Argentina's Woes Continue

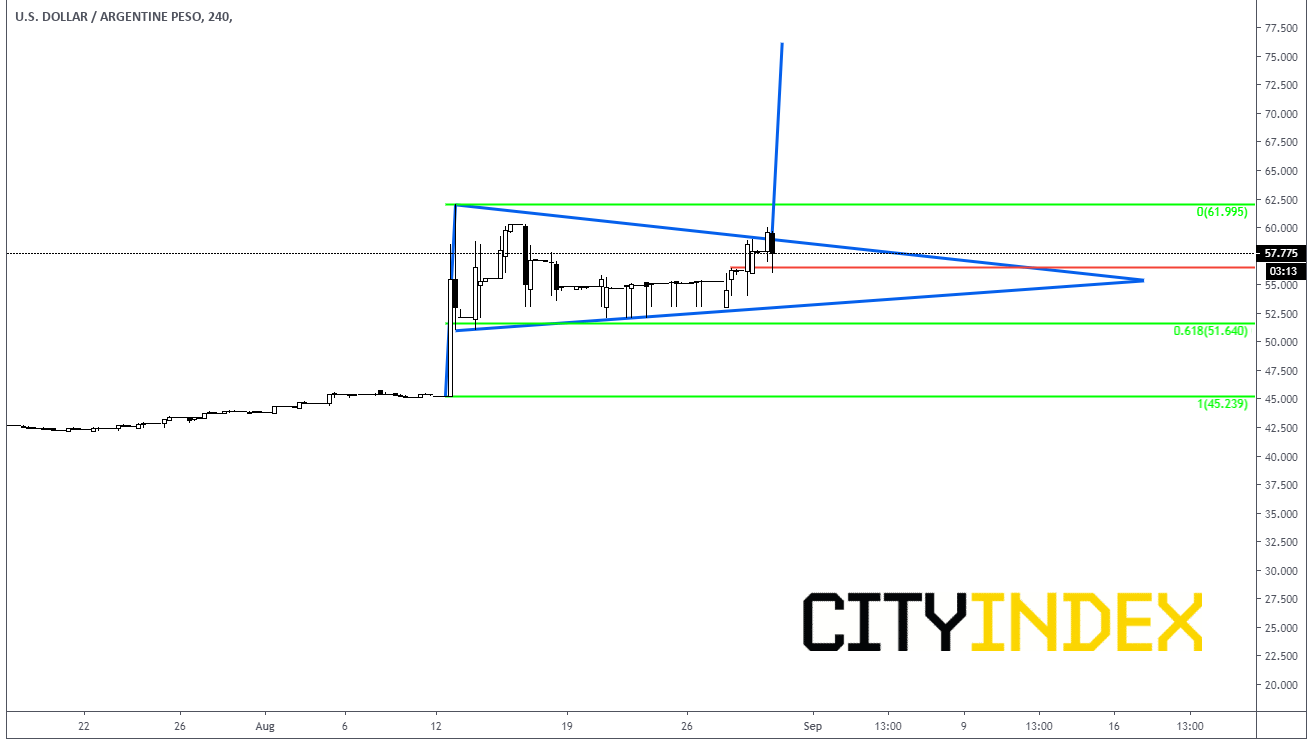

Three weeks ago, Argentina President Mauricio Macri unexpectedly a primary election lost by a landslide to leftist Alberto Fernandez. At that time, the Argentinean Peso went into a tailspin and dropped from 45.23 pesos per US Dollar to 52.14 pesos per US Dollar. At one point during the day, it went as low as 61.995 pesos per day.

Today the Argentinean government asked the IMF to restructure a $57 billion loan from last year that was used to help bail the country out during a recession. Yesterday, The Central Bank bought $300 million in pesos to help try and stabilize the market.

Perhaps the Argentinean President asked for the restructuring of the IMF bailout loan TODAY because he noticed that the Argentina Peso was breaking out of a bullish pennant formation (a picture perfect one, I might add).

Source: Tradingview, City Index

After the breakout 3 weeks ago, the USD/ARS pulled back to the 61.8% retracement of the entire move to 51.64. The pair resumed trading higher and began to break out of the triangle earlier today at 55.59 but pulled back in and held support near 56.00. USD/ARS is currently trading near 57.86. 56.00 will be key support for the pair. Next support will be 52.80, which will be the rising trendline of the pennant. Immediate resistance comes in at 60.00, todays high. After that, resistance is at the recent high at 61.995. However, the target for the pennant is all the way up at 76.25. To get the target for the pennant, you take the length of the “pole” for the pennant and add it to the breakout point.

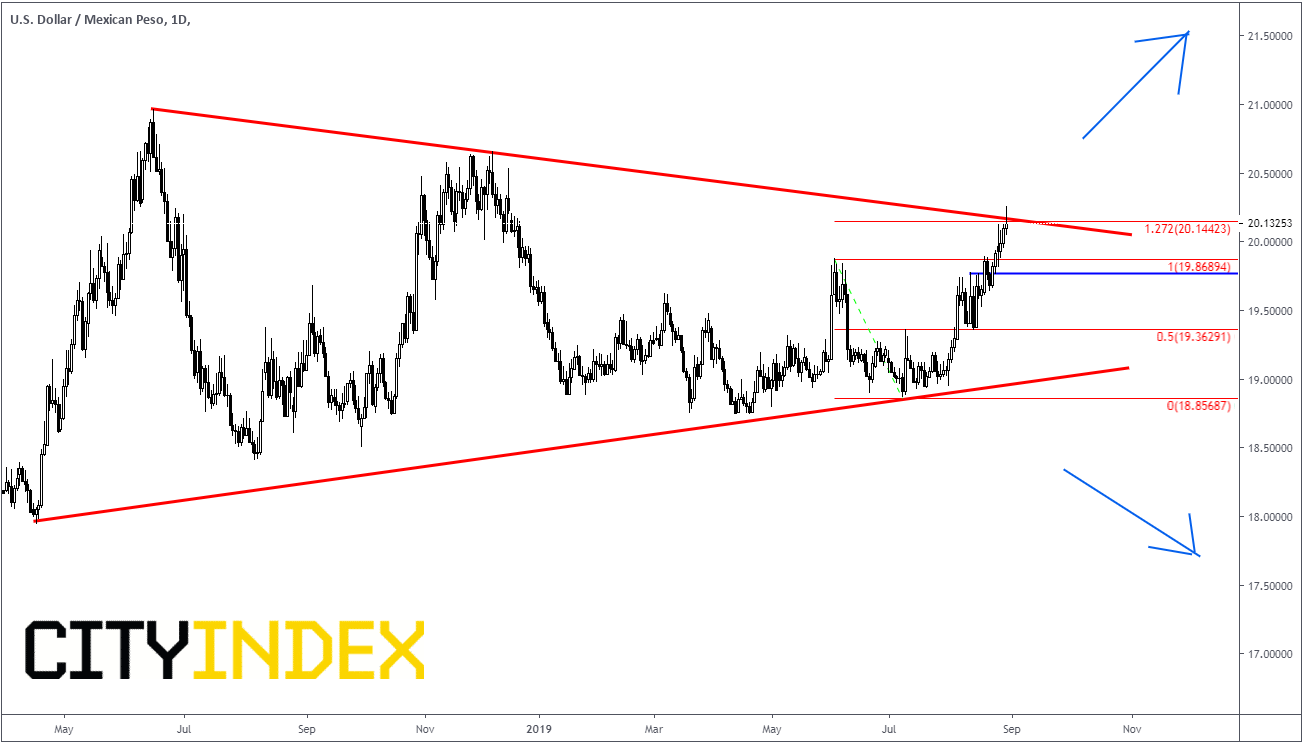

The USD/ARS is an illiquid currency and may not be available for all to trade. Howver, Emerging Market currencies tend to be somewhat correlated, so another option to trade could be the USD/MXN. On August 19th, we wrote about possibilities for the USD/MXN. This pair happened to be in a symmetrical triangle, and it was noted to watch the downward sloping trendline near 20.15.

Source: Tradingview, City Index

Today, the pair broke above the triangle and traded as high as 20.2561. However, as with the USD/ARS, the USD/MXN pulled back inside the triangle formation and created a shooting star formation on a daily chart. First support comes in at prior resistance near 19.85. Prior resistance may hold price above that level, therefore acting support. Below that, price can move down to 19.36, which is the 50% move of the prior structure. First resistance is at todays highs of 20.25. Next resistance is at prior highs of 20.65. If price gets to that point, the pair will be well above the triangle and could have further room to run.