Asia Morning: US Stocks Mixed, GBP/USD Sees Volatile Trading

On Monday, the three major U.S. indices ended mixed. The Dow Jones Industrial Average lost 148 points (-0.5%) to 30069 and S&P 500 fell 7 points (-0.2%) to 3691, while Nasdaq 100 rose 68 points (+0.5%) to 12596.

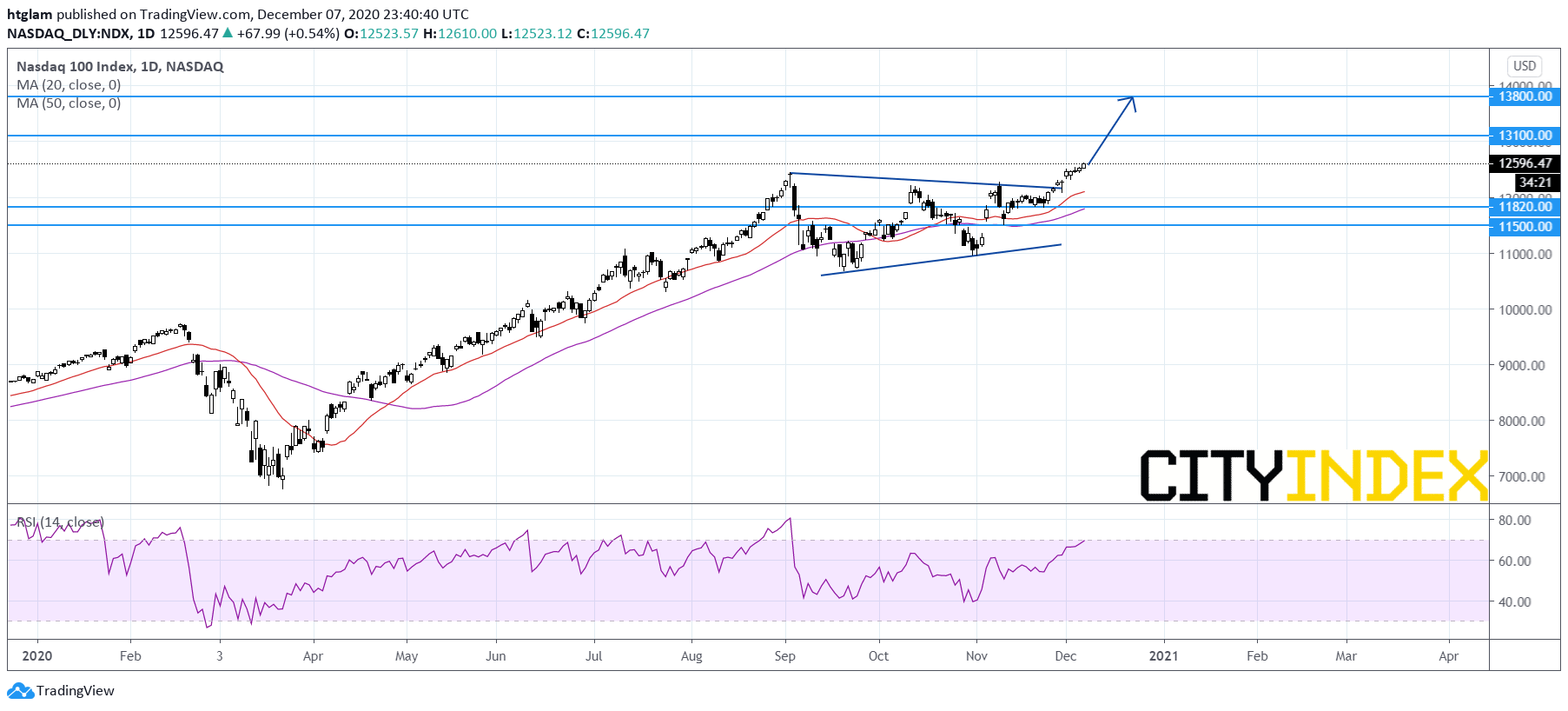

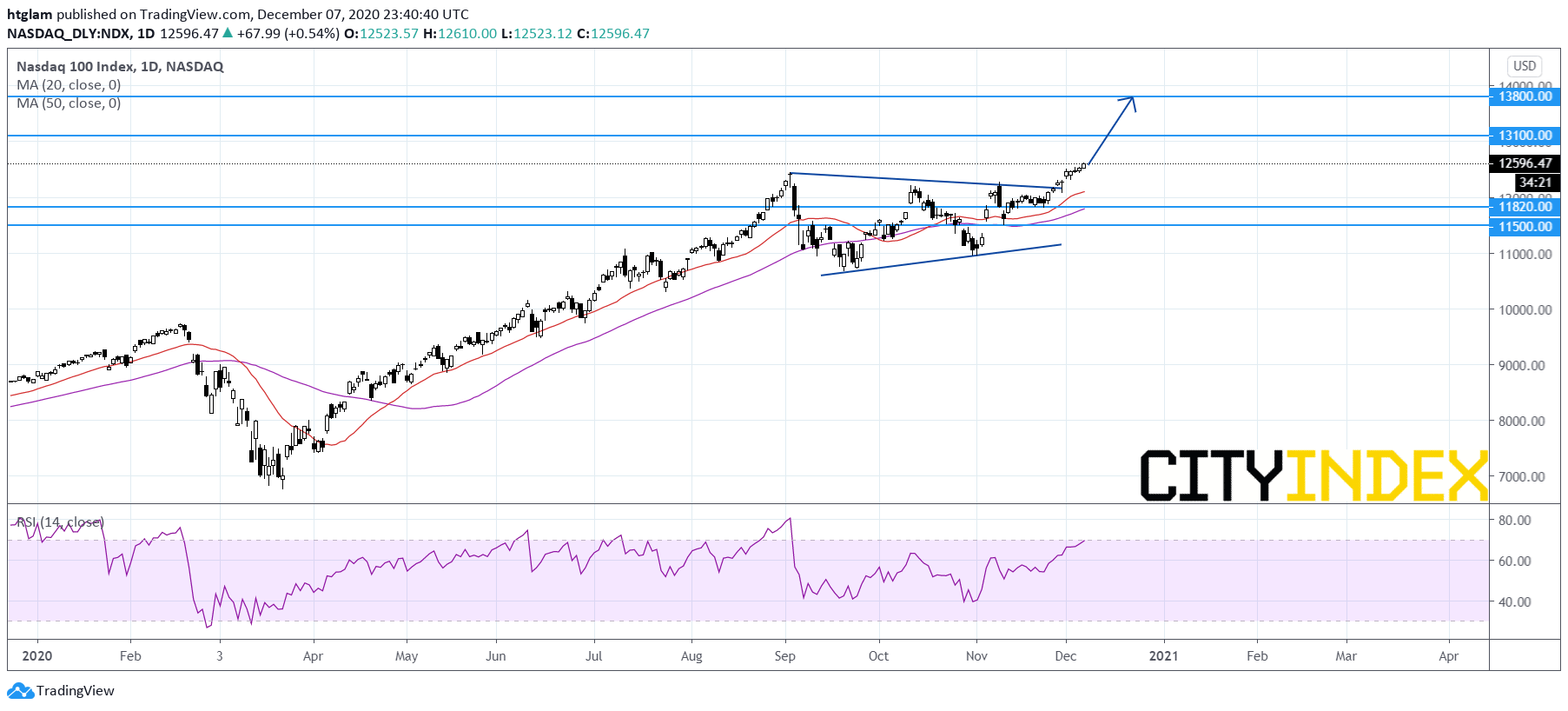

Nasdaq 100 Index Daily Chart:

Source: GAIN Capital, TradingView

Consumer Durables & Apparel (+1.0%), Technology Hardware & Equipment (+0.9%) and Media (+0.7%) were the best performing sectors on the day, while Energy (-2.4%), Insurance (-1.6%) and Real Estate (-0.9%) sectors dropped the most.

Approximately 93% of stocks in the S&P 500 Index were trading above their 200-day moving average and 77% were trading above their 20-day moving average. The VIX Index jumped 0.57pt (+2.7%) to 21.36.

European stocks were mixed. The Stoxx Europe 50 slipped 0.3%, Germany's DAX dipped 0.2% and France's CAC 40 slid 0.6%, while the U.K.'s FTSE 100 gained 0.1%.

The benchmark U.S. 10-year Treasury yield retreated to 0.9228% from 0.9659% Friday.

WTI crude futures lost 1.2% to $45.76 a barrel.

Spot gold jumped 1.3% to $1,862 an ounce, the highest level since November 20.

On the forex front, the ICE U.S. Dollar Index edged up 0.1% to 90.87.

GBP/USD saw volatile trading as it marked a day-low of 1.3225 before paring some losses to 1.3364, down 0.5%. U.K. Prime Minister Boris Johnson will meet European Commission President Ursula von der Leyen in Brussels, as "significant differences" remain unresolved.

EUR/USD slipped 0.1% to 1.2113. Official data showed that German industrial production grew 3.2% on month in October (+1.6% expected).

USD/JPY fell 0.1% to 104.01. This morning, government data showed that Japan's household spending increased 1.9% on year in October (+2.8% expected).

Commodity-linked currencies were broadly lower against the greenback. Both AUD/USD and NZD/USD edged down 0.1%, while USD/CAD added 0.1%, snapping a four-day decline.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM