Asia Morning: U.S. Stocks Mixed, Fed Reaffirms Low Rates

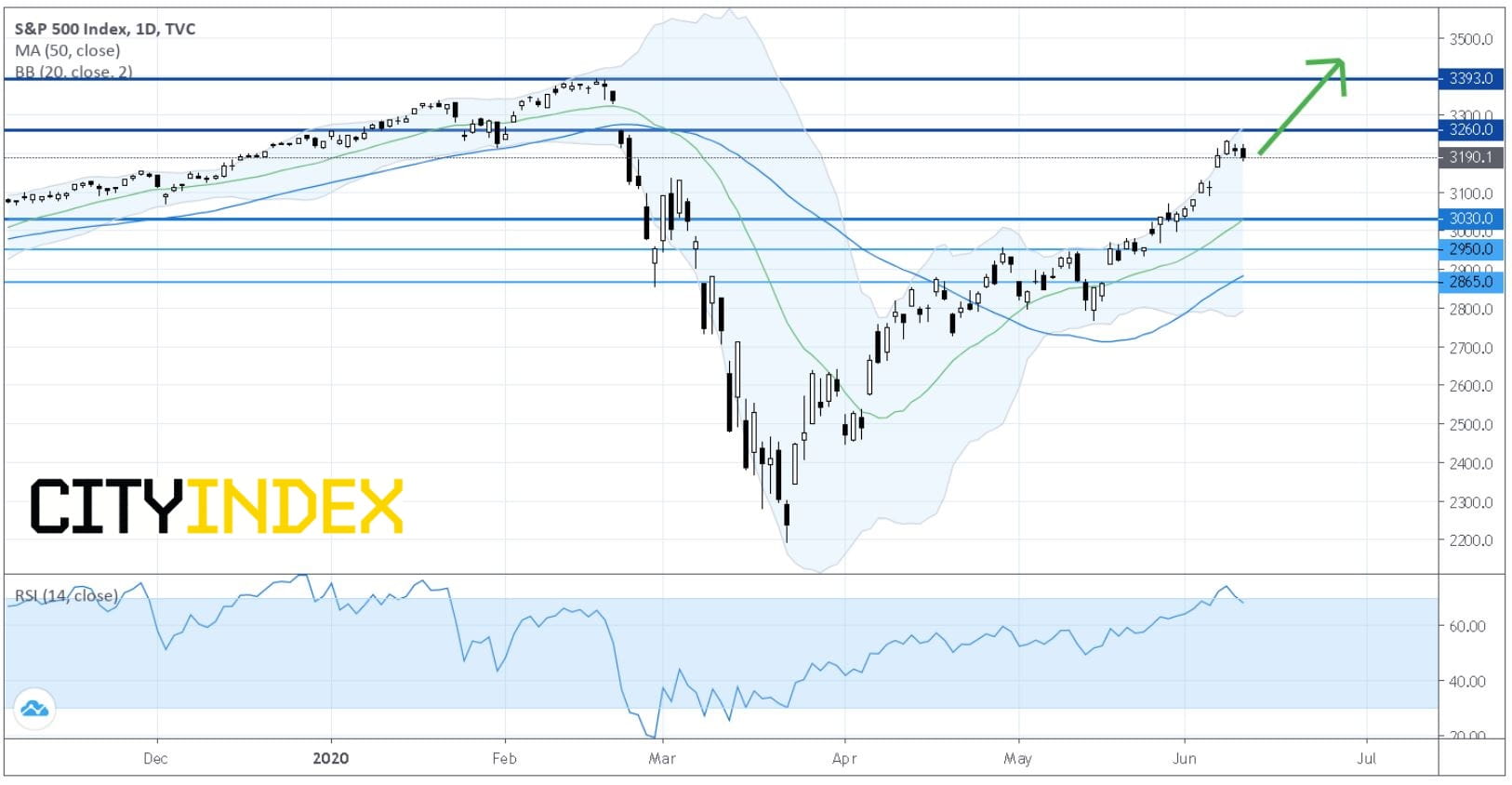

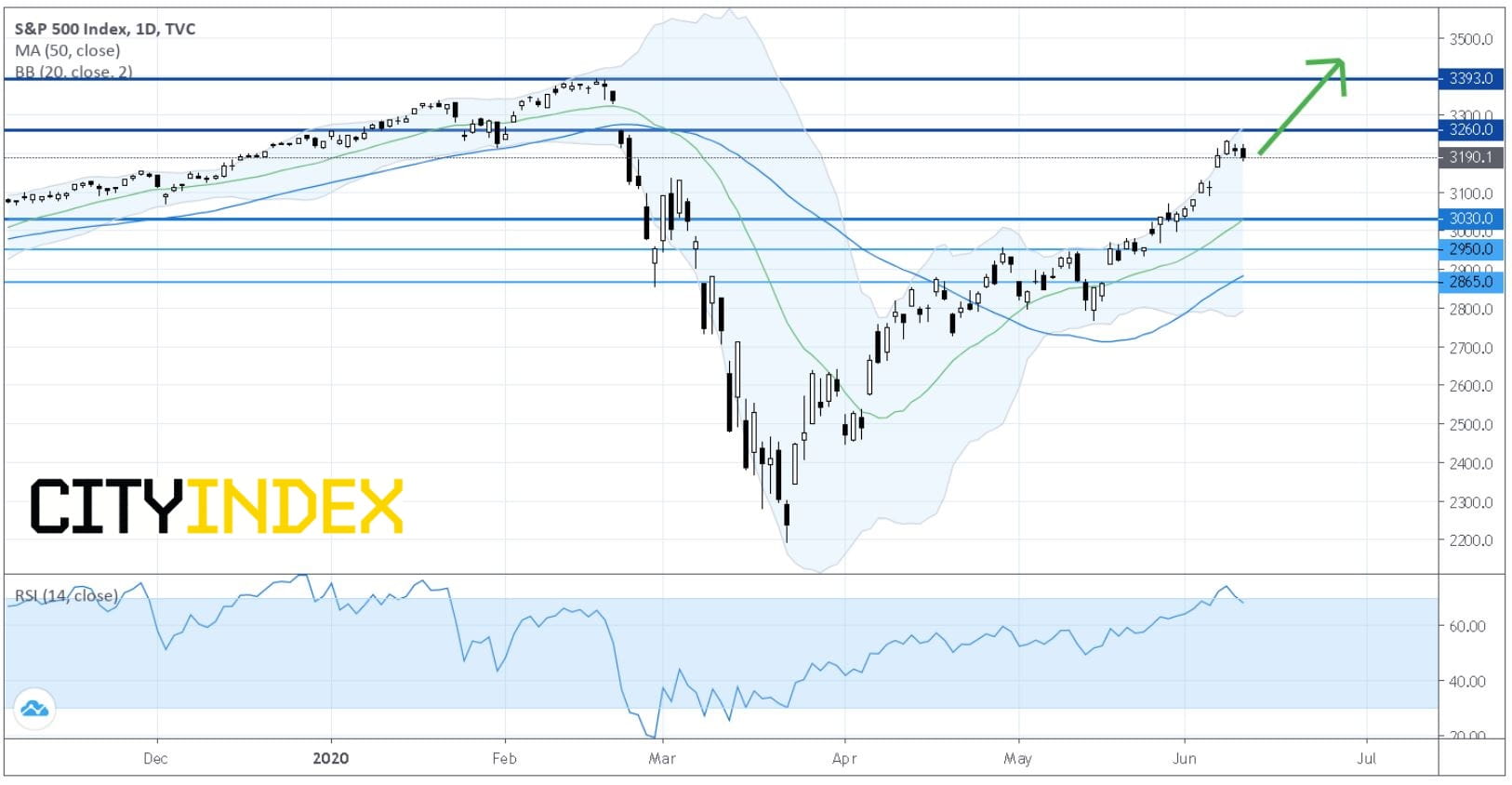

On Wednesday, U.S. stocks closed mixed after the Federal Reserve hinted at keeping interest rates near zero through 2022. The Nasdaq 100 charged 127 points (+1.3%) higher to 10094, a fresh record close. The Dow Jones Industrial Average lost another 282 points (-1.0%) to 26989, and the S&P 500 dropped 17 points (-0.5%) to 3190.

Software & Services (+2%), Technology Hardware & Equipment (+1.59%) and Semiconductors & Semiconductor Equipment (+0.92%) sectors performed the best, while Banks (-5.75%), Energy (-4.92%) and Consumer Services (-3.23%) sectors lagged behind.

Tesla (TSLA +8.97%), Apple (AAPL +2.57%) and Amazon.com (AMZN +1.79%) closed at record highs.

On the technical side, about 58.3% (68.8% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 93.3% (94.7% in the prior session) were above their 20-day moving average.

As expected, the Federal Reserve kept its key rate unchanged at 0.00%-0.25%. At the same time, the central bank said it expects the U.S. economy to contract by 6.5% this year and rebound 5.0% in 2021.

Official data showed that U.S. Consumer Prices declined 0.1% on month in May (+0.0% expected).

Later today, Producer Price Index (+0.1% on month in May expected), Initial Jobless Claims (a fall to 1.550 million expected) and Continuing Claims (a fall to 20.000 million expected).

European stocks still lacked upward momentum, with the Stoxx Europe 600 Index slipping 0.4%. Germany's DAX fell 0.7%, France's CAC dropped 0.8%, and the U.K.'s FTSE 100 edged down 0.1%.

U.S. Treasury prices remained firm after the Fed projected no interest-rate rises through 2022. The benchmark 10-year Treasury yield sank further to 0.744% from 0.829% Tuesday.

Spot gold jumped $23.00 (+1.4%) to $1,737 an ounce, extending its winning streak to a third session.

Oil prices climbed higher despite U.S. Energy Information Administration's weekly report that the country's crude-oil stockpiles rose to a record level of 538.1 million barrels. U.S. WTI crude oil futures (July) added 1.6% to $39.56 a barrel.

On the forex front, the ICE U.S. Dollar Index slid 0.4% on day to 96.05, amid Fed's commitment to low interest rates and asset purchases.

EUR/USD gained 0.3% to 1.1380, posting a three-day rally.

GBP/USD edged up 0.1% to 1.2747.

USD/JPY dropped 0.8% to 106.91, down for a third straight session. This morning, government data showed that Japan's first quarter BSI All Industry Business Condition Index for large firms sank to -47.6 (-38.4 expected) from -10.1 in the prior quarter.

S&P 500 Index Daily Chart

Source: GAIN Capital, TradingView

Software & Services (+2%), Technology Hardware & Equipment (+1.59%) and Semiconductors & Semiconductor Equipment (+0.92%) sectors performed the best, while Banks (-5.75%), Energy (-4.92%) and Consumer Services (-3.23%) sectors lagged behind.

Tesla (TSLA +8.97%), Apple (AAPL +2.57%) and Amazon.com (AMZN +1.79%) closed at record highs.

On the technical side, about 58.3% (68.8% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 93.3% (94.7% in the prior session) were above their 20-day moving average.

As expected, the Federal Reserve kept its key rate unchanged at 0.00%-0.25%. At the same time, the central bank said it expects the U.S. economy to contract by 6.5% this year and rebound 5.0% in 2021.

Official data showed that U.S. Consumer Prices declined 0.1% on month in May (+0.0% expected).

Later today, Producer Price Index (+0.1% on month in May expected), Initial Jobless Claims (a fall to 1.550 million expected) and Continuing Claims (a fall to 20.000 million expected).

European stocks still lacked upward momentum, with the Stoxx Europe 600 Index slipping 0.4%. Germany's DAX fell 0.7%, France's CAC dropped 0.8%, and the U.K.'s FTSE 100 edged down 0.1%.

U.S. Treasury prices remained firm after the Fed projected no interest-rate rises through 2022. The benchmark 10-year Treasury yield sank further to 0.744% from 0.829% Tuesday.

Spot gold jumped $23.00 (+1.4%) to $1,737 an ounce, extending its winning streak to a third session.

Oil prices climbed higher despite U.S. Energy Information Administration's weekly report that the country's crude-oil stockpiles rose to a record level of 538.1 million barrels. U.S. WTI crude oil futures (July) added 1.6% to $39.56 a barrel.

On the forex front, the ICE U.S. Dollar Index slid 0.4% on day to 96.05, amid Fed's commitment to low interest rates and asset purchases.

EUR/USD gained 0.3% to 1.1380, posting a three-day rally.

GBP/USD edged up 0.1% to 1.2747.

USD/JPY dropped 0.8% to 106.91, down for a third straight session. This morning, government data showed that Japan's first quarter BSI All Industry Business Condition Index for large firms sank to -47.6 (-38.4 expected) from -10.1 in the prior quarter.

Latest market news

Today 08:15 AM

Today 05:45 AM