So what has been behind Boohoo’s meteoric rise and could the share price have further to go?

Sales at Boohoo have surged across the lockdown period. The online retailer reported 54%yoy increase in pre-tax profit to £92 million, on revenue that grew by 44% to £1.24 billion. Last week Boohoo gave a trading update with updated forecasts exceeding market expectations.

2. Acquisitions

Acquisitions are proving to be a key tool for Boohoo as the AIM firm continues to grow. Just last month, Boohoo announced that it was buying up the remaining 34.5% of Pretty Little Things, a move that sent shares 14% higher. Coast ad Karen Millen have also been snapped up by Boohoo and just last week, the buying up of Warehouse and Oasis was also announced.

The strategy of buying well known high street retailers with recognised brand names but poor sales is proving to be a wining combination for Boohoo, accelerating the shift from the UK high street online.

What will be interesting will be how many more acquisition opportunities the coronavirus crisis will bring Boohoo’s way. There will almost certainly be more struggling fashion retailers that will fold in the coming months. Given the strength of Boohoo’s balance sheet, they are in an ideal position to take advantage of weaker players, snapping them up if the opportunity presents.

Of the 21 analysts that cover Boohoo:

13 Buys

5 Neutral

3 Sells

Chart thoughts

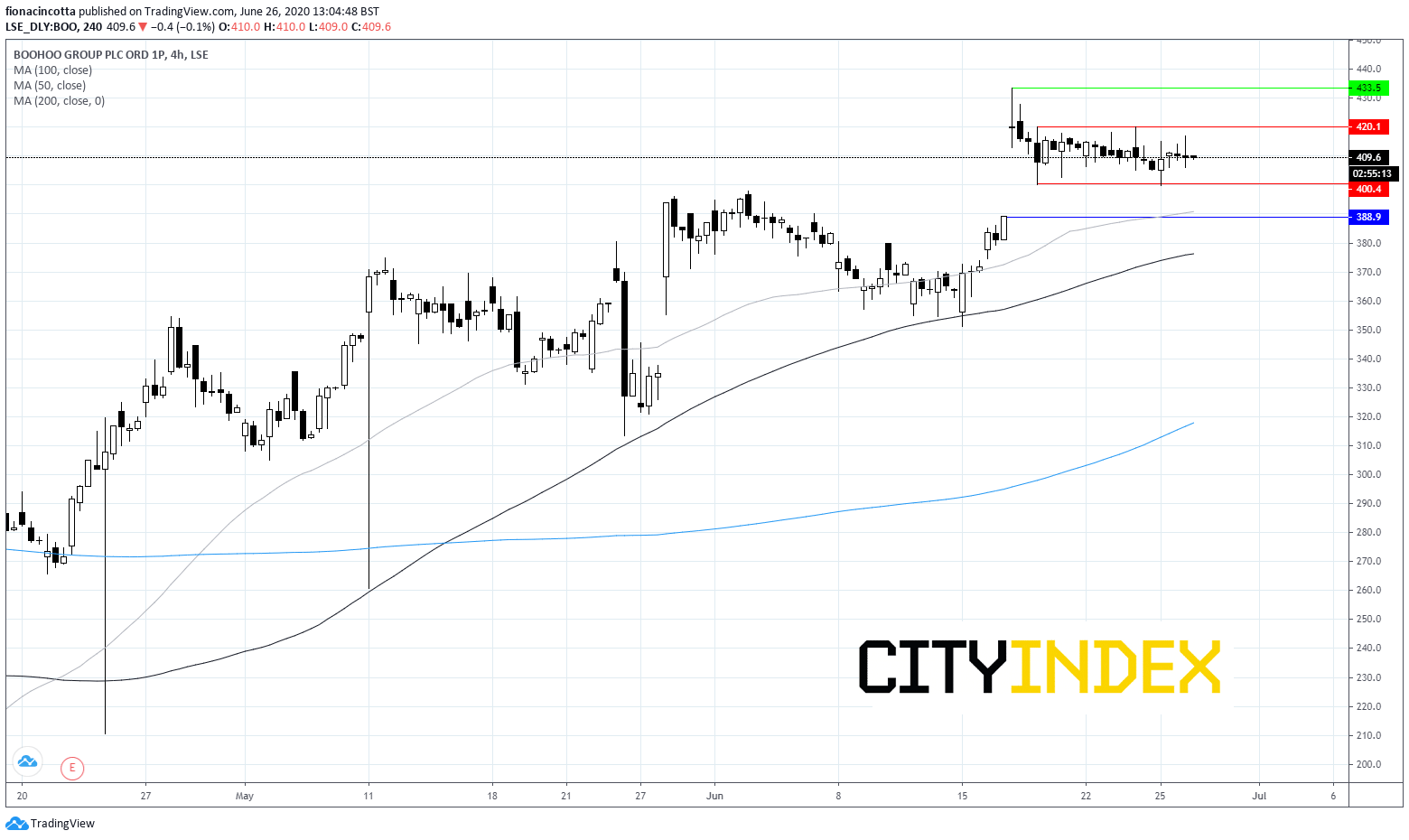

The stock trades comfortably above its 50, 100 & 200 moving average on 4 hour chart, a bullish chart.

After striking an all time high last week at 433, Bohoo have eased back and are consolidating between 400p and 420p. At 410p today, the stock trades bang in the middle of this channel. A break out above 420p could see the stock push towards a fresh all time high. A break below 400p could see the stock aim for support at 388p (50 sma and high 17th June).