Asia Morning: U.S. Stocks Gain Big on Election Day

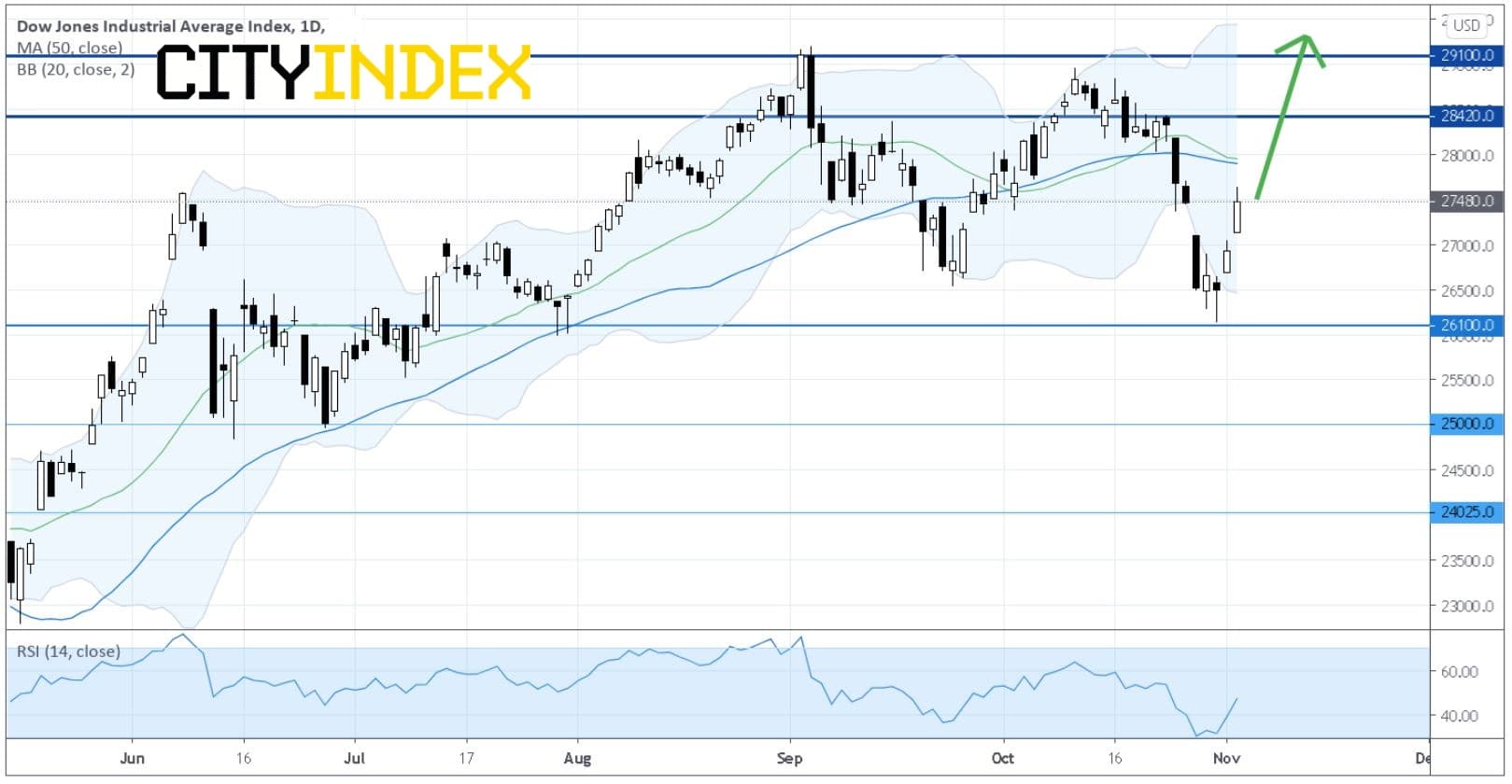

On Tuesday - the presidential election day - U.S. stocks posted strong gains for the second session. The Dow Jones Industrial Average surged 555 points (+2.06%) to 27480, the S&P 500 rose 58 points (+1.78%) to 3369, and the Nasdaq 100 was up 195 points (+1.76%) to 11279.

Dow Jones Industrial Average (Daily Chart) : Rebound Continues

Sources: GAIN Capital, TradingView

The rally was broad as 10 of 11 major S&P sectors closed higher, led by Commercial & Professional Services (+3.08%), Capital Goods (+2.95%) and Transportation (+2.73%). Arista Networks (ANET +15.44%), Gartner (IT +12.62%), Nordstrom (JWN +9.69%) and Macy’s (M +8.39%) were top gainers.

Approximately 67% (60% same as in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average and 33% (15% in the prior session) were trading above their 20-day moving average.

Alibaba Group (BABA -8.09%) came under pressure after stock exchanges in Shanghai and Hong Kong suspended the $34.5 billion initial public offering of fintech giant Ant Group. Alibaba owns an approximately 33% stake in Ant Group.

U.S. official data showed that Factory Orders increased 1.1% on month in September (+1.0% expected) and Durable Goods Orders (final reading) rose 1.9% (as expected).

European stocks advanced further. The Stoxx Europe 600 jumped 1.61%, Germany's DAX jumped 2.01%, France's CAC 40 rose 2.11% and the U.K.'s FTSE 100 was up 1.39%.

U.S. Treasury prices returned to the downside, as the benchmark 10-year Treasury yield climbed to 0.884%, the highest level since mid-June.

Commodity prices were boosted by a weakening dollar. Spot gold charged $12 higher (+0.64%) to $1,907 an ounce.

Oil prices were lifted by reports that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) would seek to prolong the current oil-output cuts into next year. U.S. WTI crude futures (December) gained $1.05 (+2.85%) to $37.86 a barrel.

On the forex front, the U.S. dollar came under pressure as investors accepted riskier assets. The ICE Dollar Index slid 0.77% to 93.40, the biggest loss since late August.

EUR/USD regained the 1.1700 level as it rebounded 0.63% to 1.1715.

GBP/USD was back above 1.3000 as it jumped 1.10% to 1.3059%. The pair has returned to levels above both 20-day and 50-day moving averages.

USD/JPY declined 0.22% to 104.48%, and USD/CAD fell a further 0.55% to 1.3145.

The Australian dollar surged over 1% against the greenback though the Reserve Bank of Australia, as expected, slashed its key interest rate to 0.10% from 0.25%. The central bank also announced a 100 billion Australian dollar quantitative easing program to purchase government bonds. AUD/USD jumped 1.54% to 0.7164.

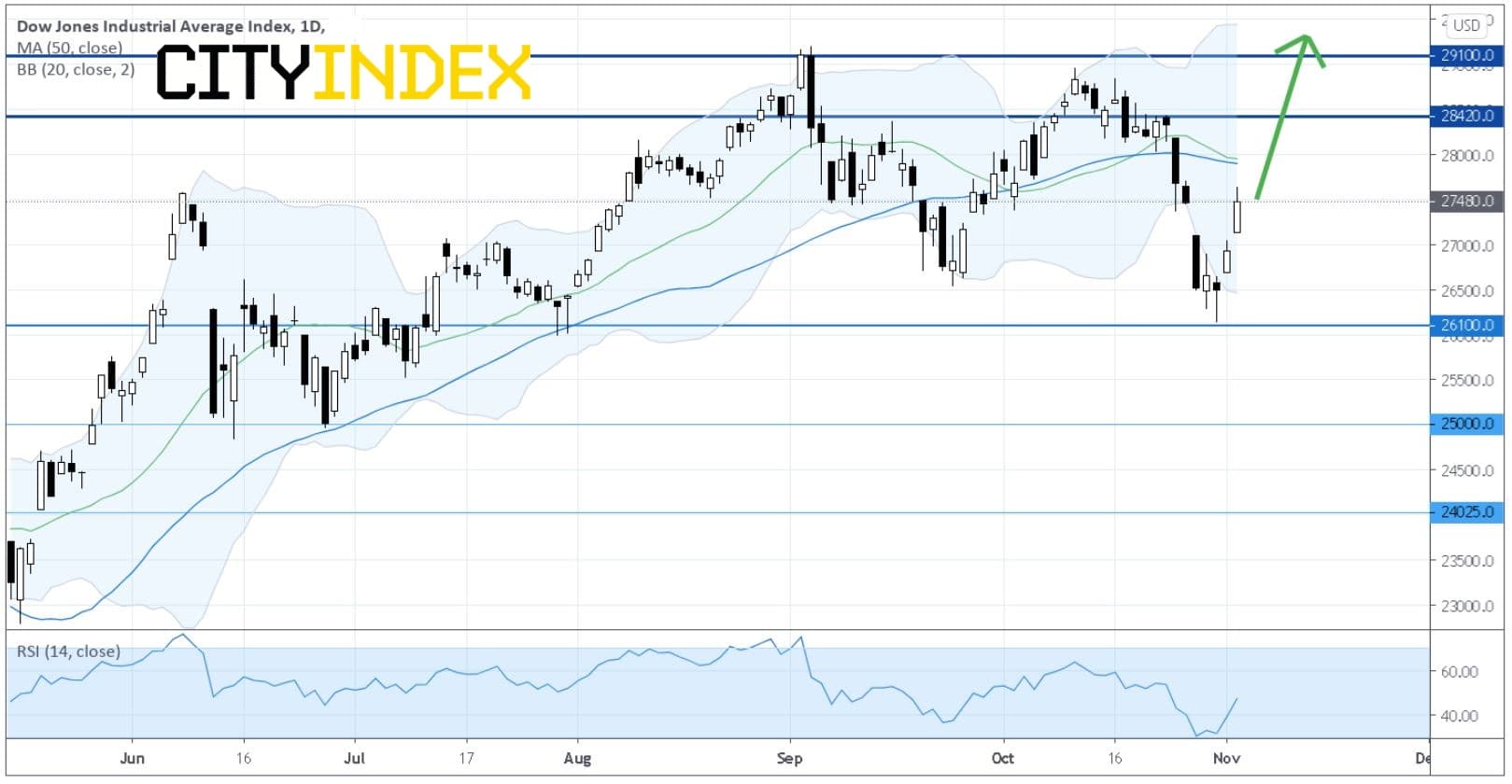

Dow Jones Industrial Average (Daily Chart) : Rebound Continues

Sources: GAIN Capital, TradingView

The rally was broad as 10 of 11 major S&P sectors closed higher, led by Commercial & Professional Services (+3.08%), Capital Goods (+2.95%) and Transportation (+2.73%). Arista Networks (ANET +15.44%), Gartner (IT +12.62%), Nordstrom (JWN +9.69%) and Macy’s (M +8.39%) were top gainers.

Approximately 67% (60% same as in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average and 33% (15% in the prior session) were trading above their 20-day moving average.

Alibaba Group (BABA -8.09%) came under pressure after stock exchanges in Shanghai and Hong Kong suspended the $34.5 billion initial public offering of fintech giant Ant Group. Alibaba owns an approximately 33% stake in Ant Group.

U.S. official data showed that Factory Orders increased 1.1% on month in September (+1.0% expected) and Durable Goods Orders (final reading) rose 1.9% (as expected).

European stocks advanced further. The Stoxx Europe 600 jumped 1.61%, Germany's DAX jumped 2.01%, France's CAC 40 rose 2.11% and the U.K.'s FTSE 100 was up 1.39%.

U.S. Treasury prices returned to the downside, as the benchmark 10-year Treasury yield climbed to 0.884%, the highest level since mid-June.

Commodity prices were boosted by a weakening dollar. Spot gold charged $12 higher (+0.64%) to $1,907 an ounce.

Oil prices were lifted by reports that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) would seek to prolong the current oil-output cuts into next year. U.S. WTI crude futures (December) gained $1.05 (+2.85%) to $37.86 a barrel.

On the forex front, the U.S. dollar came under pressure as investors accepted riskier assets. The ICE Dollar Index slid 0.77% to 93.40, the biggest loss since late August.

EUR/USD regained the 1.1700 level as it rebounded 0.63% to 1.1715.

GBP/USD was back above 1.3000 as it jumped 1.10% to 1.3059%. The pair has returned to levels above both 20-day and 50-day moving averages.

USD/JPY declined 0.22% to 104.48%, and USD/CAD fell a further 0.55% to 1.3145.

The Australian dollar surged over 1% against the greenback though the Reserve Bank of Australia, as expected, slashed its key interest rate to 0.10% from 0.25%. The central bank also announced a 100 billion Australian dollar quantitative easing program to purchase government bonds. AUD/USD jumped 1.54% to 0.7164.

Latest market news

Today 04:24 AM

Yesterday 10:48 PM

Yesterday 02:00 PM