Asia Morning: Nasdaq Led Advance, Gold Sank Further

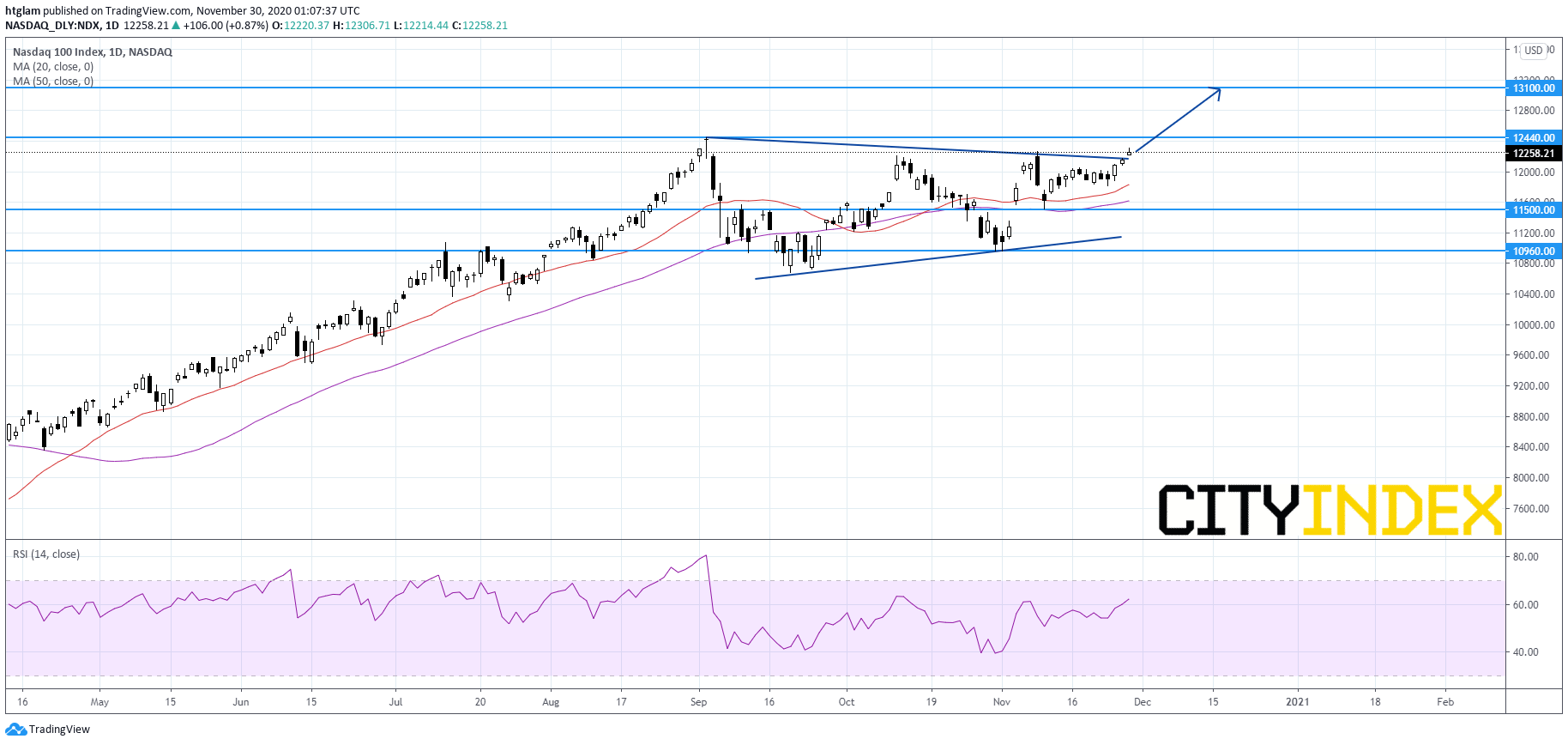

On Friday, the three major U.S. indices closed higher. The Dow Jones Industrial Average gained 37 points (+0.1%) to 29910, the S&P 500 added 8 points (+0.2%) to 3638 and the Nasdaq 100 Index rose 106 points (+0.9%) to 12258. Pharmaceuticals, Biotechnology & Life Sciences (+1.0%), Health Care Equipment & Services (+0.9%) and Semiconductors & Semiconductor Equipment (+0.8%) sectors led the rally.

Nasdaq 100 Index Daily Chart:

Source: GAIN Capital, TradingView

Approximately 91% of stocks in the S&P 500 Index were trading above their 200-day moving average and 82% were trading above their 20-day moving average. The VIX Index fell 0.41pt (-1.9%) to 20.84.

Regarding U.S. economic data, October pending home sales (+1.0% on month expected) and November Chicago PMI (59.2 expected) will be released later in the day.

European stocks were broadly higher. The Stoxx Europe 600 climbed 0.5%, Germany's DAX advanced 0.4%, France's CAC 40 rose 0.6%, and the U.K.'s FTSE 100 gained 0.1%.

The benchmark U.S. 10-year Treasury yield retreated to 0.8373% from 0.8816% in the prior session, halting a three-day rally.

WTI crude futures fell 0.4% to $45.53 a barrel.

Spot gold dropped 1.5% to $1,788 an ounce.

On the forex front, the U.S. dollar weakened further against its major peers, with the ICE Dollar Index dropping 0.2% to 91.79, the lowest close in 7 months.

EUR/USD rose 0.4% to 1.1962. Official data showed that the eurozone's Economic Confidence Index fell to 87.6 in November (86.0 expected) from 91.1 in October. Later today, the bloc's CPI for November will be reported (-0.1% on year expected).

GBP/USD lost 0.3% to 1.3314, down for a second straight session.

USD/JPY slipped 0.2% to 104.09. This morning, government data showed that Japan's industrial production rose 3.8% on month in October (+2.2% expected), and retail sales grew 0.4% (+0.5% expected)

Commodity-linked currencies were broadly higher against the greenback. Both AUD/USD and NZD/USD gained 0.3%, while USD/CAD fell 0.2%.

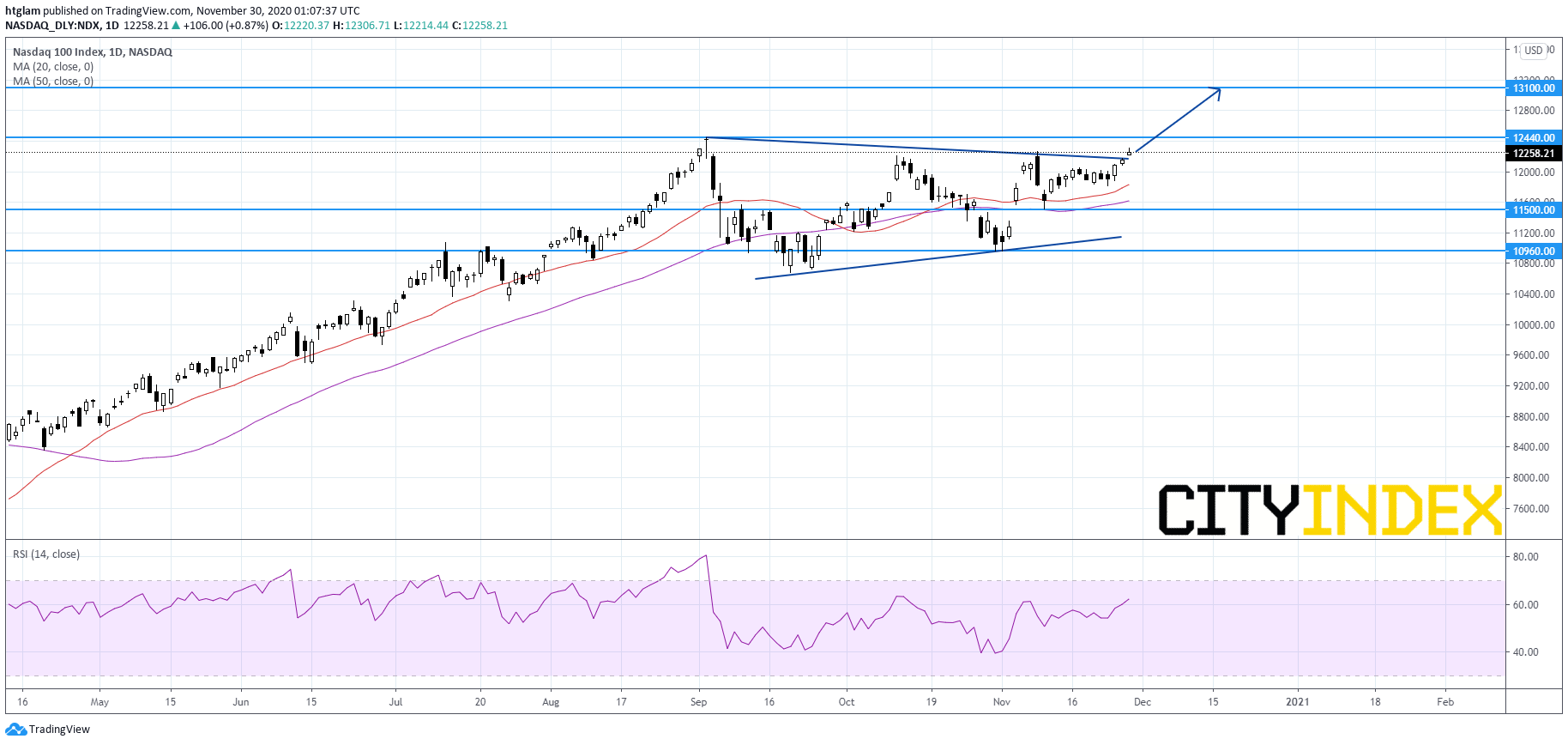

Nasdaq 100 Index Daily Chart:

Source: GAIN Capital, TradingView

Approximately 91% of stocks in the S&P 500 Index were trading above their 200-day moving average and 82% were trading above their 20-day moving average. The VIX Index fell 0.41pt (-1.9%) to 20.84.

Regarding U.S. economic data, October pending home sales (+1.0% on month expected) and November Chicago PMI (59.2 expected) will be released later in the day.

European stocks were broadly higher. The Stoxx Europe 600 climbed 0.5%, Germany's DAX advanced 0.4%, France's CAC 40 rose 0.6%, and the U.K.'s FTSE 100 gained 0.1%.

The benchmark U.S. 10-year Treasury yield retreated to 0.8373% from 0.8816% in the prior session, halting a three-day rally.

WTI crude futures fell 0.4% to $45.53 a barrel.

Spot gold dropped 1.5% to $1,788 an ounce.

On the forex front, the U.S. dollar weakened further against its major peers, with the ICE Dollar Index dropping 0.2% to 91.79, the lowest close in 7 months.

EUR/USD rose 0.4% to 1.1962. Official data showed that the eurozone's Economic Confidence Index fell to 87.6 in November (86.0 expected) from 91.1 in October. Later today, the bloc's CPI for November will be reported (-0.1% on year expected).

GBP/USD lost 0.3% to 1.3314, down for a second straight session.

USD/JPY slipped 0.2% to 104.09. This morning, government data showed that Japan's industrial production rose 3.8% on month in October (+2.2% expected), and retail sales grew 0.4% (+0.5% expected)

Commodity-linked currencies were broadly higher against the greenback. Both AUD/USD and NZD/USD gained 0.3%, while USD/CAD fell 0.2%.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM