Asia Morning: DJIA Posts 3-Day Rally, USD Index Below 91.00 ahead of NFP

On Thursday, the three major U.S. indices closed mixed. The Dow Jones Industrial Average rose 85 points (+0.3%) to 29969 and Nasdaq 100 added 10 points (+0.1%) to 12467, while S&P 500 slipped 2 points (-0.1%) to 3666.

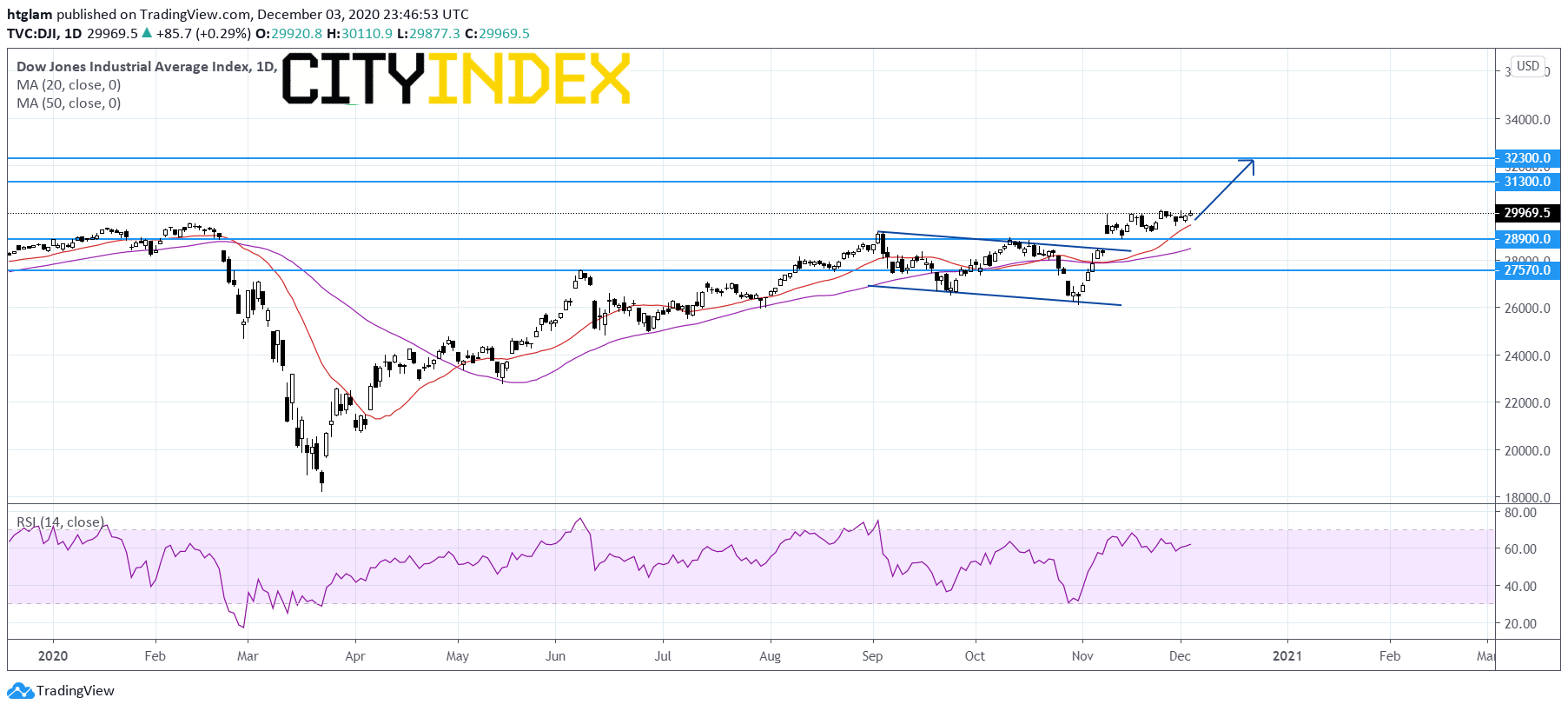

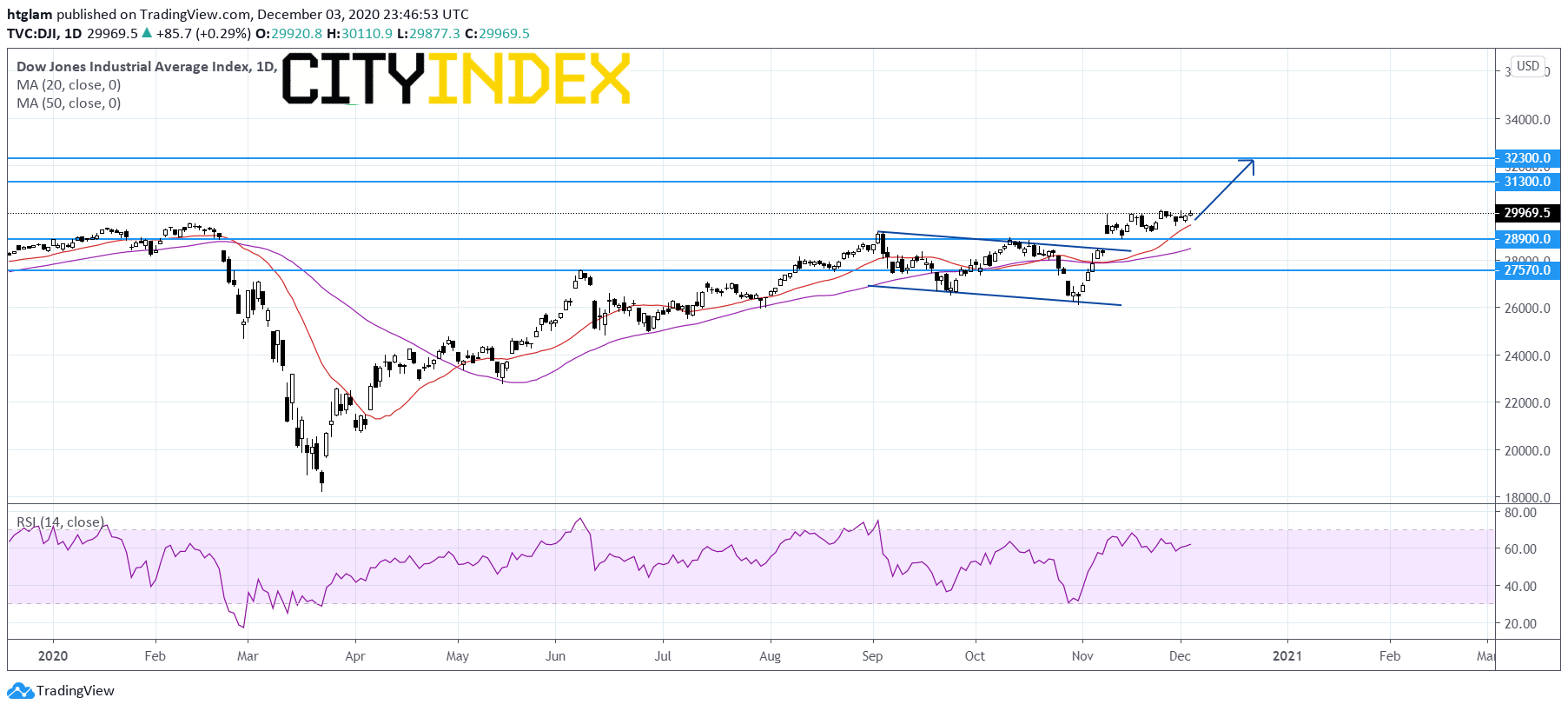

Dow Jones Industrial Average Daily Chart:

Source: GAIN Capital, TradingView

Consumer Durables & Apparel (+2.0%), Consumer Services (+1.4%) and Energy (+1.1%) sectors gained the most, while Utilities (-1.1%), Food & Staples Retailing (-0.8%) and Materials (-0.7%) sectors were the worst performers.

Approximately 93% of stocks in the S&P 500 Index were trading above their 200-day moving average and 75% were trading above their 20-day moving average. The VIX Index gained 0.28pt (+1.3%) to 21.45.

Regarding U.S. economic data, initial jobless claims fell to 0.71 million in the week ending November 28 (0.77 million expected) from 0.79 million in the prior week, while the ISM Services Index dropped to 55.9 in November (55.8 expected) from 56.6 in October. Later today, the closely watched nonfarm payrolls report for November will be released (+0.48 million jobs, jobless rate at 6.8% expected).

European stocks were mixed. The Stoxx Europe 50 slipped 0.1%, Germany's DAX slid 0.5% and France's CAC 40 fell 0.2%, while the U.K.'s FTSE 100 advanced 0.4%.

The benchmark U.S. 10-year Treasury yield retreated to 0.9063% from 0.9360% in the prior session, halting a three-day rally.

WTI crude futures bounced 0.8% to $45.64 a barrel. It is reported that OPEC+ members agreed to increase oil production by 0.5 million barrels per day in January and gradually easing output cuts.

Spot gold gained 0.5% to $1,841 an ounce, posting a three-day rebound.

On the forex front, the ICE U.S. Dollar Index remains under pressure as it slid 0.5% further to 90.70. Investors will watch closely the U.S. nonfarm payrolls report for November due to be released.

EUR/USD added 0.2% to 1.2143. Official data showed that the eurozone's retail sales grew 1.5% on month in October (+0.7% on month expected). Later today, German factory orders for October will be released (+1.5% on month expected).

GBP/USD bounced 0.7% to 1.3454. The Markit U.K. Construction PMI for November will be reported later in the day (52.0 expected).

USD/JPY lost 0.5% to a 2-week low of 103.86.

USD/CAD dropped 0.4% to a 2-year low of 1.2866. Canada's official jobs report for November will be released later today (+20,000 jobs, jobless rate steady at 8.9% expected).

Other commodity-linked currencies strengthened against the greenback. AUD/USD climbed 0.3% to 0.7438 and NZD/USD gained 0.1% to 0.7076, both up for third straight session.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM