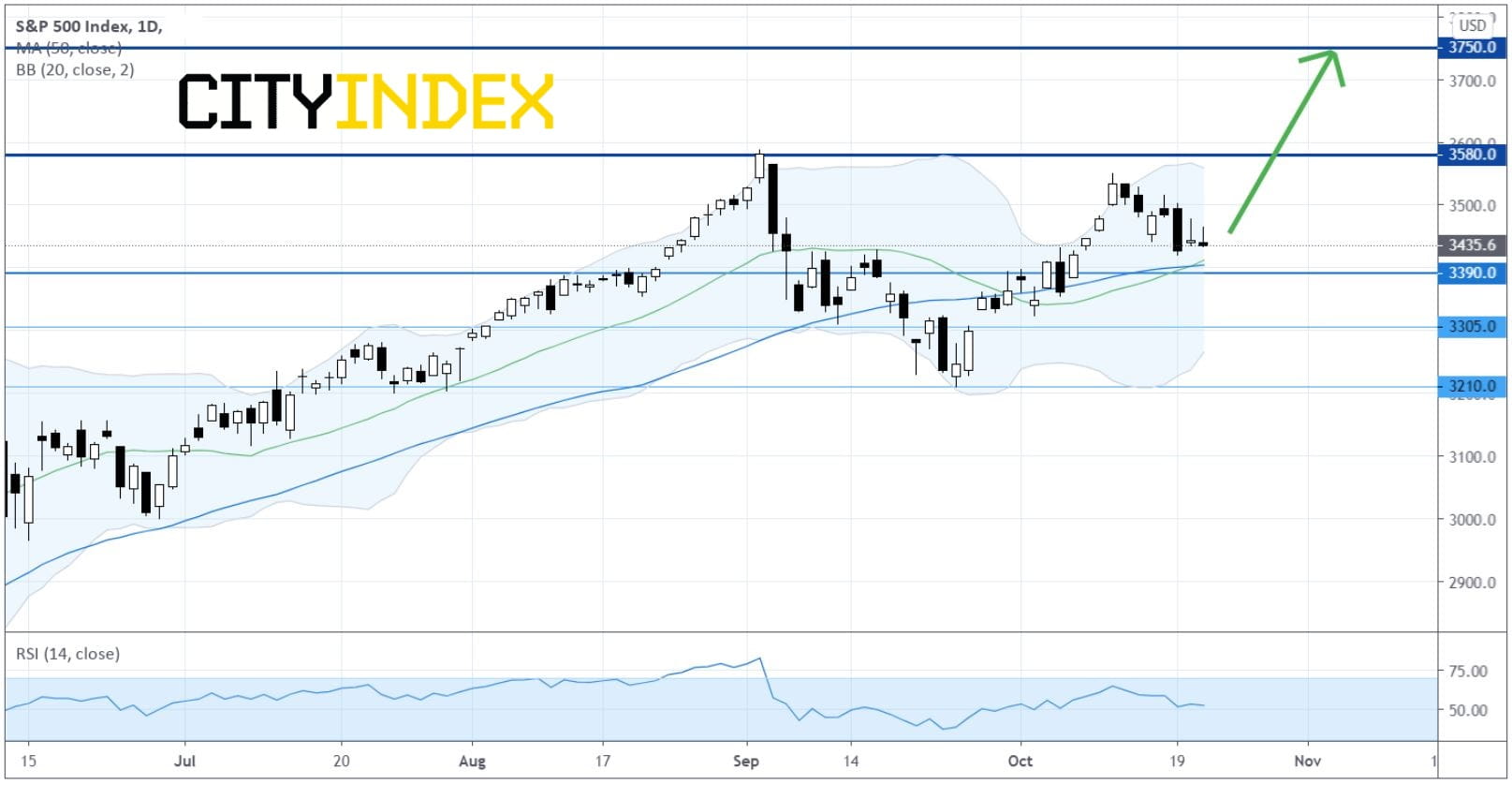

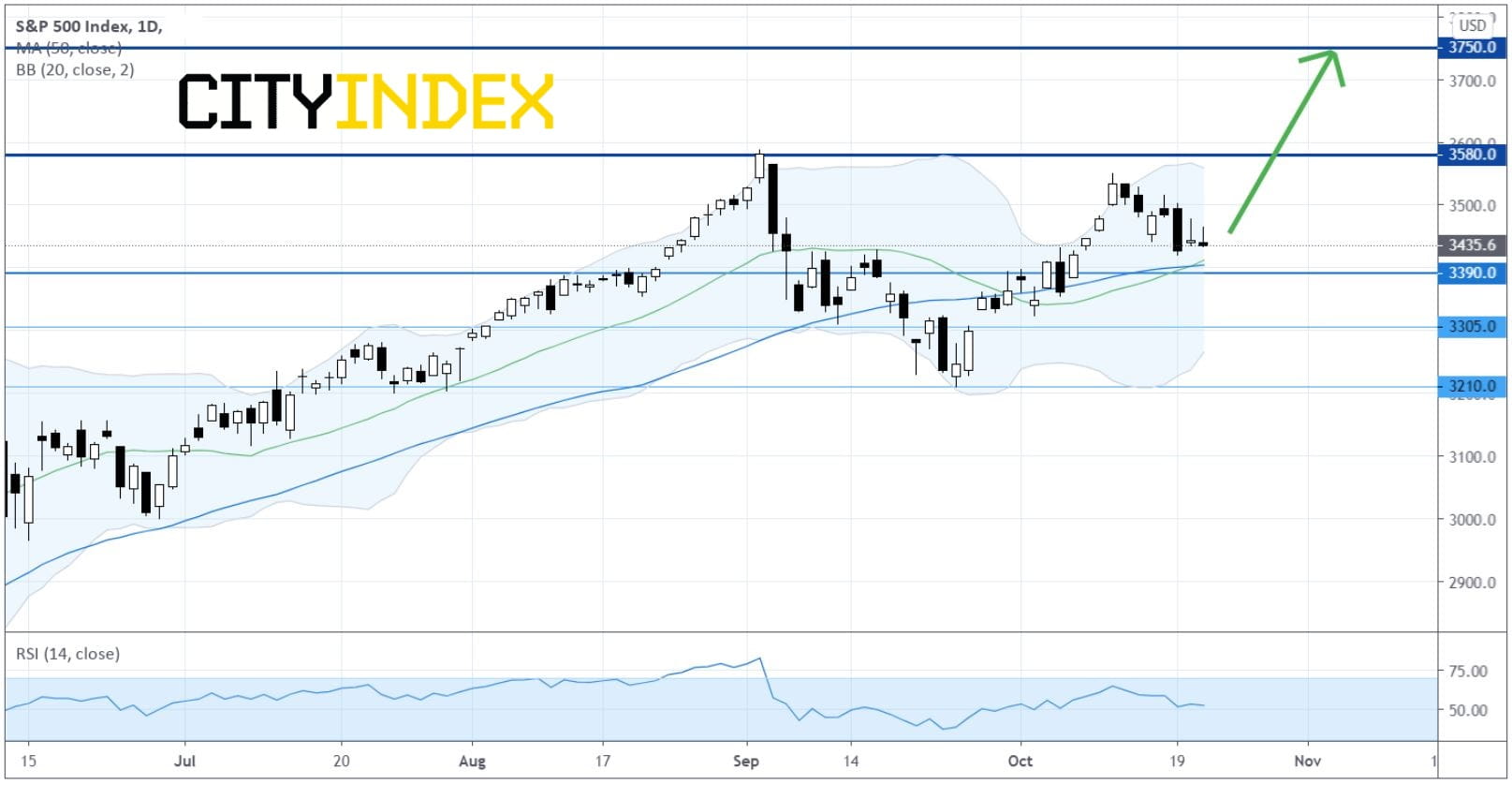

S&P 500 Index (Daily Chart) : Bullish Above 3390

Sources: GAIN Capital, TradingView

U.S. White House Chief of Staff Mark Meadows said in a TV interview that a stimulus deal is near. In a separate interview, House Speaker Nancy Pelosi also said there are hopes for a deal.

Energy (-1.99%), Transportation (-1.75%) and Diversified Financials (-0.87%) sectors lost the most. Netflix (NFLX -6.92%) was the top loser.

PayPal (PYPL +5.50%) surged after announcing plans to let customers buy and sell crypto-currencies using their PayPay accounts.

In after-market hours, Tesla (TSLA) climbed over 2% after reporting record quarterly profit.

The U.S. Federal Reserve said in its Beige Book economic report that all districts have seen continued growth at a moderate pace since the downturn. The central bank added that employment increased across all districts and prices rose modestly.

European stocks were broadly lower. The Stoxx Europe 600 Index fell 1.29%, Germany's DAX 30 sank 1.41%, France's CAC 40 declined 1.53%, and the U.K.'s FTSE 100 shed 1.91%.

U.S. Treasury prices sank further, as the benchmark 10-year Treasury yield jumped to a five-month high of 0.815% from 0.795% Tuesday.

Spot gold rose $18 (+0.94%) to $1,924 an ounce.

Oil prices tumbled after the U.S. Energy Information Administration reported increased gasoline inventories last week, which indicated weak demand for fuel. U.S. WTI crude futures (December) fell $1.71 (-4.1%) to $39.99 a barrel.

On the forex front, the U.S. dollar widened its weakness against other major currencies amid a looming fiscal stimulus deal. The ICE Dollar Index dropped 0.48% to a 7-week low of 92.61 posting a four-session losing streak.

GBP/USD surged 1.56% 1.3149, the highest close since September 7. News reports said U.K. and European Union negotiators are to resume trade talks with an aim to reach a deal by mid-November. U.K. official data showed that consumer prices increased 0.5% on year in September (+0.6% expected).

EUR/USD rose 0.33% to 1.1861. On a daily chart the pair has swung up to the upper Bollinger band.

USD/JPY accelerated to the downside after losing the key 105.00 level, tumbling 0.86% to 104.59.

AUD/USD rebounded 0.98% to 0.7117 ending a five-session decline.

USD/CNH (offshore yuan) slipped 0.27% to 6.6439, the lowest level since July 2018.

S&P 500 Index (Daily Chart) : Bullish Above 3390

Sources: GAIN Capital, TradingView

U.S. White House Chief of Staff Mark Meadows said in a TV interview that a stimulus deal is near. In a separate interview, House Speaker Nancy Pelosi also said there are hopes for a deal.

Energy (-1.99%), Transportation (-1.75%) and Diversified Financials (-0.87%) sectors lost the most. Netflix (NFLX -6.92%) was the top loser.

PayPal (PYPL +5.50%) surged after announcing plans to let customers buy and sell crypto-currencies using their PayPay accounts.

In after-market hours, Tesla (TSLA) climbed over 2% after reporting record quarterly profit.

The U.S. Federal Reserve said in its Beige Book economic report that all districts have seen continued growth at a moderate pace since the downturn. The central bank added that employment increased across all districts and prices rose modestly.

European stocks were broadly lower. The Stoxx Europe 600 Index fell 1.29%, Germany's DAX 30 sank 1.41%, France's CAC 40 declined 1.53%, and the U.K.'s FTSE 100 shed 1.91%.

U.S. Treasury prices sank further, as the benchmark 10-year Treasury yield jumped to a five-month high of 0.815% from 0.795% Tuesday.

Spot gold rose $18 (+0.94%) to $1,924 an ounce.

Oil prices tumbled after the U.S. Energy Information Administration reported increased gasoline inventories last week, which indicated weak demand for fuel. U.S. WTI crude futures (December) fell $1.71 (-4.1%) to $39.99 a barrel.

On the forex front, the U.S. dollar widened its weakness against other major currencies amid a looming fiscal stimulus deal. The ICE Dollar Index dropped 0.48% to a 7-week low of 92.61 posting a four-session losing streak.

GBP/USD surged 1.56% 1.3149, the highest close since September 7. News reports said U.K. and European Union negotiators are to resume trade talks with an aim to reach a deal by mid-November. U.K. official data showed that consumer prices increased 0.5% on year in September (+0.6% expected).

EUR/USD rose 0.33% to 1.1861. On a daily chart the pair has swung up to the upper Bollinger band.

USD/JPY accelerated to the downside after losing the key 105.00 level, tumbling 0.86% to 104.59.

AUD/USD rebounded 0.98% to 0.7117 ending a five-session decline.

USD/CNH (offshore yuan) slipped 0.27% to 6.6439, the lowest level since July 2018.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM