Asia Morning: U.S. Stocks Rebound, Banks Lead Market

On Thursday, U.S. stocks rebounded making most of the gains in the last trading hour. The Dow Jones Industrial Average rose 299 points (+1.18%) to 25745, the S&P 500 gained 33 points (+1.10%) to 3083, and the Nasdaq 100 was up 99 points (+0.99%) to 10101.

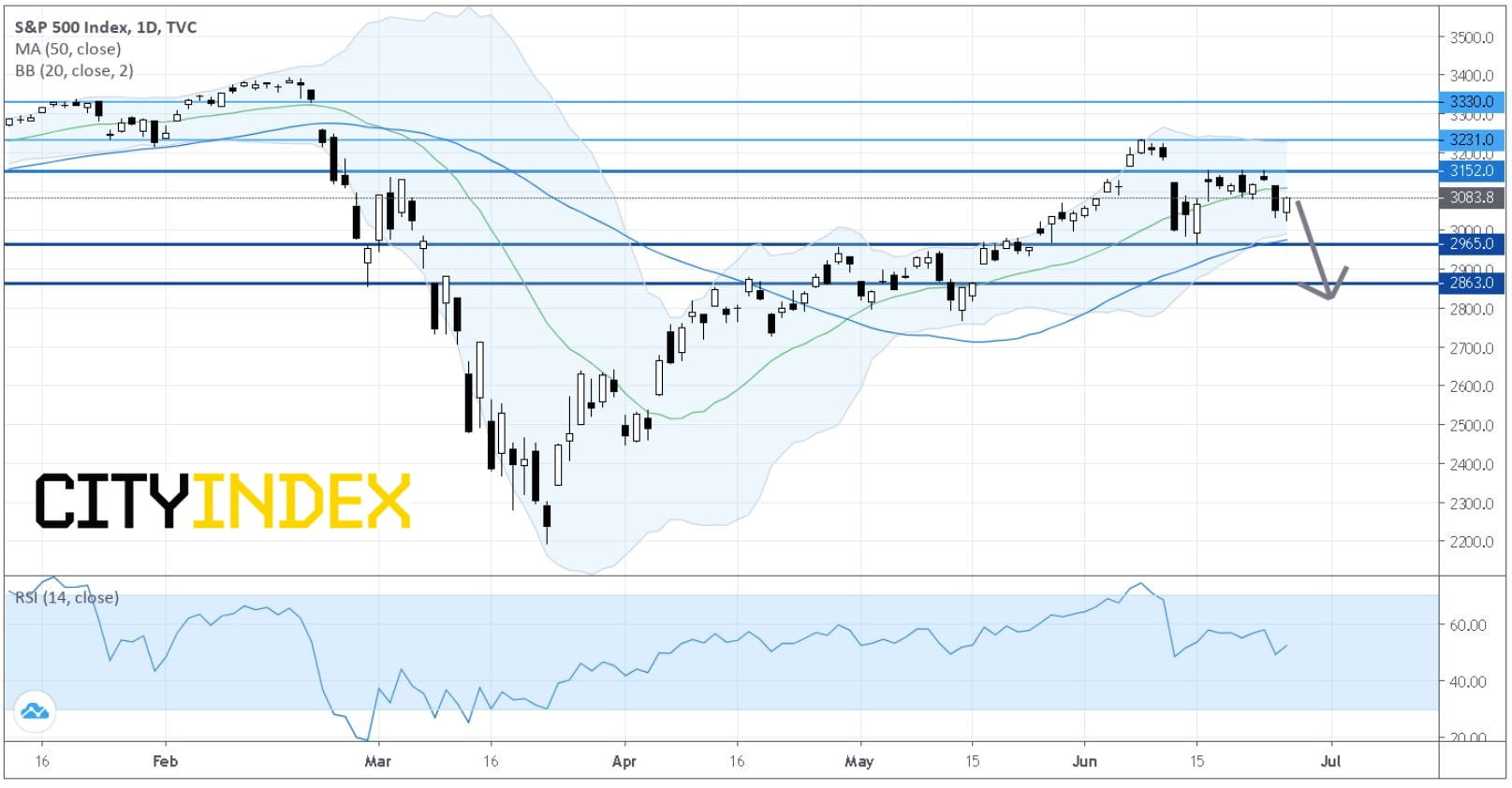

S&P 500 Index: Daily Chart

Source: GAIN Captial, TradingView

Banks (+3.57%), Insurance (+2.55%) and Diversified Financials (+2.07%) sectors gained the most after financial regulators eased up "Volcker Rule" restrictions on banks' risk-taking. Goldman Sachs (GS +4.59%), Wells Fargo (WFC +4.79%) and JPMorgan Chase (JPM +3.49%) led major indexes higher.

However, in after-market hours, the Federal Reserve, in anticipation of a prolonged economic downturn, announced measures to bar the nation's biggest banks from buying back their own stocks or increasing dividend payments in the third quarter.

On the technical side, about 36.7% (43.1% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 13.5% (35.3% in the prior session) were trading above their 20-day moving average.

The U.S. Labor Department reported that Initial Jobless Claims decreased to 1.480 million for the week ended June 20 (1.320 million expected) and Continuing Claims slid to 19.522 million for the week ended June 13 (20.000 million expected).

And the Commerce Department said first-quarter GDP contracted 5.0% on quarter annualized (as expected), and Durable Goods Orders (preliminary reading) jumped 15.8% on month in May (+10.5% expected).

Due later today are reports on May Personal Income (-6.0% on month expected), Personal Spending (+9.0% expected), and the University of Michigan's Consumer Sentiment Index (a rise to 79.2 in June expected).

European stocks were broadly higher. The Stoxx Europe 600 Index climbed 0.7%, Germany's DAX rose 0.7%, France's CAC jumped 1.0%, and the U.K.'s FTSE 100 was up 0.4%.

U.S. government bond prices remained firm, as the benchmark 10-year Treasury yield dropped further to 0.670% from 0.683% Wednesday.

Spot gold price added $2.00 (+0.1%) to $1,763 an ounce.

Oil prices stabilized after losing for two sessions. WTI crude oil futures (August) increased 1.9% to $38.72 a barrel.

On the forex front, the ICE U.S. Dollar Index climbed 0.2% on day to 97.39, up for a second straight session. The Federal Reserve released the results of its stress tests, stating: ""The banking system has been a source of strength during this crisis, and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks."

EUR/USD fell 0.3% to 1.1220. Germany's GfK Consumer Confidence Index for July improved to -9.6 (-12.0 expected) from -18.6 in June.

GBP/USD was little changed at 1.2424.

USD/JPY edged up 0.1% to 107.18. This morning, official data showed that Japan's Tokyo CPI grew 0.3% on year in June (as expected).

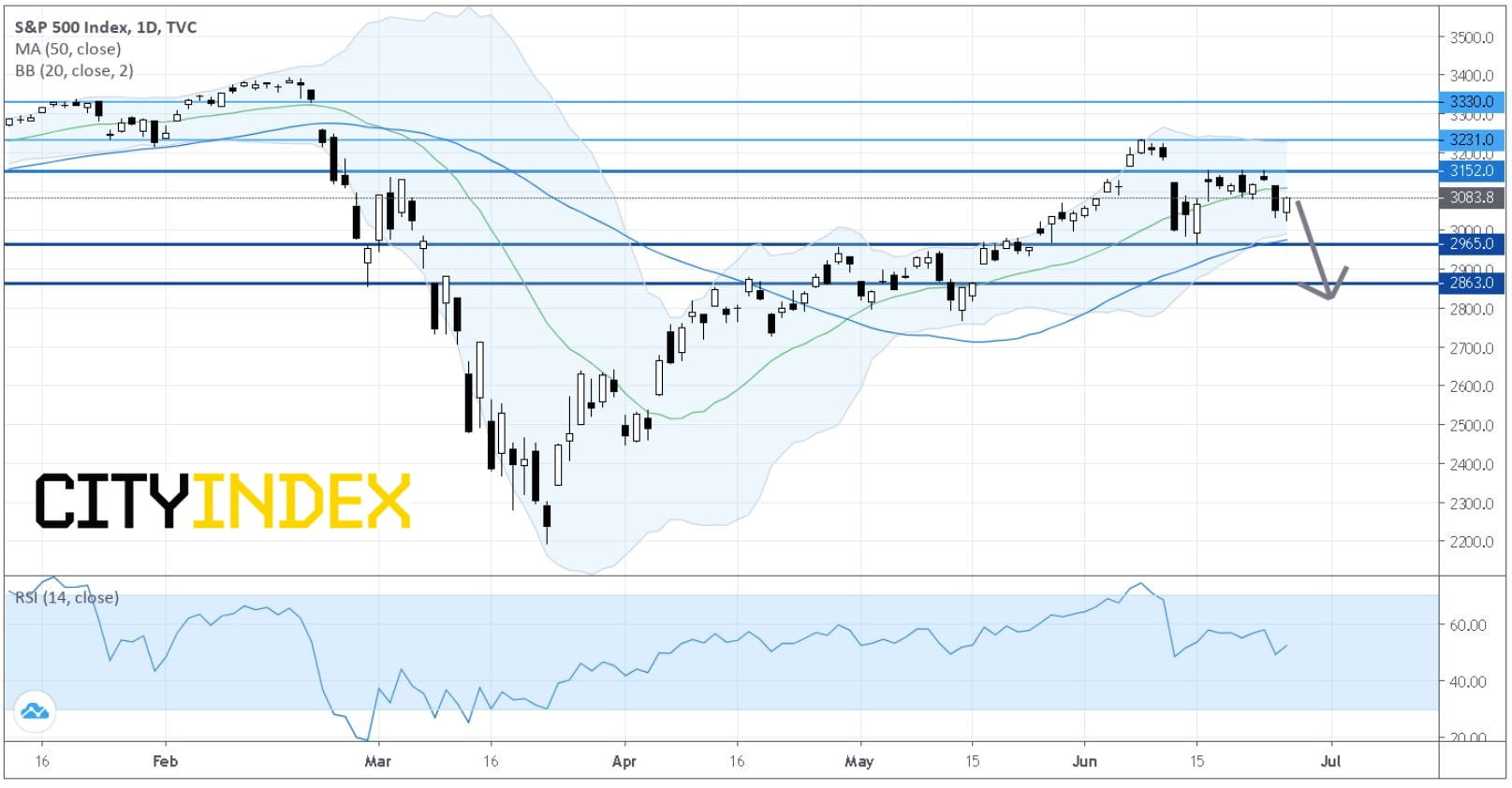

S&P 500 Index: Daily Chart

Source: GAIN Captial, TradingView

Banks (+3.57%), Insurance (+2.55%) and Diversified Financials (+2.07%) sectors gained the most after financial regulators eased up "Volcker Rule" restrictions on banks' risk-taking. Goldman Sachs (GS +4.59%), Wells Fargo (WFC +4.79%) and JPMorgan Chase (JPM +3.49%) led major indexes higher.

However, in after-market hours, the Federal Reserve, in anticipation of a prolonged economic downturn, announced measures to bar the nation's biggest banks from buying back their own stocks or increasing dividend payments in the third quarter.

On the technical side, about 36.7% (43.1% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 13.5% (35.3% in the prior session) were trading above their 20-day moving average.

The U.S. Labor Department reported that Initial Jobless Claims decreased to 1.480 million for the week ended June 20 (1.320 million expected) and Continuing Claims slid to 19.522 million for the week ended June 13 (20.000 million expected).

And the Commerce Department said first-quarter GDP contracted 5.0% on quarter annualized (as expected), and Durable Goods Orders (preliminary reading) jumped 15.8% on month in May (+10.5% expected).

Due later today are reports on May Personal Income (-6.0% on month expected), Personal Spending (+9.0% expected), and the University of Michigan's Consumer Sentiment Index (a rise to 79.2 in June expected).

European stocks were broadly higher. The Stoxx Europe 600 Index climbed 0.7%, Germany's DAX rose 0.7%, France's CAC jumped 1.0%, and the U.K.'s FTSE 100 was up 0.4%.

U.S. government bond prices remained firm, as the benchmark 10-year Treasury yield dropped further to 0.670% from 0.683% Wednesday.

Spot gold price added $2.00 (+0.1%) to $1,763 an ounce.

Oil prices stabilized after losing for two sessions. WTI crude oil futures (August) increased 1.9% to $38.72 a barrel.

On the forex front, the ICE U.S. Dollar Index climbed 0.2% on day to 97.39, up for a second straight session. The Federal Reserve released the results of its stress tests, stating: ""The banking system has been a source of strength during this crisis, and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks."

EUR/USD fell 0.3% to 1.1220. Germany's GfK Consumer Confidence Index for July improved to -9.6 (-12.0 expected) from -18.6 in June.

GBP/USD was little changed at 1.2424.

USD/JPY edged up 0.1% to 107.18. This morning, official data showed that Japan's Tokyo CPI grew 0.3% on year in June (as expected).

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM