Asia FX Handover: Sentiment Remains Fragile

- The renewed threat of China tariffs were brushed aside to see equity markets broadly higher, with Chinese benchmark indices leading the way. Although we’d stop short of calling it a risk-on session as sentiment remains fragile.

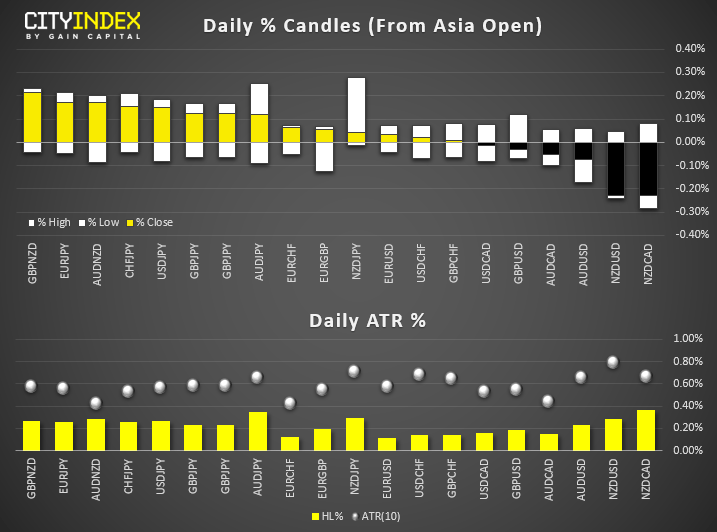

- JPY and EUR are marginal leaders among FX majors, whilst NZD and JPY are the weakest. GBP/NZD and NZD/CAD are today’s biggest movers.

- Australian business confidence jumped to its highest level since September, following the federal elections and RBA cut. However, conditions slumped to its lowest level since September 2014. Hitting 1 versus 3 expected, it’s just two units away from flipping to pessimistic.

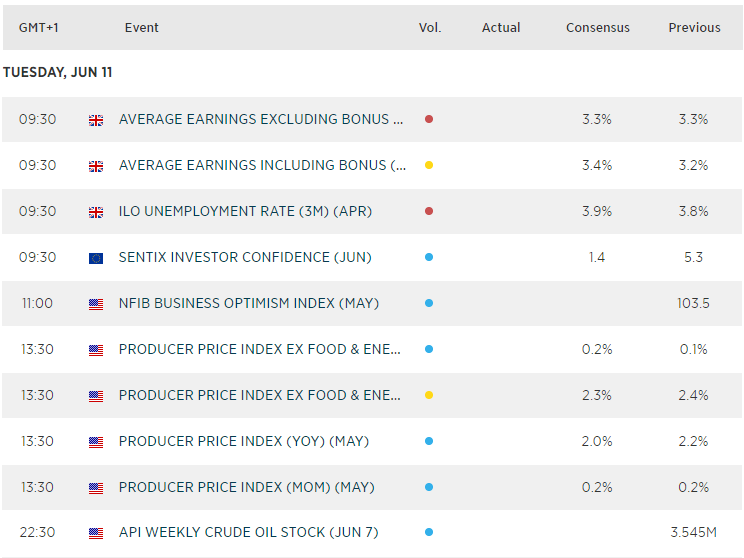

- BOE’s Saunders stated earlier in the session that BOE will ‘probably’ need to return to a neutral policy stance sooner than markets expect, and they don’t necessarily have to hold rates until all Brexit certainties are resolved.

Recent Analysis:

Daily FX Technical Trend Bias/Key Levels (Tues 11 Jun)

NZD/CAD Could Be Gearing Up For A 300 Pip-Slide

US Equity Handover: Five Straight Up Days for Stocks Among M&A News

Markets barely keep an eye on Tory contest for now

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM