April 2020 Fed Meeting Instant Analysis

With traders keyed in on arguably the biggest week for earnings reports ever, not to mention daily 20%-30% moves in oil, today’s Federal Reserve meeting may have snuck up on some readers. Of course, the central bank has hardly had the luxury of waiting for its scheduled meetings to introduce new measures to limit the impact of the unprecedented economic disruption from the spread of COVID-19 over the past few weeks anyway!

In any event, the Fed remains the world’s most important central bank, and arguably the most important policymaking body when it comes to financial markets, so traders still tuned in for the latest economic assessment from Jerome Powell and Company.

As it turns out, the central bank mostly “stuck to the script” in its decision, leaving the Fed funds rate unchanged in the 0.00-0.25% range and the interest on excess reserves (IOER) at 0.10%. At the same time, the Fed also vowed to continue buying Treasuries, agency debt, and commercial mortgage-backed securities, as well as conducting large-scale repos, as much as needed. Finally, in a nod to the ongoing COVID-19 pandemic, the statement noted, “The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term...”

Finally, and perhaps most importantly, “the Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” In other words, near-zero interest rates and asset purchases are here to stay for the foreseeable future.

Market Reaction

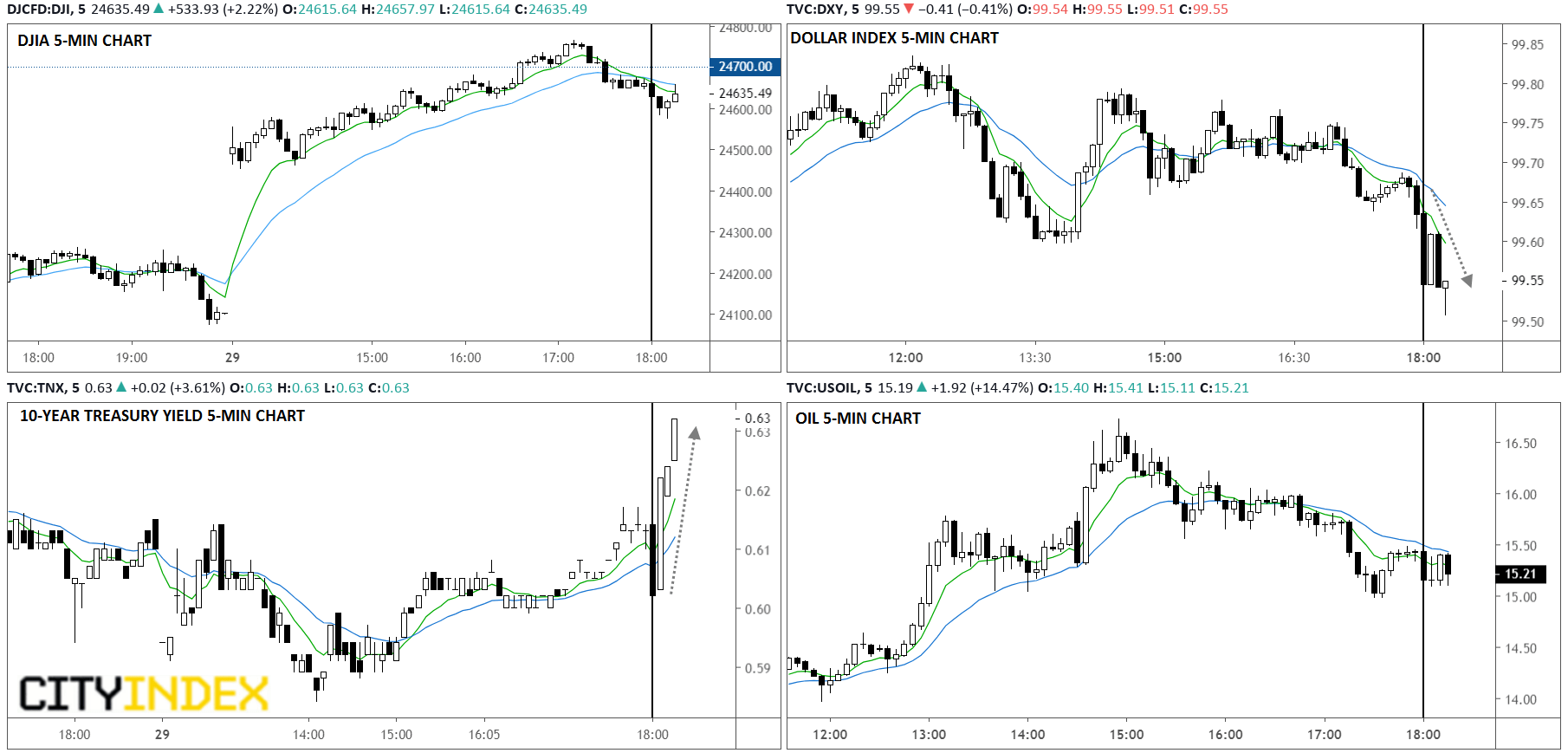

Financial markets took the Fed’s statement mostly in stride, with only small adjustments in major assets: US stock indices ticked lower (though remain well higher on the day), 10-year treasury yields ticked up 2bps to 0.63%, oil and gold both edged lower, and the US dollar dropped about 20 pips against most of its major rivals:

Source: TradingView, GAIN Capital

Now traders will tune in for Fed Chairman Powell’s press conference for any hints on future policy tweaks and more details on the central bank’s outlook for the economy.