Asia Morning: Dow Up 2%, Jobs Reduction Smaller Than Expected

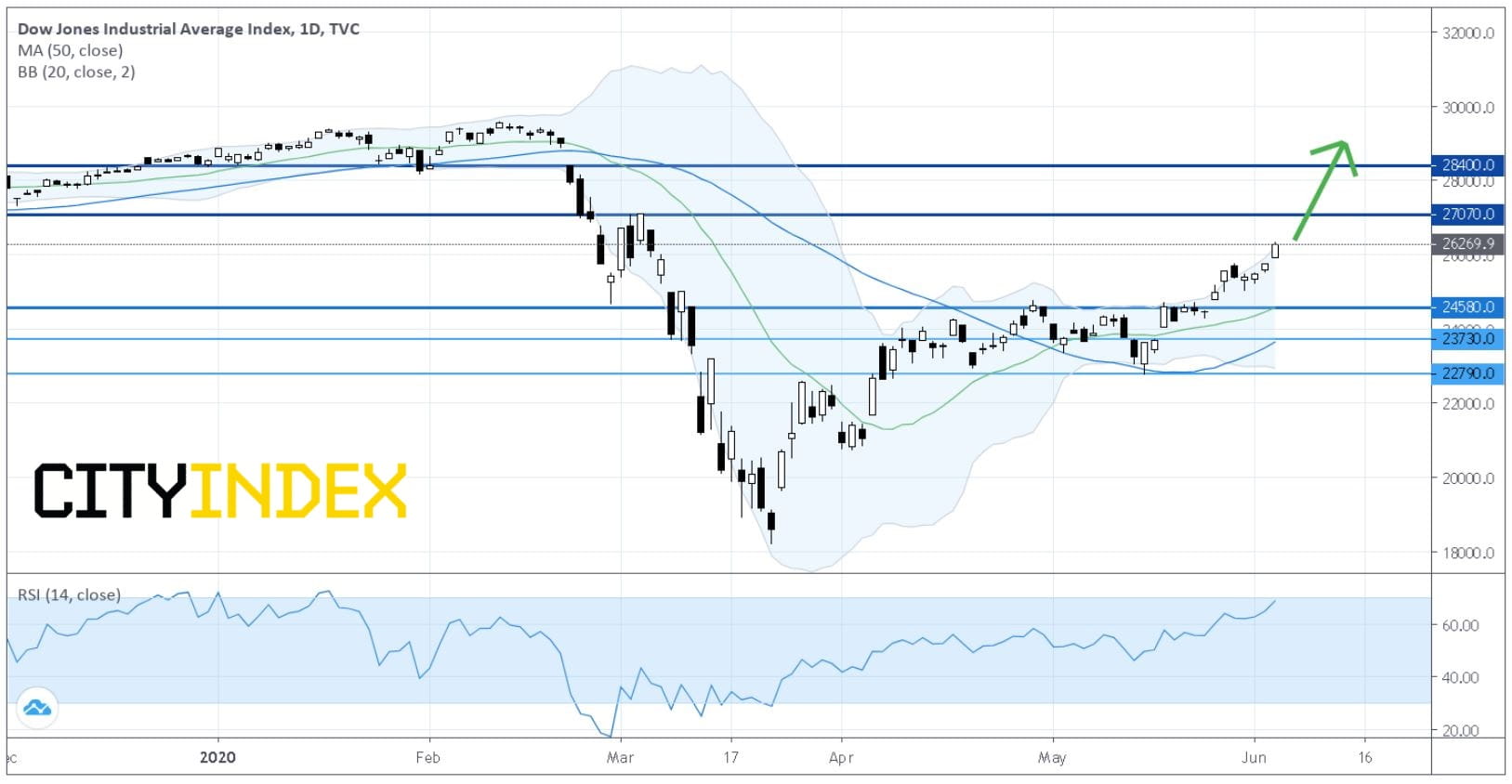

The Dow Jones Industrial Average surged 527 points (+2.1%) to 26269, the S&P 500 rose 42 points (+1.4%) to 3122, and the Nasdaq 100 was up 47 points (+0.5%) to 9704.

Source: GAIN Capital, TradingView

Banks (+5.21%), Automobiles & Components (+4.92%) and Consumer Durables & Apparel (+4.58%) sectors performed the best.

Simon Property Group Inc (SPG +14.86%), Macerich Company (MAC +14.23%), Coty (COTY +13.37%, Boeing Co (BA +12.95%), Macy’s (M +12.93%) and United Airlines (UAL +12.50%) were top gainers.

On the technical side, about 46.4% (44.6% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 95.8% (94.9% in the prior session) were above their 20-day moving average.

The Automatic Data Processing (ADP) employment report showed a reduction of 2.760 million private jobs in May, much better than -9.000 million expected and -19,557 million in April.

Also, U.S. official data showed that Factory Orders decreased 13.0% on month in April (-13.4% expected) and Durable Goods Orders (final reading) dropped 17.7% (-17.2% expected).

Later today, Initial Jobless Claims (a decline to 1.843 million expected), Continuing Claims (a decline to 20.050 million expected), and Trade Balance (a deficit of 49.2 billion dollar expected for April) will be reported.

Meanwhile, the U.S. government said it will block Chinese airlines from flying into the country in response to China's decision to ban U.S. air carriers.

European stocks saw another session of beefy gains, with the Stoxx Europe 600 Index surging 2.5%. Germany's DAX jumped 3.9%, the U.K.'s FTSE 100 rose 2.6% and France's CAC gained 3.4%.

Safe-haven assets declined in prices amid growing market optimism. U.S. Treasury prices sank further as the benchmark 10-year Treasury yield advanced to 0.761% from 0.679% Tuesday. Spot gold price fell $26.00 (-1.5%) to $1,698 posting a two-day decline.

Oil prices charged higher on reports that Saudi Arabia and Russia have agreed to extend an output cut deal through July. U.S. WTI crude oil futures (July) added 1.3% $37.29 a barrel.

On the forex front, the ICE U.S. Dollar Index extended its decline on Wednesday, dropping 0.3% on day to 97.31.

EUR/USD rose 0.6% to 1.1232, posting a seven-day winning streak. The German coalition parties have agreed a fresh 130 billion euros stimulus package. Meanwhile, official data showed that the eurozone's jobless rates edged up to 7.3% in April (8.2% expected) from 7.1% in March, while German jobless rate climbed to 6.3% in May (6.2% expected) from 5.8% in April. On the other hand, the European Central Bank is expected to keep its key interest rates unchanged later today.