Asia Morning: US Stock Indices Closed Lower amid Declining Risk Appetite

On Thursday, the three major U.S. indices closed lower as investors' risk appetite declined. The Dow Jones Industrial Average lost 317 points (-1.1%) to 29080, the S&P 500 slid 35 points (-1.0%) to 3537 and the Nasdaq 100 Index dropped 65 points (-0.6%) to 11827.

Energy (-3.39%), Automobiles & Components (-2.59%) and Materials (-2.17%) sectors led the decline. Approximately 85% of stocks in the S&P 500 Index were trading above their 200-day moving average and 85% were trading above their 20-day moving average. The VIX Index jumped 1.82pt (+7.76%) to 25.27.

Regarding U.S. economic data, CPI grew 1.2% on year in October (+1.3% expected), while jobless claims fell to 709,000 in the week ending Nov. 7 (731,000 expected) from 757,000 in the prior week. Later today, PPI for October (+0.4% on year expected) will be released and the University of Michigan will publish its Consumer Sentiment Index for November (82.0 expected).

European stocks were broadly under pressure. The Stoxx Europe 600 dropped 1.1%, Germany's DAX slid 1.2%, France's CAC 40 declined 1.5%, and the U.K.'s FTSE 100 fell 0.7%.

The benchmark U.S. 10-year Treasury yield retreated to 0.8815% from 0.9753% Wednesday, halting a four-day rally.

WTI crude futures slid 0.8% to $41.12 a barrel. The U.S. Energy Information Administration (EIA) reported that crude oil inventories increased 0.43 million barrels in the week ending Nov. 6 (-0.87 million barrels expected).

Spot gold rose 0.6% to $1,877 an ounce.

On the forex front, the U.S. dollar was broadly stable against its major peers, as the ICE Dollar Index edged down just 0.1% to 92.96.

EUR/USD gained 0.2% to 1.1805. Official data showed that the eurozone's industrial production fell 0.4% on month in September (+0.6% expected). Meanwhile, investors will focus on the bloc's third quarter GDP data due later in the day (-4.3% on year expected).

GBP/USD dropped 0.8% to 1.3120, amid persistent concern over the future relationship of Britain and the European Union. On the other hand, government data showed that U.K. third quarter GDP shrank 9.6% on year (-9.4% expected), while industrial production grew 0.5% on month in September (+1.0% expected).

USD/JPY lost 0.3% to 105.11.

Commodity-linked currencies weakened against the greenback. AUD/USD slid 0.6% to 0.7234 and NZD/USD dipped 0.7% to 0.6834, while USD/CAD advanced 0.6% to 1.3142.

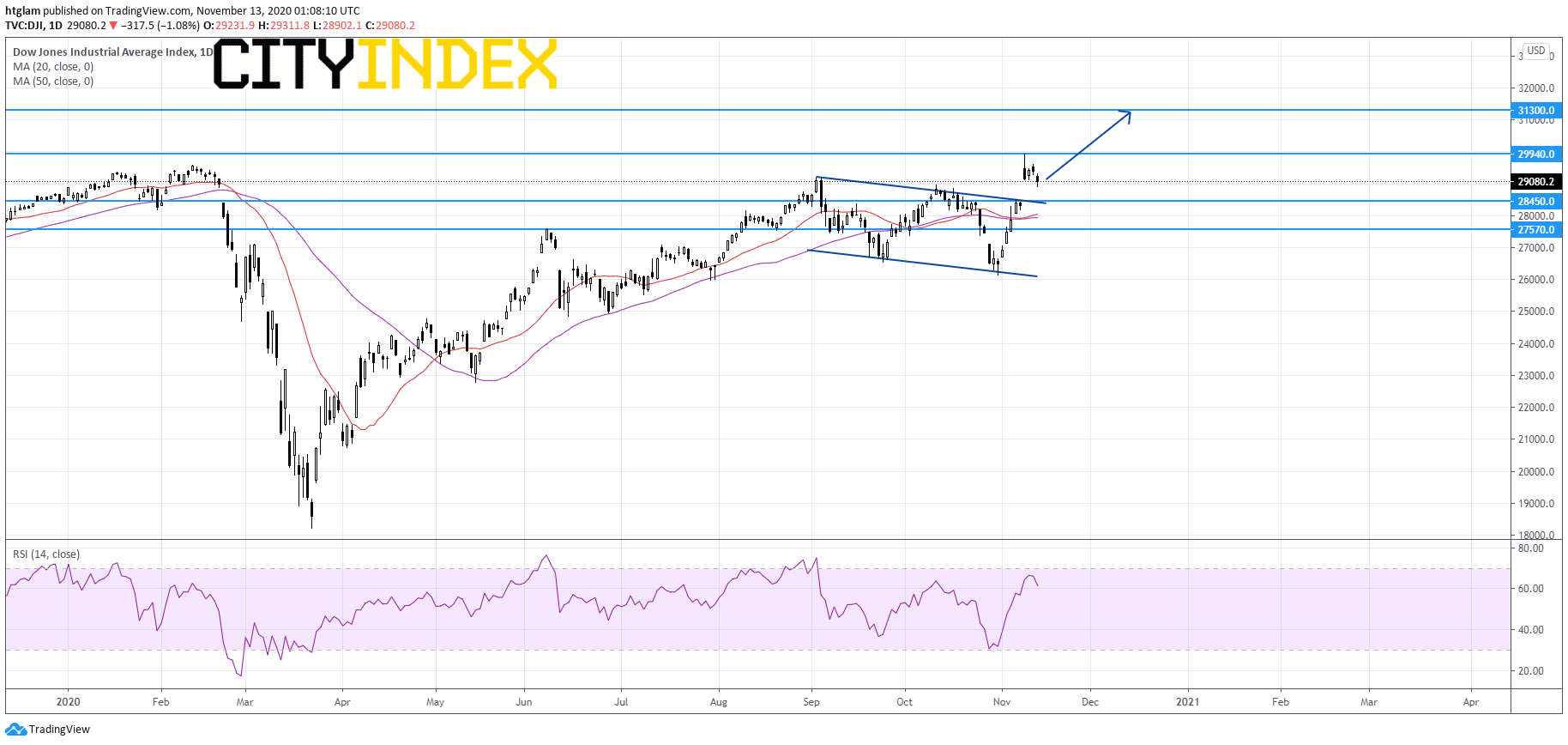

Dow Jones Industrial Average daily chart:

Source: GAIN Capital, TradingView

Energy (-3.39%), Automobiles & Components (-2.59%) and Materials (-2.17%) sectors led the decline. Approximately 85% of stocks in the S&P 500 Index were trading above their 200-day moving average and 85% were trading above their 20-day moving average. The VIX Index jumped 1.82pt (+7.76%) to 25.27.

Regarding U.S. economic data, CPI grew 1.2% on year in October (+1.3% expected), while jobless claims fell to 709,000 in the week ending Nov. 7 (731,000 expected) from 757,000 in the prior week. Later today, PPI for October (+0.4% on year expected) will be released and the University of Michigan will publish its Consumer Sentiment Index for November (82.0 expected).

European stocks were broadly under pressure. The Stoxx Europe 600 dropped 1.1%, Germany's DAX slid 1.2%, France's CAC 40 declined 1.5%, and the U.K.'s FTSE 100 fell 0.7%.

The benchmark U.S. 10-year Treasury yield retreated to 0.8815% from 0.9753% Wednesday, halting a four-day rally.

WTI crude futures slid 0.8% to $41.12 a barrel. The U.S. Energy Information Administration (EIA) reported that crude oil inventories increased 0.43 million barrels in the week ending Nov. 6 (-0.87 million barrels expected).

Spot gold rose 0.6% to $1,877 an ounce.

On the forex front, the U.S. dollar was broadly stable against its major peers, as the ICE Dollar Index edged down just 0.1% to 92.96.

EUR/USD gained 0.2% to 1.1805. Official data showed that the eurozone's industrial production fell 0.4% on month in September (+0.6% expected). Meanwhile, investors will focus on the bloc's third quarter GDP data due later in the day (-4.3% on year expected).

GBP/USD dropped 0.8% to 1.3120, amid persistent concern over the future relationship of Britain and the European Union. On the other hand, government data showed that U.K. third quarter GDP shrank 9.6% on year (-9.4% expected), while industrial production grew 0.5% on month in September (+1.0% expected).

USD/JPY lost 0.3% to 105.11.

Commodity-linked currencies weakened against the greenback. AUD/USD slid 0.6% to 0.7234 and NZD/USD dipped 0.7% to 0.6834, while USD/CAD advanced 0.6% to 1.3142.

Latest market news

Yesterday 08:33 AM