Asia Morning: U.S. Stocks Extend Rally Amid Risk-on Sentiment

On Friday, U.S. stocks closed higher. The Dow Jones Industrial Average rose 161 points (+0.6%) to 28653, S&P 500 added 23 points (+0.7%) to 3508 and Nasdaq 100 gained 69 points (+0.6%) to 11995.

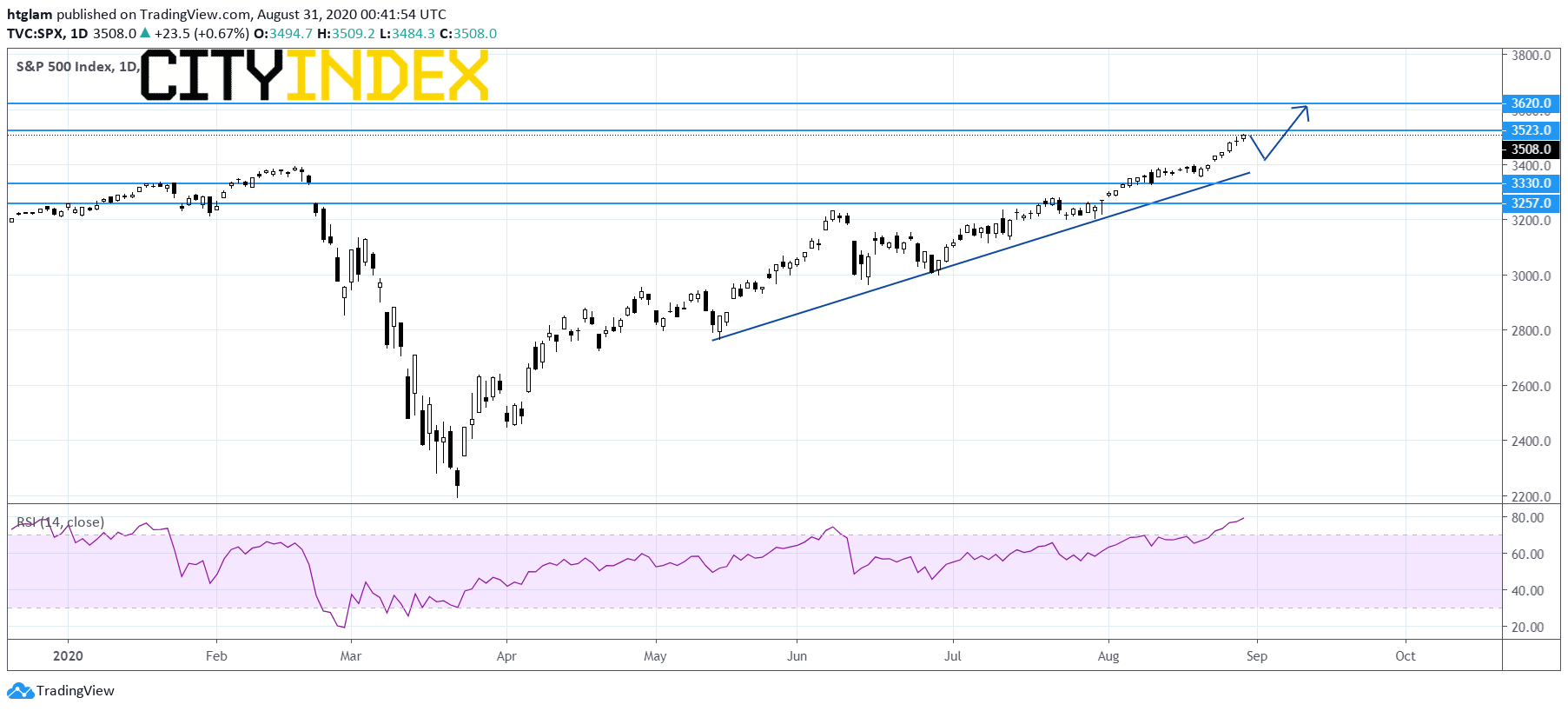

S&P 500 daily chart:

Source: Gain Capital, TradingView

The Semiconductors & Semiconductor Equipment (+2.37%), Consumer Services (+2.3%) and Energy (+1.85%) sectors led the advance. Approximately 61.8% of stocks in the S&P 500 Index were trading above their 200-day moving average and 67.9% were trading above their 20-day moving average.

Regarding U.S. economic data, personal spending increased 1.9% on month in July (+1.6% expected) and personal income grew 0.4% (-0.2% expected). The Market News International's Chicago PMI slipped to 51.2 in August (52.6 expected).

European stocks were broadly lower. The Stoxx Europe 600 Index lost 0.5%, Germany's DAX 30 dropped 0.5%, France's CAC 40 fell 0.3% and the U.K.'s FTSE 100 was down 0.6%.

The benchmark U.S. 10-year Treasury yield retreated to 0.7211% from 0.7522% Thursday.

WTI crude oil futures (October) edged down 0.2% to $42.97 a barrel. The total number of rotary rigs in the U.S. was unchanged at 254 as of August 28 as compared with the prior week, according to Baker Hughes.

Spot gold advanced 1.8% to $1,964 an ounce.

On the forex front, the U.S. dollar weakened against its major peers, with the ICE Dollar Index dropping 0.7% to 92.37.

EUR/USD bounced 0.7% to 1.1903. Official data showed that the eurozone's Economic Confidence Index climbed to 87.7 in August (85.0 expected) from 82.4 in July.

GBP/USD jumped 1.1% to 1.3349, the highest level since December.

USD/JPY sank 1.1% to 105.34. Japan's Prime Minister Shinzo Abe announced that he will resign from his position due to a chronic illness. Meanwhile, this morning, official data showed that Japan's industrial production grew 8.0% on month in July (+5.0% expected), while retail sales slid 3.3% (-2.5% expected),

USD/CAD fell 0.2% to 1.3097, down for a fourth straight session. Government data showed that Canada's second quarter annualized GDP shrank 38.7% on quarter (-39.4% expected).

Commodity-linked currencies were broadly higher against the greenback. AUD/USD rallied 1.5% to a 20-month high of 0.7366 and NZD/USD surged 1.6% to an 8-month high of 0.6742.

Latest market news

Today 08:15 AM