Asia Morning: S&P 500 and Nasdaq 100 Post Five-day Rally

On Wednesday, U.S. stocks closed higher. The Nasdaq 100 jumped 250 points (+2.1%) to 11,971 and the S&P 500 rose 35 points (+1.0%) to 3,478, both up for a fifth straight session. The Dow Jones Industrial Average gained 83 points (+0.3%) to 28,331.

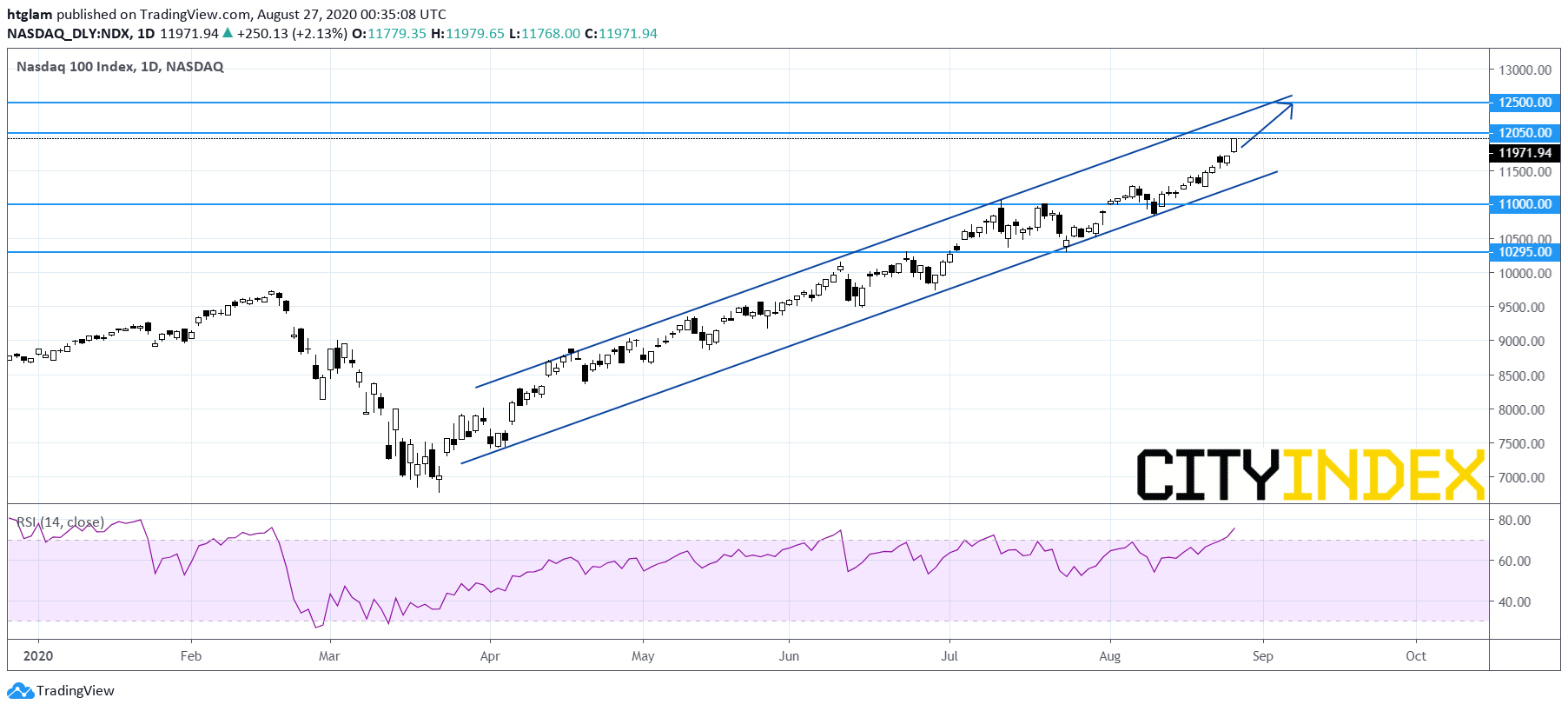

Nasdaq 100 Daily Chart:

Source: Gain Capital, TradingView

Media (+4.43%), Software & Services (+3.15%) and Retailing (+2.14%) sectors led the rally. Approximately 61.2% of stocks in the S&P 500 Index were trading above their 200-day moving average and 66.3% were trading above their 20-day moving average.

Regarding U.S. economic data, durable goods orders rose 11.2% on month in July (+4.8% expected).

Federal Reserve Chairman Jerome Powell's scheduled speech at Jackson Hole meeting will be the key focus today. Meanwhile, the second estimate of U.S. 2Q annualized GDP (-32.5% on quarter expected) and initial jobless claims for the week ending August 22 (1 million expected) will be released later in the day.

European stocks were broadly higher. The Stoxx Europe 600 Index advanced 0.8%, Germany's DAX 30 rose 1.0%, France's CAC 40 was up 0.8% and the U.K.'s FTSE 100 gained 0.1%.

The benchmark U.S. 10-year Treasury yield climbed to 0.688% from 0.684% Tuesday.

WTI crude oil futures (October) edged up 0.1% to $43.39 a barrel. The U.S. Energy Information Administration reported that crude inventories dropped 4.69 million barrels in the week ending August 21 (-2.53 million barrels expected). Meanwhile, Hurricane Laura has grown into a powerful Category 4 storm that potentially poses devastating threats to areas near the Texas-Louisiana border, according to the National Hurricane Center.

Spot gold marked a day-low near $1,903 before ending up 1.4% at $1,954.

On the forex front, the ICE U.S. Dollar Index slipped 0.1% on day to 92.89, ahead of Fed Chairman Jerome Powell's scheduled speech today.

EUR/USD gained 0.1% to 1.1839.

GBP/USD advanced 0.5% to 1.3217. It is reported that Germany has canceled plans to discuss Brexit at a high-level diplomatic meeting next week due to a lack of "tangible progress" in talks.

USD/JPY retreated 0.4% to 105.89.

Commodity-linked currencies were broadly higher against the greenback. AUD/USD rose 0.7% to 0.7240 and NZD/USD surged 1.2% to 0.6627, while USD/CAD fell 0.2% to 1.3143.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM