Asia FX Handover: Mild Risk Off As Trade Headlines Dwindle

- The Hang Seng led Asian equities lower due to the extradition protest, with reports now flowing in that the government has postponed their vote. Gold is back above $1300 after yesterday’s doji. WTI back below $53 as the daily chart tries to carve out a top.

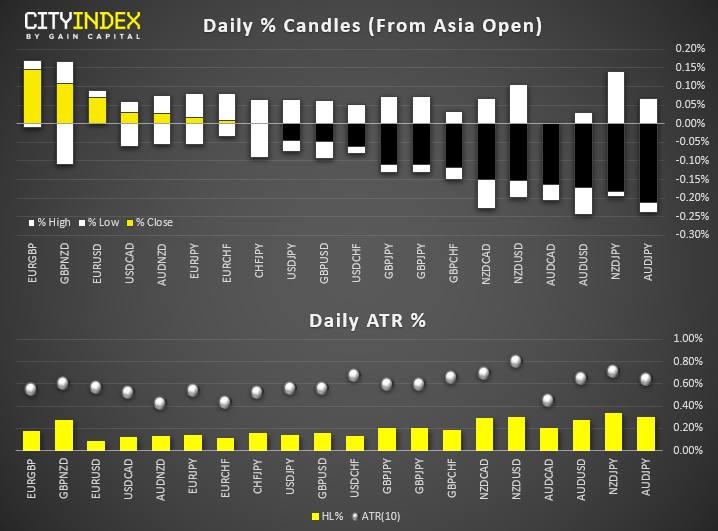

- It’s a narrow-ranged day for FX overall, although there’s a slight bid for safe havens to see CHF and JPY are the strongest majors, whilst NZD and AUD are the weakest. AUD/USD is testing yesterday’s lows on weaker consumer sentiment, although currently testing its daily retracement line.

- Japan’s machinery tool orders rose 5.2% in May to beat expectations of -5.3% and drag the YoY rate up to 2.5%. Yet sceptics point out it is masking a drop in the investment outloook, and doubt these expansive numbers can be maintained.

- No headline surprises in China’s CPI or PPI data, with inflation remaining stagnant at 0% in May, 2.7% YoY and producer prices rising 0.6% YoY all as expected.

- Australian consumer sentiment dipped by 0.6% in June after a run of disapointing data overshadowed this month’s RBA cut. This is in stark contracts to business sentiment which jumped to its highest level since September.

Today's Key Levels for FX Markets:

Daily Forex Technical Trend Bias/Key Levels (Wed 12 Jun)

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM