Asia Morning: U.S. Tech Stocks Lead Market

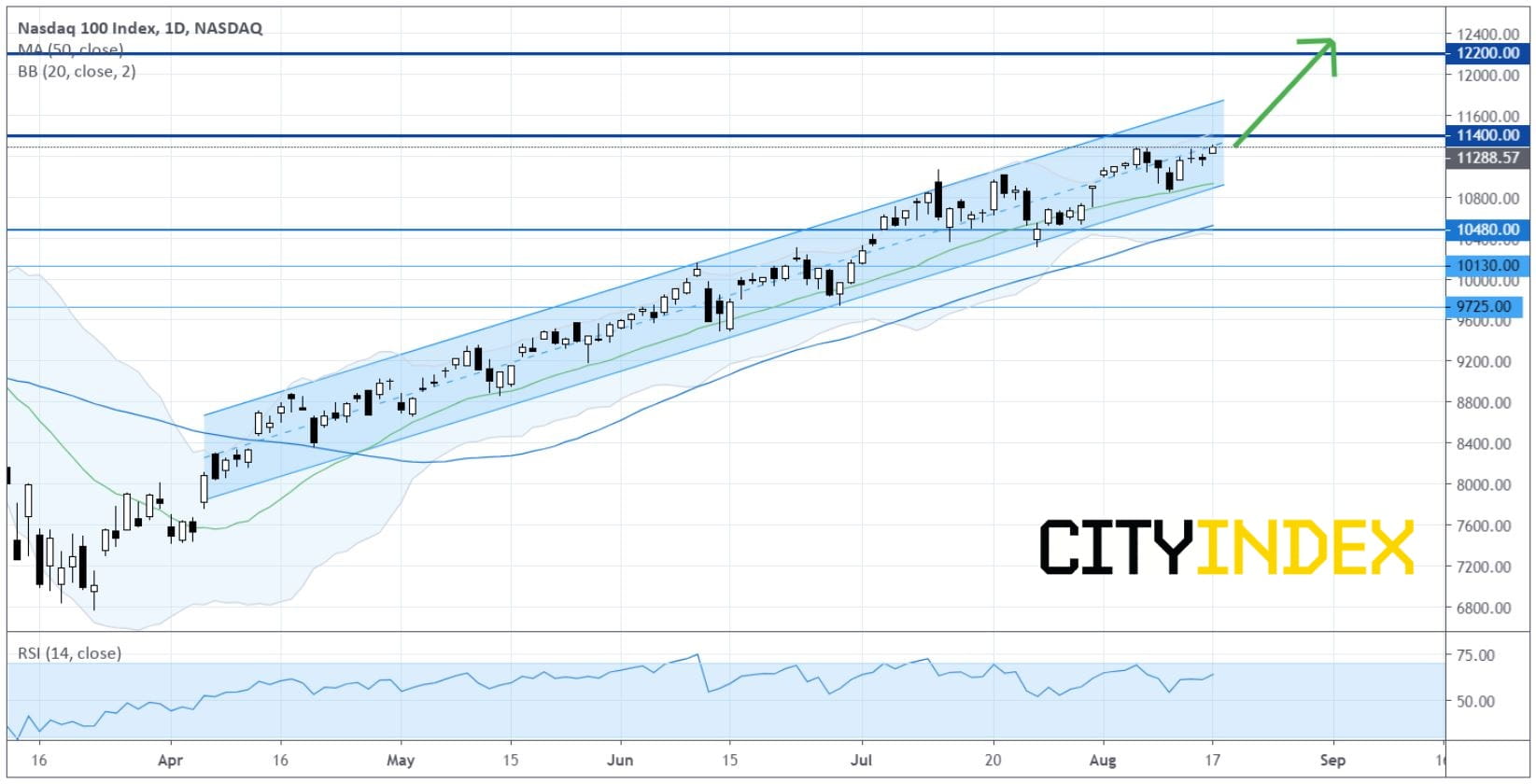

On Monday, the Nasdaq 100 Index charged 124 points (+1.11%) higher to a fresh record close of 11288. The S&P 500 added 9 points (+0.27%) to 3382, just below its record close of 3386 seen in February. The Dow Jones Industrial Average fell 86 points (-0.31%) to 27844.

Nasdaq 100 Index: Daily Chart

Source: GAIN Capital, TradingView

Automobiles & Components (+2.51%), Semiconductors & Semiconductor Equipment (+1.68%) and Retailing (+1.43%) sectors performed the best, while Bank (-2.39%), Insurance (-1.42%) and Diversified Financials (-0.92%) sectors were laggards.

Barrick Gold (GOLD +11.63%) jumped after a public filing revealed that Warren Buffett's Berkshire Hathaway had taken a new stake in the gold miner,

Shares of cancer drug developer Principia Biopharma (PRNB +9.38%) rose after French drugmaker Sanofi agreed to buy it for $100 per share.

On the other hand, American Airlines Group (AAL -5.33%), Carnival Corp (CCL -5.11%) and Occidental Petroleum (OXY -4.99%) were top losers.

Approximately 62.6% of stocks in the S&P 500 Index were trading above their 200-day moving average and 76.8% were trading above their 20-day moving average.

Regarding U.S. economic data, the Empire Manufacturing Index posted 3.7 in August, compared to 15.0 expected and 17.2 in July.

Housing Starts for July (annualized rate rising to 1.240 million units expected) will be reported later today.

European stocks closed higher. The Stoxx Europe 600 Index gained 0.32%, Germany's DAX 30 added 0.15%, France's CAC 40 climbed 0.18%, and the U.K.'s FTSE 100 rose 0.61%.

U.S. government bond prices traded higher, as the benchmark 10-year Treasury yield eased further to 0.682%.

Spot gold price jumped $40.00 (+2.08%) to $1,985 an ounce, and spot silver price surged 3.96% to $27.49 an ounce.

U.S. WTI crude oil futures (September) advanced 2.1% to $42.89 a barrel. Reports showed that major oil producers from the OPEC-plus group stuck to their agreed emergency production cuts in July.

On the forex front, the ICE U.S. Dollar Index slid 0.3% on day to 92.82, down for a fourth straight session.

EUR/USD rose 0.3% to 1.1873, posting a four-day rally.

GBP/USD gained 0.2% to 1.3104. It is reported that the British government is hopeful of a post-Brexit trade deal with European Union next month, as the two sides entered their seventh round of negotiations.

USD/JPY dropped 0.5% to 106.04.

Commodity-linked currencies were broadly higher against the greenback. AUD/USD advanced 0.6% to 0.7214 and NZD/USD was up 0.3% to 0.6554, while USD/CAD lost 0.3% to 1.3225.

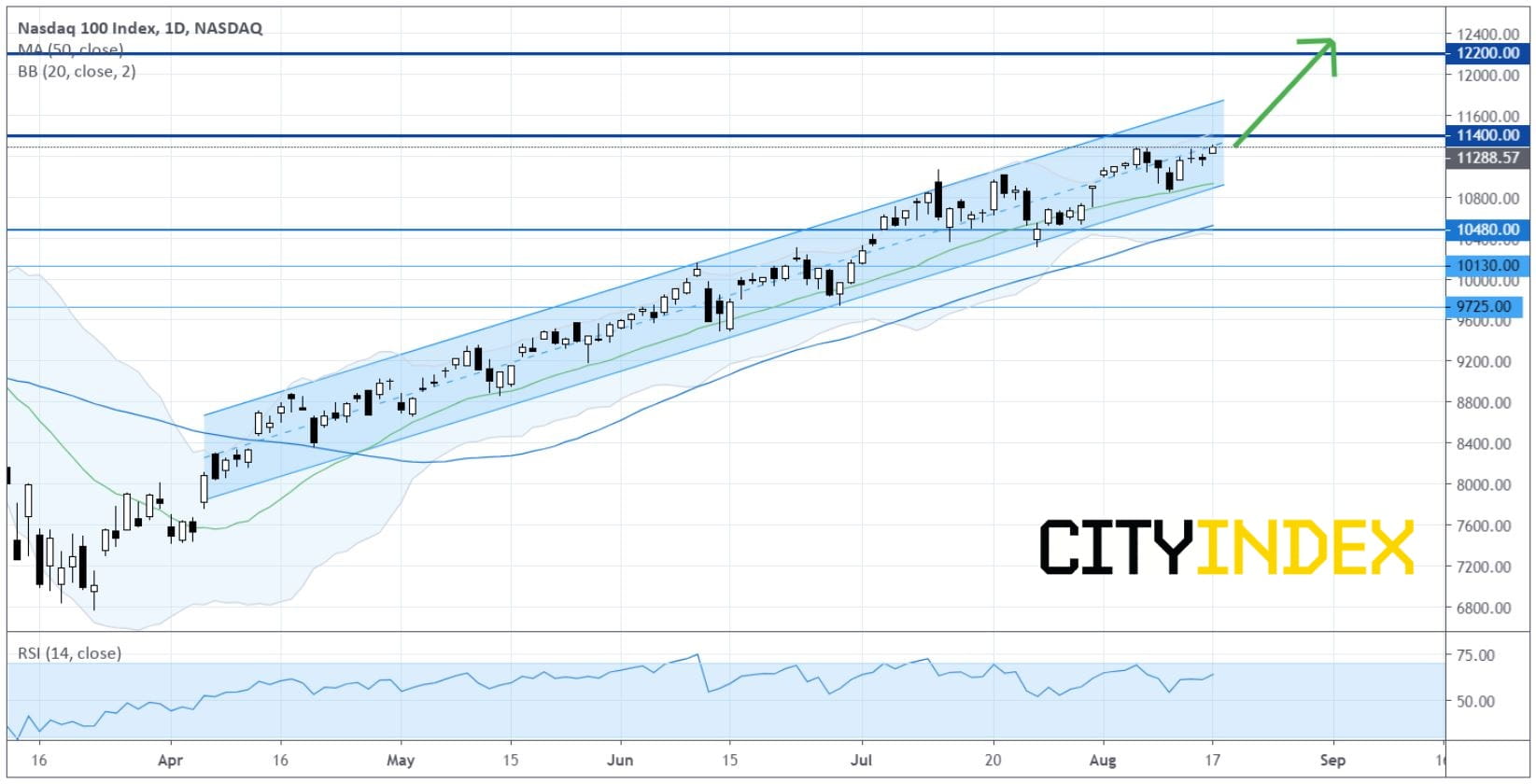

Nasdaq 100 Index: Daily Chart

Source: GAIN Capital, TradingView

Automobiles & Components (+2.51%), Semiconductors & Semiconductor Equipment (+1.68%) and Retailing (+1.43%) sectors performed the best, while Bank (-2.39%), Insurance (-1.42%) and Diversified Financials (-0.92%) sectors were laggards.

Barrick Gold (GOLD +11.63%) jumped after a public filing revealed that Warren Buffett's Berkshire Hathaway had taken a new stake in the gold miner,

Shares of cancer drug developer Principia Biopharma (PRNB +9.38%) rose after French drugmaker Sanofi agreed to buy it for $100 per share.

On the other hand, American Airlines Group (AAL -5.33%), Carnival Corp (CCL -5.11%) and Occidental Petroleum (OXY -4.99%) were top losers.

Approximately 62.6% of stocks in the S&P 500 Index were trading above their 200-day moving average and 76.8% were trading above their 20-day moving average.

Regarding U.S. economic data, the Empire Manufacturing Index posted 3.7 in August, compared to 15.0 expected and 17.2 in July.

Housing Starts for July (annualized rate rising to 1.240 million units expected) will be reported later today.

European stocks closed higher. The Stoxx Europe 600 Index gained 0.32%, Germany's DAX 30 added 0.15%, France's CAC 40 climbed 0.18%, and the U.K.'s FTSE 100 rose 0.61%.

U.S. government bond prices traded higher, as the benchmark 10-year Treasury yield eased further to 0.682%.

Spot gold price jumped $40.00 (+2.08%) to $1,985 an ounce, and spot silver price surged 3.96% to $27.49 an ounce.

U.S. WTI crude oil futures (September) advanced 2.1% to $42.89 a barrel. Reports showed that major oil producers from the OPEC-plus group stuck to their agreed emergency production cuts in July.

On the forex front, the ICE U.S. Dollar Index slid 0.3% on day to 92.82, down for a fourth straight session.

EUR/USD rose 0.3% to 1.1873, posting a four-day rally.

GBP/USD gained 0.2% to 1.3104. It is reported that the British government is hopeful of a post-Brexit trade deal with European Union next month, as the two sides entered their seventh round of negotiations.

USD/JPY dropped 0.5% to 106.04.

Commodity-linked currencies were broadly higher against the greenback. AUD/USD advanced 0.6% to 0.7214 and NZD/USD was up 0.3% to 0.6554, while USD/CAD lost 0.3% to 1.3225.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM