Asia Morning: DJIA Extends Gains, GBP/USD Weighs by Brexit Uncertainty

On Wednesday, the three major U.S. indices closed mixed. The Dow Jones Industrial Average gained 59 points (+0.2%) to 298883 and the S&P 500 rose 6 points (+0.2%) to 3669, while Nasdaq 100 was flat at 12456.

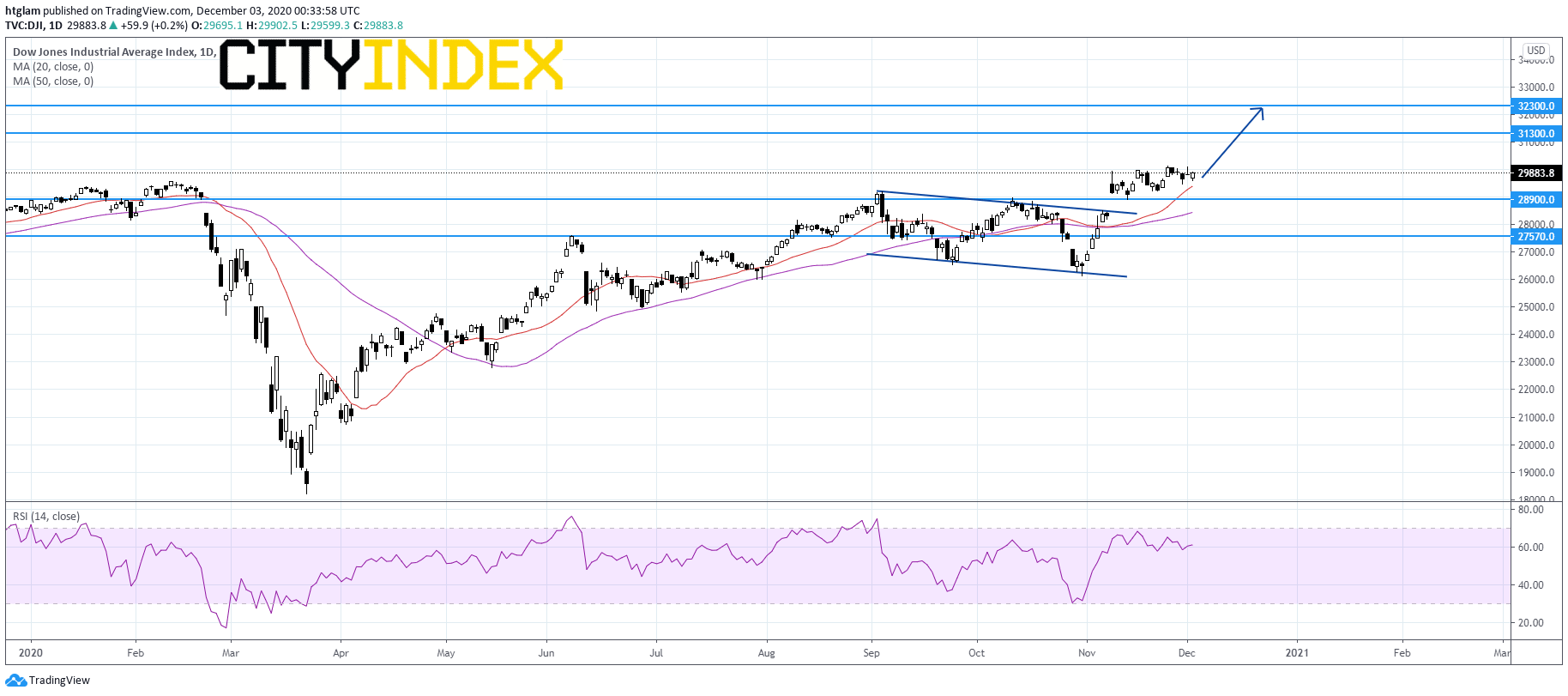

Dow Jones Industrial Average Daily Chart:

Source: GAIN Capital, TradingView

Energy (+3.2%), Banks (+1.7%) and Health Care Equipment & Services (+1.1%) were leading sectors, while Materials (-1.4%), Commercial & Professional Services (-1.4%) and Real Estate (-1.1%) sectors were the worst performers.

Approximately 93% of stocks in the S&P 500 Index were trading above their 200-day moving average and 80% were trading above their 20-day moving average. The VIX Index rose 0.38pt (+1.8%) to 21.15

Regarding U.S. economic data, ADP private jobs increased 307,000 in November (+440,000 expected). Later today, initial jobless claims for the week ending November 28 (0.77 million expected) and the ISM Services Index for November (55.8 expected) will be released.

European stocks were mixed. The Stoxx Europe 50 fell 0.1%, Germany's DAX dropped 0.5% and France's CAC 40 was little changed, while the U.K.'s FTSE 100 surged 1.2%.

The benchmark U.S. 10-year Treasury yield advanced to 0.9360% from 0.9260% Tuesday, up for a third straight session.

WTI crude futures rebounded 1.6% to $45.28 a barrel, snapping a three-day decline. The U.S. Energy Information Administration (EIA) reported that U.S. crude oil inventories dropped 0.68 million barrels in the week ending November 27 (-1.90 million barrels expected).

Spot gold climbed 0.9% to $1,831 an ounce.

On the forex front, the U.S. dollar weakened further against its major peers, with the ICE Dollar Index dropping 0.3% to 91.02. House Speaker Nancy Pelosi and Senate Democratic leader Chuck Schumer support immediate stimulus talks and are planning for a 908 billion dollars aid proposal.

EUR/USD gained 0.4% to 1.2112. Official data showed that German retail sales grew 2.6% on month in October (+1.2% expected). Later today, the eurozone's retail sales for October will be released (+0.7% on month expected).

GBP/USD lost 0.3% to 1.3372. It is reported that European ambassadors warned chief Brexit negotiator Michel Barnier not to make further concessions to Britain or such a deal would be vetoed by E.U. leaders.

USD/JPY edged up 0.2% to 104.49.

AUD/USD rose 0.6% to 0.7416, the highest level since August 2018. Government data showed that the Australian economy contracted 3.8% on year in the third quarter (-4.4% expected).

Other commodity-linked currencies were broadly higher against the greenback. NZD/USD added 0.1% to 0.7070, while USD/CAD slipped 0.1% to 1.2919.

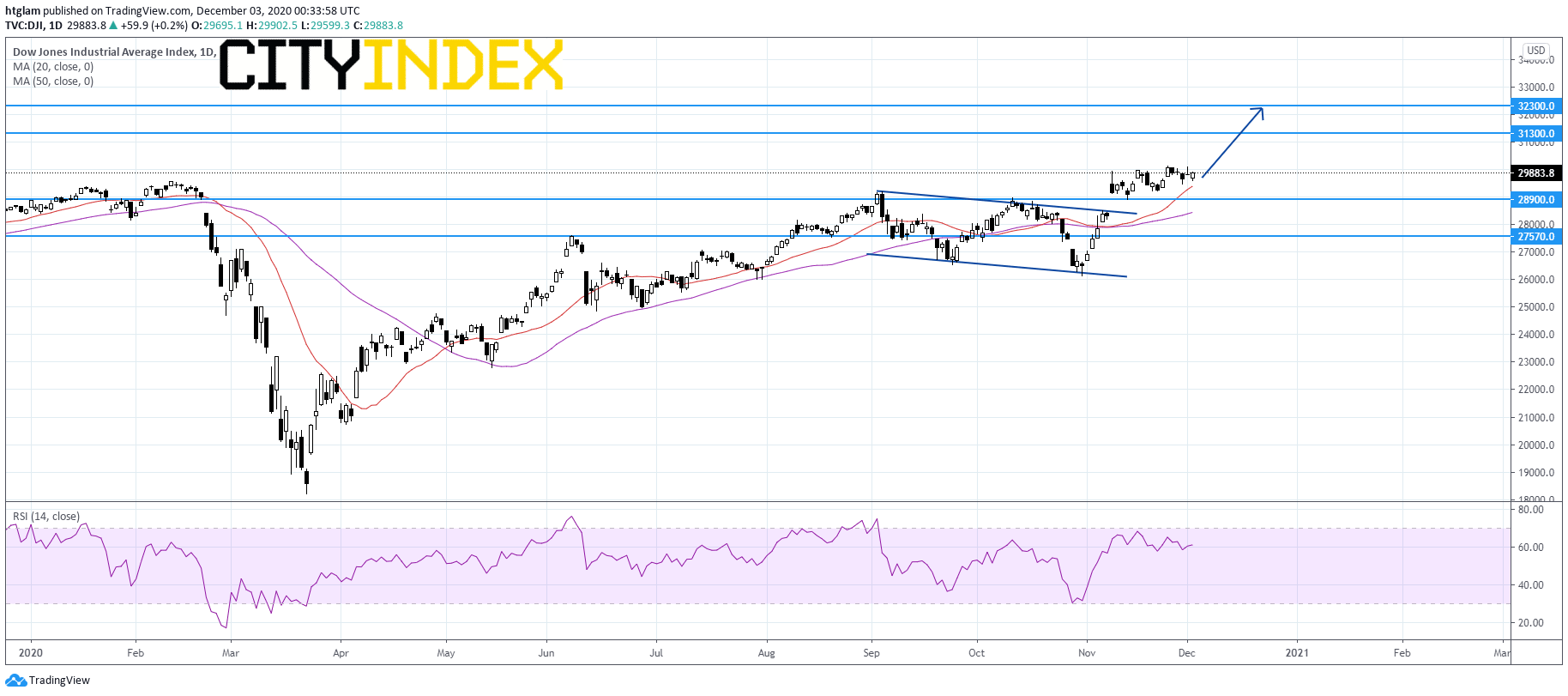

Dow Jones Industrial Average Daily Chart:

Source: GAIN Capital, TradingView

Energy (+3.2%), Banks (+1.7%) and Health Care Equipment & Services (+1.1%) were leading sectors, while Materials (-1.4%), Commercial & Professional Services (-1.4%) and Real Estate (-1.1%) sectors were the worst performers.

Approximately 93% of stocks in the S&P 500 Index were trading above their 200-day moving average and 80% were trading above their 20-day moving average. The VIX Index rose 0.38pt (+1.8%) to 21.15

Regarding U.S. economic data, ADP private jobs increased 307,000 in November (+440,000 expected). Later today, initial jobless claims for the week ending November 28 (0.77 million expected) and the ISM Services Index for November (55.8 expected) will be released.

European stocks were mixed. The Stoxx Europe 50 fell 0.1%, Germany's DAX dropped 0.5% and France's CAC 40 was little changed, while the U.K.'s FTSE 100 surged 1.2%.

The benchmark U.S. 10-year Treasury yield advanced to 0.9360% from 0.9260% Tuesday, up for a third straight session.

WTI crude futures rebounded 1.6% to $45.28 a barrel, snapping a three-day decline. The U.S. Energy Information Administration (EIA) reported that U.S. crude oil inventories dropped 0.68 million barrels in the week ending November 27 (-1.90 million barrels expected).

Spot gold climbed 0.9% to $1,831 an ounce.

On the forex front, the U.S. dollar weakened further against its major peers, with the ICE Dollar Index dropping 0.3% to 91.02. House Speaker Nancy Pelosi and Senate Democratic leader Chuck Schumer support immediate stimulus talks and are planning for a 908 billion dollars aid proposal.

EUR/USD gained 0.4% to 1.2112. Official data showed that German retail sales grew 2.6% on month in October (+1.2% expected). Later today, the eurozone's retail sales for October will be released (+0.7% on month expected).

GBP/USD lost 0.3% to 1.3372. It is reported that European ambassadors warned chief Brexit negotiator Michel Barnier not to make further concessions to Britain or such a deal would be vetoed by E.U. leaders.

USD/JPY edged up 0.2% to 104.49.

AUD/USD rose 0.6% to 0.7416, the highest level since August 2018. Government data showed that the Australian economy contracted 3.8% on year in the third quarter (-4.4% expected).

Other commodity-linked currencies were broadly higher against the greenback. NZD/USD added 0.1% to 0.7070, while USD/CAD slipped 0.1% to 1.2919.

Latest market news

Yesterday 08:33 AM