Asia Morning: U.S. Stocks Pressured by Resurging Virus Cases

On Wednesday, U.S. stocks lost over 2% as investors' confidence in the economic recovery was shaken by resurging coronavirus cases. The U.S. recorded a one-day total of more than 36,000 new cases, the highest level since late April. California, Florida and Oklahoma reported record highs in new cases.

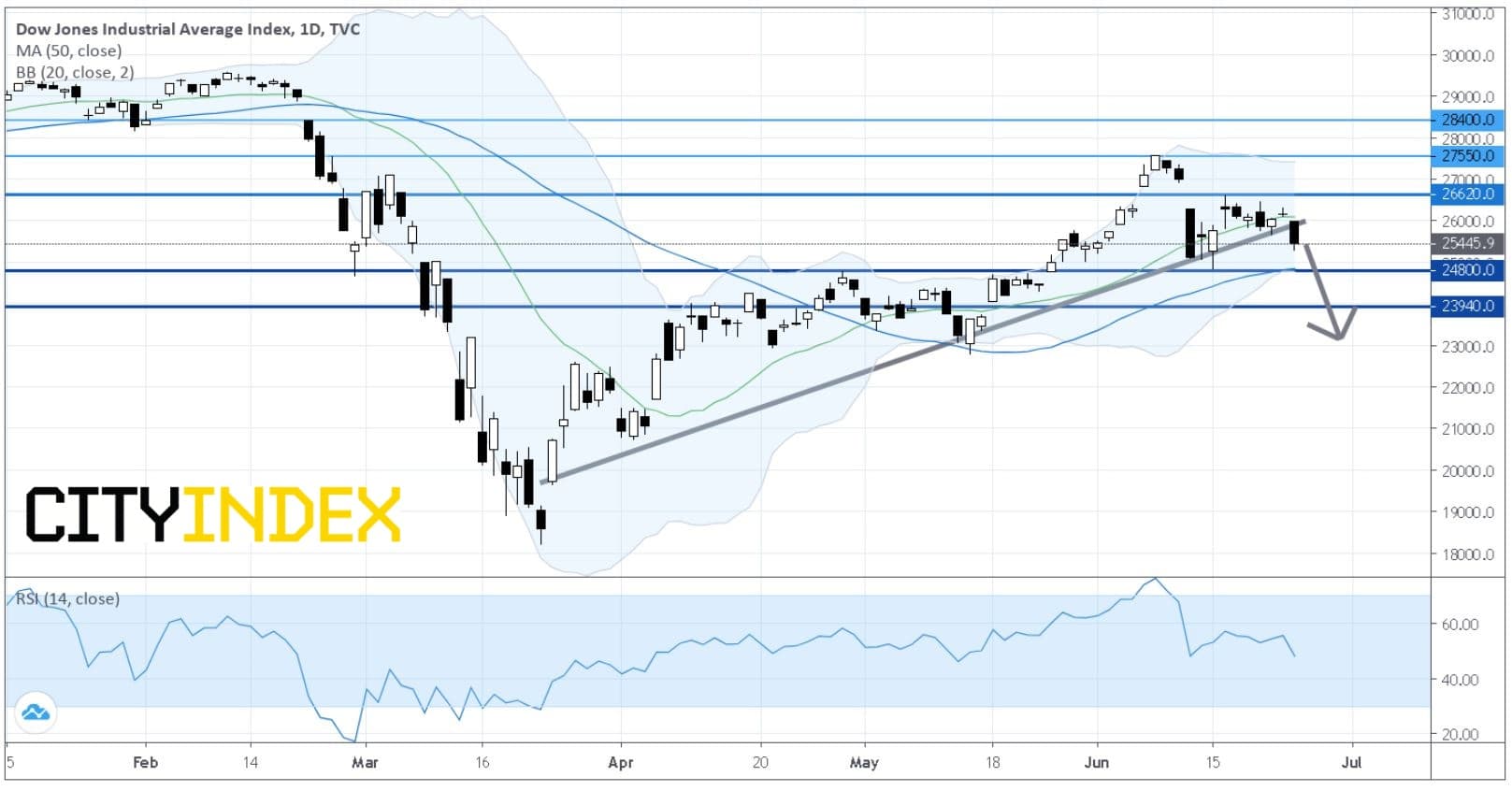

The Dow Jones Industrial Average tumbled 710 points (-2.7%) to 25445, the S&P 500 lost 81 points (-2.6%) to 3050, and the Nasdaq 100 was down 207 points (-2.0%) to 10002.

Energy (-5.54%), Automobiles & Components (-4.17%) and Banks (-4.12%) sectors lost the most.

Energy stocks such as Halliburton (HAL -8.77%) and Occidental Petroleum (OXY -9.04%) declined as oil prices plunged. Cruise companies such as Norwegian Cruise Line (NCLH -12.37%) and Royal Caribbean Cruises (RCL -11.26%) lost big. Boeing (BA -5.96%) also weighed down major indexes.

On the technical side, about 43.1% (42.3% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 35.3% (36.3% in the prior session) were trading above their 20-day moving average.

Later today, first-quarter GDP growth (third reading, -5.0% on quarter annualized expected), Initial Jobless Claims (a fall to 1.335 million expected) and Durable Goods Orders (May preliminary reading, +10.1% on month expected) will be reported.

European stocks were heavy on Wednesday, with the Stoxx Europe 600 Index sank 2.8%. Germany's DAX fell 3.4%, France's CAC dropped 2.9%, and the U.K.'s FTSE 100 was down 3.1%.

U.S. government bond prices increased, as the benchmark 10-year Treasury yield declined to 0.683% from 0.712% Tuesday.

Spot gold price retreated $7.00 (-0.4%) to $1,761 an ounce halting a three-session rally.

Oil prices were dragged by worries over new coronavirus cases impeding demand recovery. They came under more pressure after the Energy Information Administration reported that crude oil stockpiles increased 1.4 million barrels to another record high level last week. U.S. WTI crude oil futures (July) slid 5.8% to $38.01 a barrel.

On the forex front, the ICE U.S. Dollar Index gained 0.6% on day to 97.21, as safe-haven demand was lifted by a resurgence in coronavirus infections across the U.S..

EUR/USD retreated 0.5% to 1.1250. The German IFO Business Climate Index climbed to 86.2 in June (85.0 expected) from 79.7 in May and Expectations Index rose to 91.4 (87.0 expected) from 80.5.

GBP/USD sank 0.9% to 1.2413.

USD/JPY bounced 0.5% to 107.06.

USD/CAD advanced 0.7% to 1.3643. Canada's credit rating was downgraded to "AA+" from "AAA" at Fitch, outlook "Stable". The rating agency said "the rating downgrade reflects the deterioration of Canada's public finances in 2020 resulting from the coronavirus pandemic".

The Dow Jones Industrial Average tumbled 710 points (-2.7%) to 25445, the S&P 500 lost 81 points (-2.6%) to 3050, and the Nasdaq 100 was down 207 points (-2.0%) to 10002.

Dow Jones Industrial Average: Daily Chart

Source: GAIN Capital, TradingView

Energy (-5.54%), Automobiles & Components (-4.17%) and Banks (-4.12%) sectors lost the most.

Energy stocks such as Halliburton (HAL -8.77%) and Occidental Petroleum (OXY -9.04%) declined as oil prices plunged. Cruise companies such as Norwegian Cruise Line (NCLH -12.37%) and Royal Caribbean Cruises (RCL -11.26%) lost big. Boeing (BA -5.96%) also weighed down major indexes.

On the technical side, about 43.1% (42.3% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 35.3% (36.3% in the prior session) were trading above their 20-day moving average.

Later today, first-quarter GDP growth (third reading, -5.0% on quarter annualized expected), Initial Jobless Claims (a fall to 1.335 million expected) and Durable Goods Orders (May preliminary reading, +10.1% on month expected) will be reported.

European stocks were heavy on Wednesday, with the Stoxx Europe 600 Index sank 2.8%. Germany's DAX fell 3.4%, France's CAC dropped 2.9%, and the U.K.'s FTSE 100 was down 3.1%.

U.S. government bond prices increased, as the benchmark 10-year Treasury yield declined to 0.683% from 0.712% Tuesday.

Spot gold price retreated $7.00 (-0.4%) to $1,761 an ounce halting a three-session rally.

Oil prices were dragged by worries over new coronavirus cases impeding demand recovery. They came under more pressure after the Energy Information Administration reported that crude oil stockpiles increased 1.4 million barrels to another record high level last week. U.S. WTI crude oil futures (July) slid 5.8% to $38.01 a barrel.

On the forex front, the ICE U.S. Dollar Index gained 0.6% on day to 97.21, as safe-haven demand was lifted by a resurgence in coronavirus infections across the U.S..

EUR/USD retreated 0.5% to 1.1250. The German IFO Business Climate Index climbed to 86.2 in June (85.0 expected) from 79.7 in May and Expectations Index rose to 91.4 (87.0 expected) from 80.5.

GBP/USD sank 0.9% to 1.2413.

USD/JPY bounced 0.5% to 107.06.

USD/CAD advanced 0.7% to 1.3643. Canada's credit rating was downgraded to "AA+" from "AAA" at Fitch, outlook "Stable". The rating agency said "the rating downgrade reflects the deterioration of Canada's public finances in 2020 resulting from the coronavirus pandemic".

Latest market news

Today 01:15 PM

Today 07:49 AM

Today 04:24 AM