Asia Morning: U.S. Stocks Ease, Airline Shares Shed Over 5%

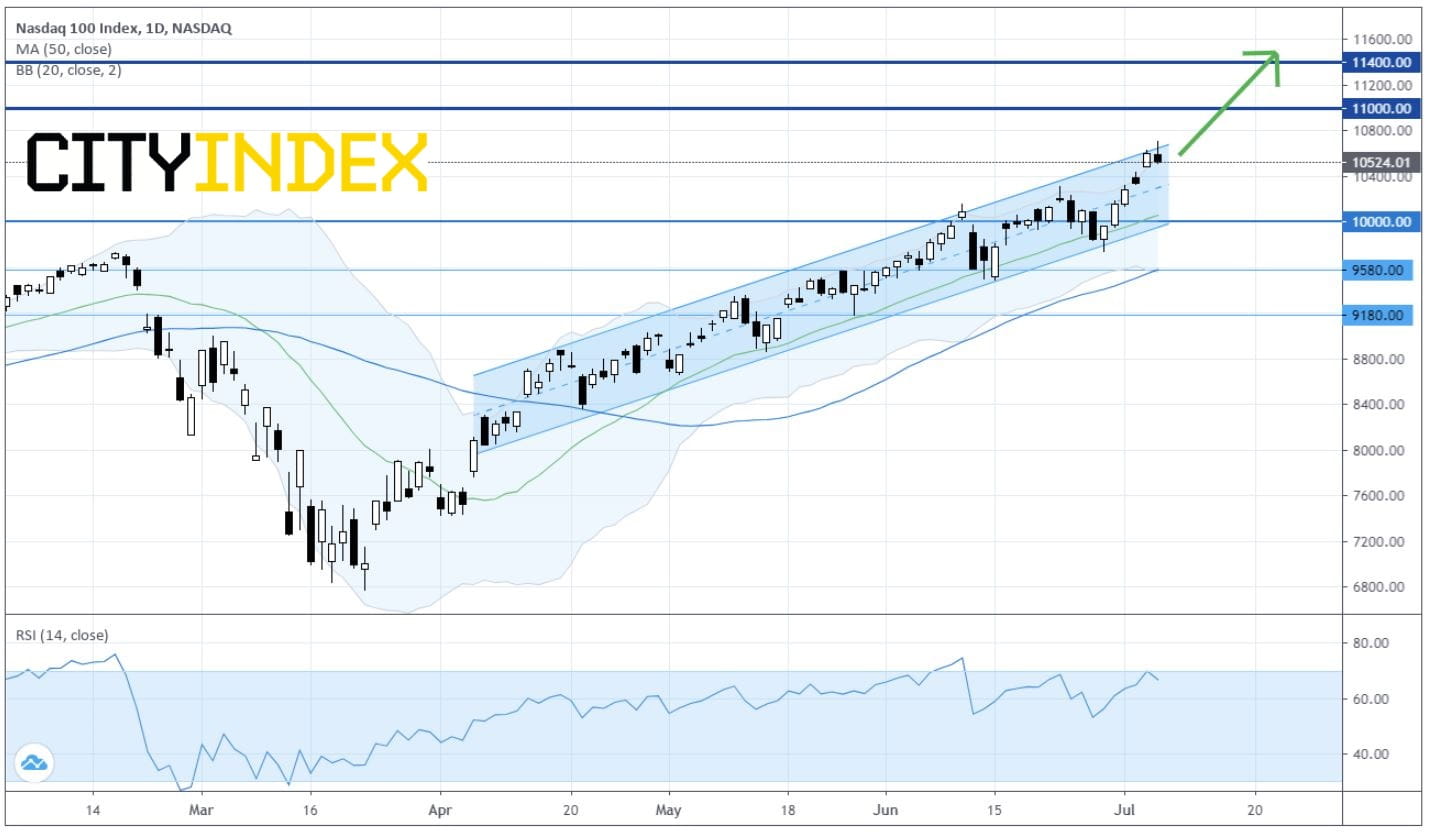

On Tuesday, U.S. stocks reversed course to the downside after a surge in the prior session. The Dow Jones Industrial Average fell 396 points (-1.51%) to 25890, the S&P 500 dropped 34 points (-1.08%) to 3145, and the Nasdaq 100 was down 80 points (-0.75%) to 10524.

Energy (-3.18%), Banks (-3.16%) and Capital Goods (-2.24%) sectors lost the most. Devon Energy (DVN -7.26%), Phillips 66 (PSX -5.21%), United Airlines (UAL -7.47%), American Airlines (AAL -6.68%), Delta Airlines (DAL -5.19%) and Boeing Co (BA -4.81%) were top losers.

On the technical side, about 45.9% (43.3% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 56.7% (39.3% in the prior session) were trading above their 20-day moving average.

European stocks were broadly lower. The Stoxx Europe 600 Index declined 0.61%. Germany's DAX 30 fell 0.92%, France's CAC 40 lost 0.74%, and the U.K.'s FTSE 100 was down 1.53%.

U.S. government bond prices rebounded, as the benchmark 10-year Treasury yield eased to 0.652% from 0.683% Monday.

Spot gold price extended its winning streak to a fourth session gaining $10.00 (+0.6%) to $1,795 an ounce, the highest close since September 2011.

U.S. WTI crude oil futures (August) were little changed at $40.62 a barrel.

On the forex front, the ICE U.S. Dollar Index rose 0.2% on day to 96.97. Federal Reserve Bank of Atlanta President Raphael Bostic said the coronavirus impacts might go on longer than they had expected and planned for.

EUR/USD lost 0.3% to 1.1276. Official data showed that German industrial production grew 7.8% on month in May (+11.1% expected).

GBP/USD climbed 0.4% to 1.2543. U.K. chief negotiator David Frost met his European Union counterpart Michel Barnier on Tuesday evening, and investors were hopeful ahead of the trade talks scheduled later today.

USD/JPY gained 0.2% to 107.60.

AUD/USD dropped 0.4% to 0.6944. The Reserve Bank of Australia kept its benchmark rate unchanged at 0.25% as expected.

Nasdaq 100 Index: Daily Chart

Source: GAIN Capital, TradingView

Energy (-3.18%), Banks (-3.16%) and Capital Goods (-2.24%) sectors lost the most. Devon Energy (DVN -7.26%), Phillips 66 (PSX -5.21%), United Airlines (UAL -7.47%), American Airlines (AAL -6.68%), Delta Airlines (DAL -5.19%) and Boeing Co (BA -4.81%) were top losers.

On the technical side, about 45.9% (43.3% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 56.7% (39.3% in the prior session) were trading above their 20-day moving average.

European stocks were broadly lower. The Stoxx Europe 600 Index declined 0.61%. Germany's DAX 30 fell 0.92%, France's CAC 40 lost 0.74%, and the U.K.'s FTSE 100 was down 1.53%.

U.S. government bond prices rebounded, as the benchmark 10-year Treasury yield eased to 0.652% from 0.683% Monday.

Spot gold price extended its winning streak to a fourth session gaining $10.00 (+0.6%) to $1,795 an ounce, the highest close since September 2011.

U.S. WTI crude oil futures (August) were little changed at $40.62 a barrel.

On the forex front, the ICE U.S. Dollar Index rose 0.2% on day to 96.97. Federal Reserve Bank of Atlanta President Raphael Bostic said the coronavirus impacts might go on longer than they had expected and planned for.

EUR/USD lost 0.3% to 1.1276. Official data showed that German industrial production grew 7.8% on month in May (+11.1% expected).

GBP/USD climbed 0.4% to 1.2543. U.K. chief negotiator David Frost met his European Union counterpart Michel Barnier on Tuesday evening, and investors were hopeful ahead of the trade talks scheduled later today.

USD/JPY gained 0.2% to 107.60.

AUD/USD dropped 0.4% to 0.6944. The Reserve Bank of Australia kept its benchmark rate unchanged at 0.25% as expected.

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM