Nasdaq at Record High, EUR/USD Surges Above 1.2000

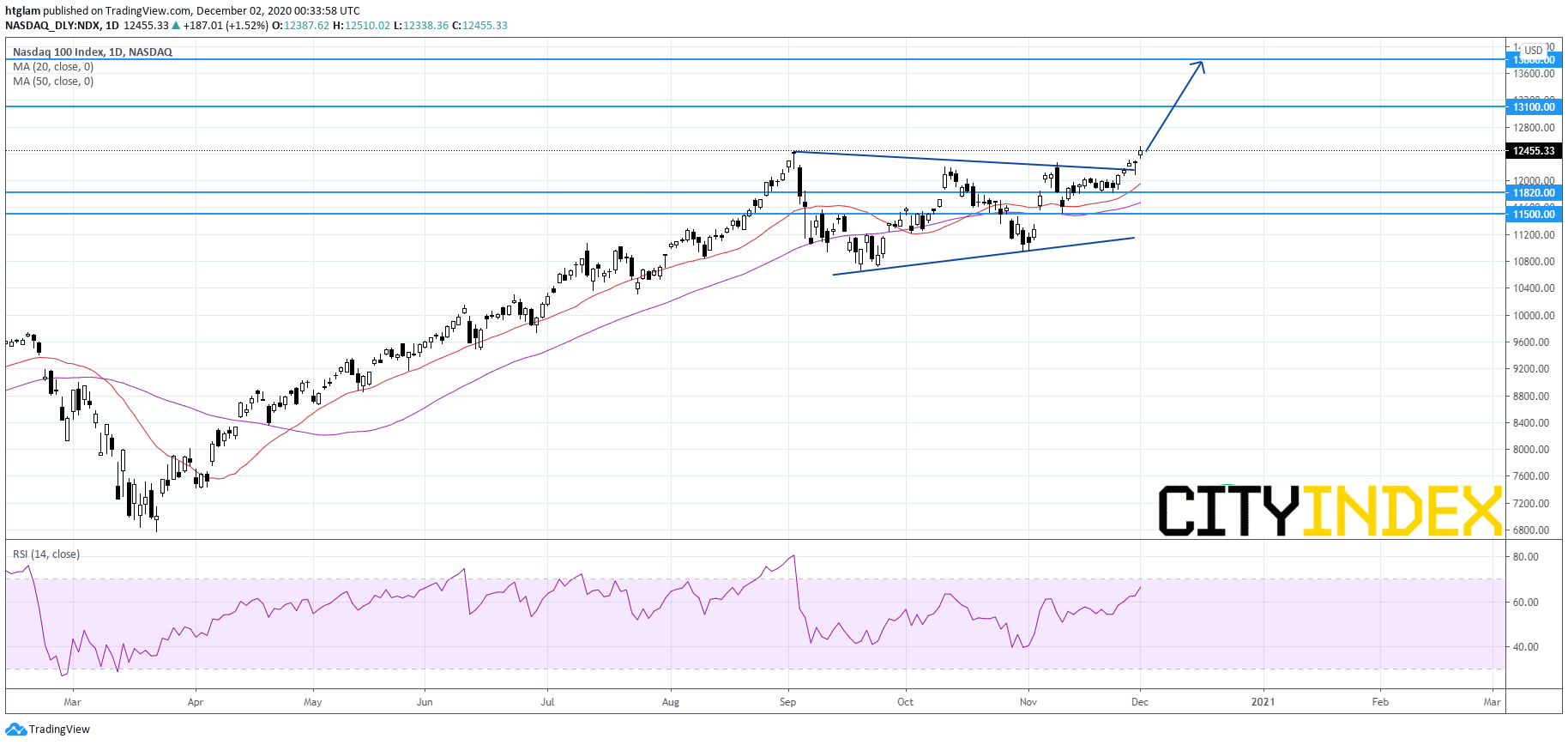

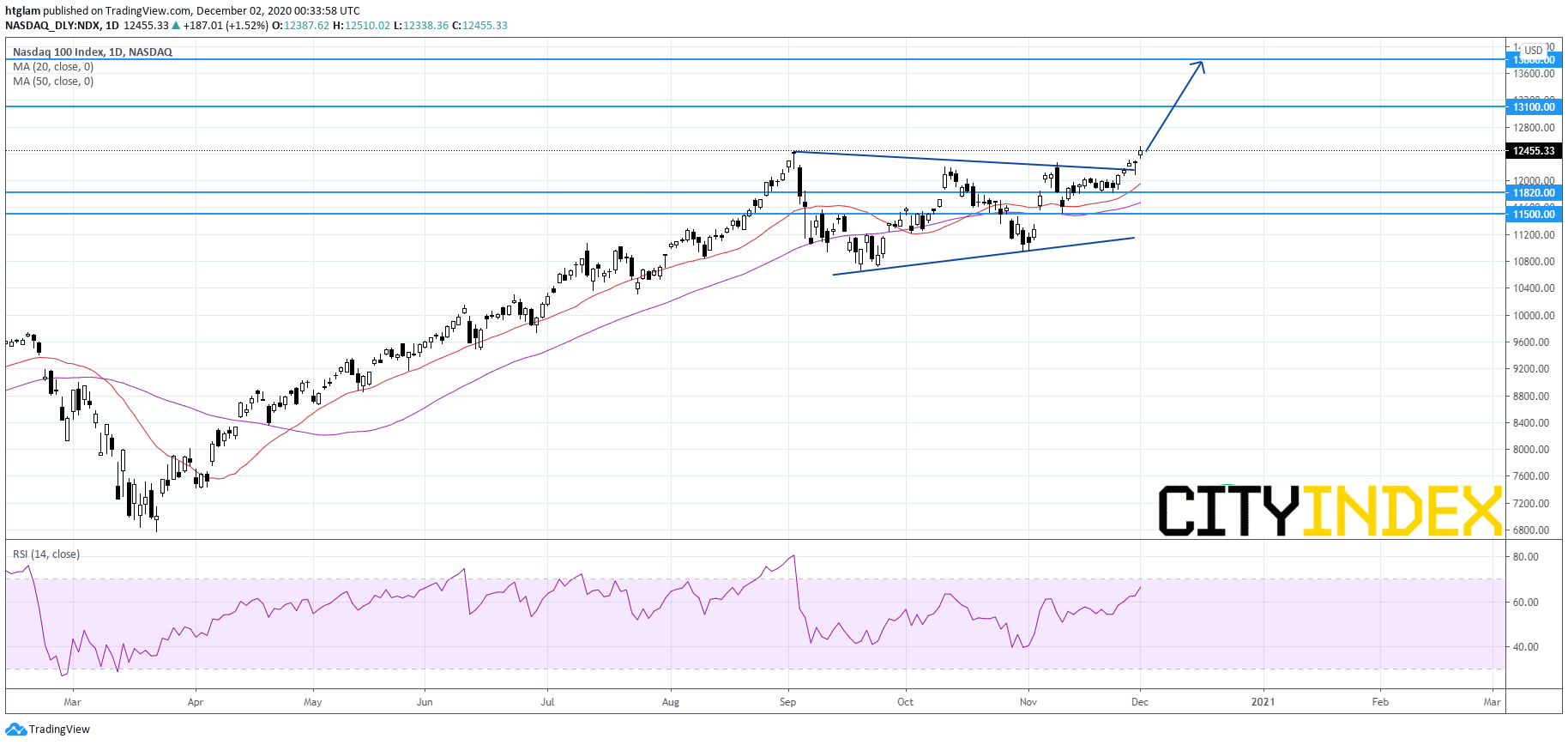

On Tuesday, the three major U.S. indices closed higher, with Nasdaq 100 rising 187 points (+1.5%) to a fresh record high of 12455. The Dow Jones Industrial Average gained 185 points (+0.6%) to 29823 and the S&P 500 added 40 points (+1.1%) to 3662. Technology Hardware & Equipment (+2.7%), Insurance (+2.3%) and Media (+2.3%) sectors led the rally.

Nasdaq 100 Index Daily Chart:

Source: GAIN Capital, TradingView

Approximately 91% of stocks in the S&P 500 Index were trading above their 200-day moving average and 78% were trading above their 20-day moving average. The VIX Index rose 0.2 point (+1.0%) to 20.77.

It is reported that Pfizer (PFE +2.9%) and BioNTech sought regulatory approval for their Covid-19 vaccine in the European Union, which could be approved before year-end.

Regarding U.S. economic data, the ISM Manufacturing Index fell to 57.5 in November (58.0 expected) from 59.3 in October, while construction spending grew 1.3% in October (+0.8% expected). Later today, investors will focus on the November ADP jobs report (+0.43 million jobs expected). The Federal Reserve will release its economic report, the Beige Book.

European stocks were broadly higher. The Stoxx Europe 50 climbed 0.9%, Germany's DAX advanced 0.7%, France's CAC 40 rose 1.1%, and the U.K.'s FTSE 100 jumped 1.9%.

The benchmark U.S. 10-year Treasury yield surged to a 3-week high of 0.9260% from 0.8389% Monday.

WTI crude futures slid 1.7% to $44.55 a barrel. The American Petroleum Institute (API) reported that U.S. crude-oil inventories increased 4.15 million barrels in the week ending November 27 (-2.36 million barrels expected).

Spot gold rallied 2.2% to $1,815 an ounce.

On the forex front, the ICE U.S. Dollar Index dropped 0.7% to 91.19, the lowest level since April 2018.

EUR/USD surged 1.2% to 1.2072, the highest level since May 2018. Official data showed that the eurozone's CPI slipped 0.3% on year in November (-0.2% expected), while German jobless rate fell to 6.1% in November (6.3% expected) from 6.2% in October. Later today, German retail sales for October will be released (+1.2% on month expected).

GBP/USD advanced 0.8% to 1.3427. European Commission President Ursula von der Leyen said it is very clear that they want an agreement with the U.K., despite difficult negotiations.

USD/JPY was little changed at 104.29.

USD/CAD slid 0.5% to 1.2933. Government data showed that Canada's third quarter annualized GDP bounced 40.5% on quarter (+47.9% expected).

AUD/USD climbed 0.5% to 0.7380. The Reserve Bank of Australia kept its benchmark rate unchanged at 0.10% as expected.

Nasdaq 100 Index Daily Chart:

Source: GAIN Capital, TradingView

Approximately 91% of stocks in the S&P 500 Index were trading above their 200-day moving average and 78% were trading above their 20-day moving average. The VIX Index rose 0.2 point (+1.0%) to 20.77.

It is reported that Pfizer (PFE +2.9%) and BioNTech sought regulatory approval for their Covid-19 vaccine in the European Union, which could be approved before year-end.

Regarding U.S. economic data, the ISM Manufacturing Index fell to 57.5 in November (58.0 expected) from 59.3 in October, while construction spending grew 1.3% in October (+0.8% expected). Later today, investors will focus on the November ADP jobs report (+0.43 million jobs expected). The Federal Reserve will release its economic report, the Beige Book.

European stocks were broadly higher. The Stoxx Europe 50 climbed 0.9%, Germany's DAX advanced 0.7%, France's CAC 40 rose 1.1%, and the U.K.'s FTSE 100 jumped 1.9%.

The benchmark U.S. 10-year Treasury yield surged to a 3-week high of 0.9260% from 0.8389% Monday.

WTI crude futures slid 1.7% to $44.55 a barrel. The American Petroleum Institute (API) reported that U.S. crude-oil inventories increased 4.15 million barrels in the week ending November 27 (-2.36 million barrels expected).

Spot gold rallied 2.2% to $1,815 an ounce.

On the forex front, the ICE U.S. Dollar Index dropped 0.7% to 91.19, the lowest level since April 2018.

EUR/USD surged 1.2% to 1.2072, the highest level since May 2018. Official data showed that the eurozone's CPI slipped 0.3% on year in November (-0.2% expected), while German jobless rate fell to 6.1% in November (6.3% expected) from 6.2% in October. Later today, German retail sales for October will be released (+1.2% on month expected).

GBP/USD advanced 0.8% to 1.3427. European Commission President Ursula von der Leyen said it is very clear that they want an agreement with the U.K., despite difficult negotiations.

USD/JPY was little changed at 104.29.

USD/CAD slid 0.5% to 1.2933. Government data showed that Canada's third quarter annualized GDP bounced 40.5% on quarter (+47.9% expected).

AUD/USD climbed 0.5% to 0.7380. The Reserve Bank of Australia kept its benchmark rate unchanged at 0.10% as expected.

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM