The UK construction equipment hire firm has raised its full year outlook after a less than feared fall in H1 sales & profits as it benefitted from status as an essential business during the covid pandemic.

Whilst trading volumes dropped owing to the covid crisis this was offset by the firm’s emergency response efforts, helping the governments in US, Canada and the UK react to the pandemic by providing equipment to hospitals, first responders and food service companies.

Q2 revenue fell 1% to £1.2 billion and underlying pre-tax profit dropped 7% to £330 million a significant improvement on declines of 6% & 38% respectively reported in Q1. The performance was also notably better than the 20% fall in profits expected. As a result, H1 profits were down 21% to £538 million. Revenue for the year is now seen falling 3% -7% compared to previously expected 5%-9%.

The firm has maintained its interim dividend at 7.15p after a record 3 months for cash flow. Management touched on the share buyback but said it was waiting for the right time.

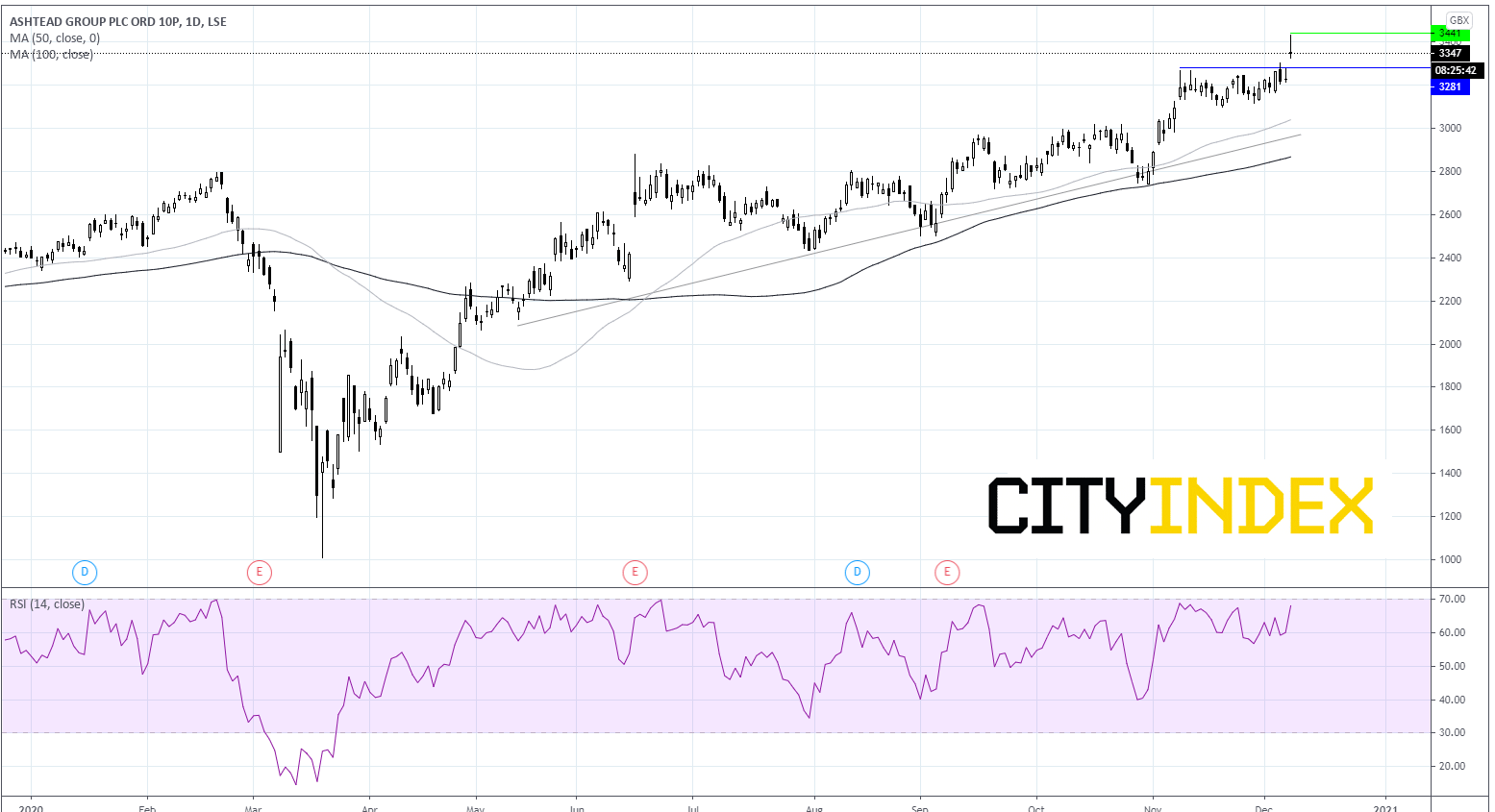

Ashtead Chart Thoughts

Ashtead has surged 5% spiking to 3431p an all time high. It trades comfortably above its ascending trendline dating back to early May. Ashtead sits above its 50 & 100 sma on the daily chart, suggesting there could be more upside on the cards. It is worth noting that the RSI on the same chart is approaching overbought territory, so it is worth keeping an eye on this level for clues for a pullback. Looking back Ashtead often respects the overbought level 70 on the RSI.

Immediate support can be seen at 3280, resistance turned support which capped gains several times across November & December. A breakthrough here could see 50 day sma tested at 3040. Resistance is seen at 3431 the all time high.