Apple: What levels to watch after stock split?

The market capitalization of Apple (AAPL) is over $2 trillion, being the first stock to reach this level in the U.S. market. In addition, Apple would take place the four-for-one stock split after the close of trading on last Friday. The stock split would make its share more accessible to a broader base of investors.

Besides, the release date of iPhone 12 is officially delayed. However, the rumors said iPhone 12 would be relatively affordable. In addition, the investors would expect iPhone 12 would widely support the 5G function.

Last month, Apple reported that 3Q EPS was up 18% on year to $2.58 on revenue of $59.70 billion, up 11%.

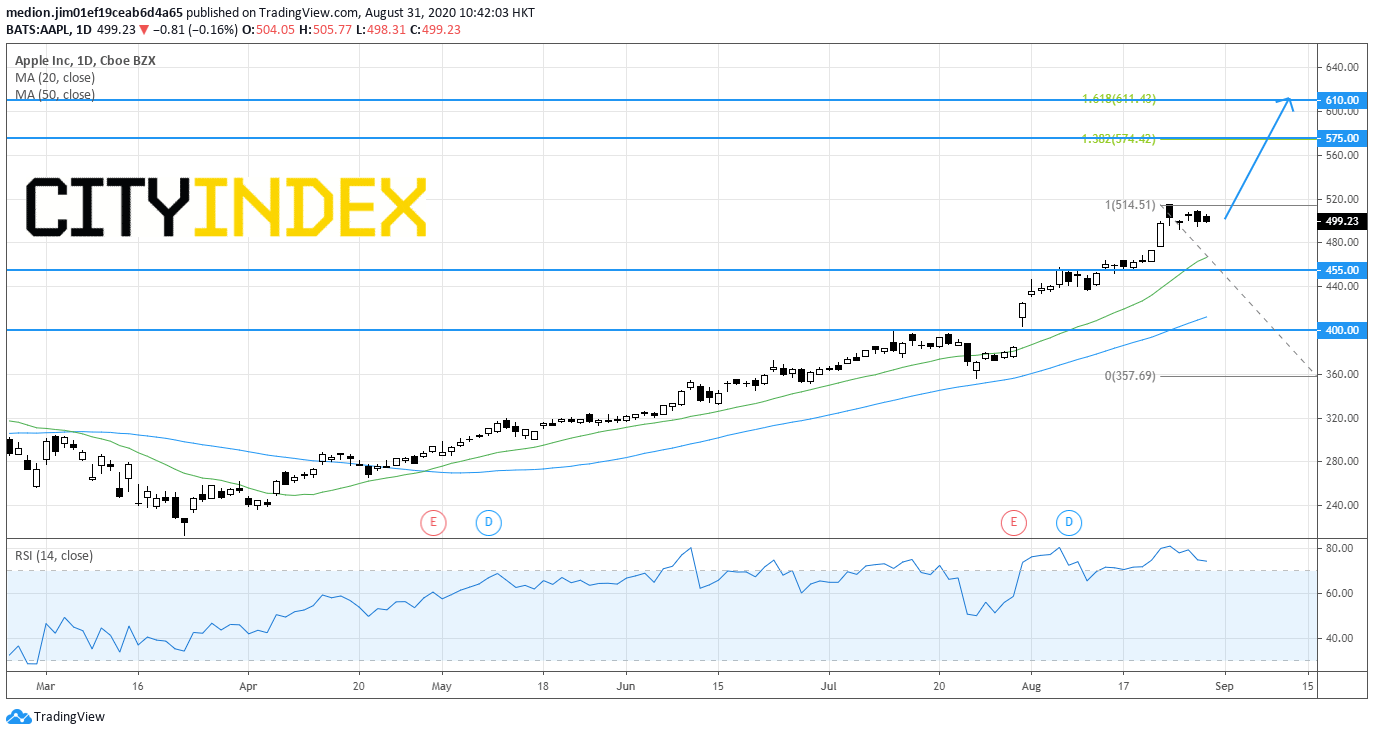

From a technical point of view, the stock is holding around the historical high, suggesting the strong upward momentum for the prices.

Currently, the prices are trading above both 20-day moving and 50-day moving averages.

The bullish readers could set the support level at $455 ($113.75 after stock split), while resistance levels would be located at $575.00 ($143.75 after stock split) and $610.00 ($152.50 after stock split).

Source: GAIN Capital, TradingView

Besides, the release date of iPhone 12 is officially delayed. However, the rumors said iPhone 12 would be relatively affordable. In addition, the investors would expect iPhone 12 would widely support the 5G function.

Last month, Apple reported that 3Q EPS was up 18% on year to $2.58 on revenue of $59.70 billion, up 11%.

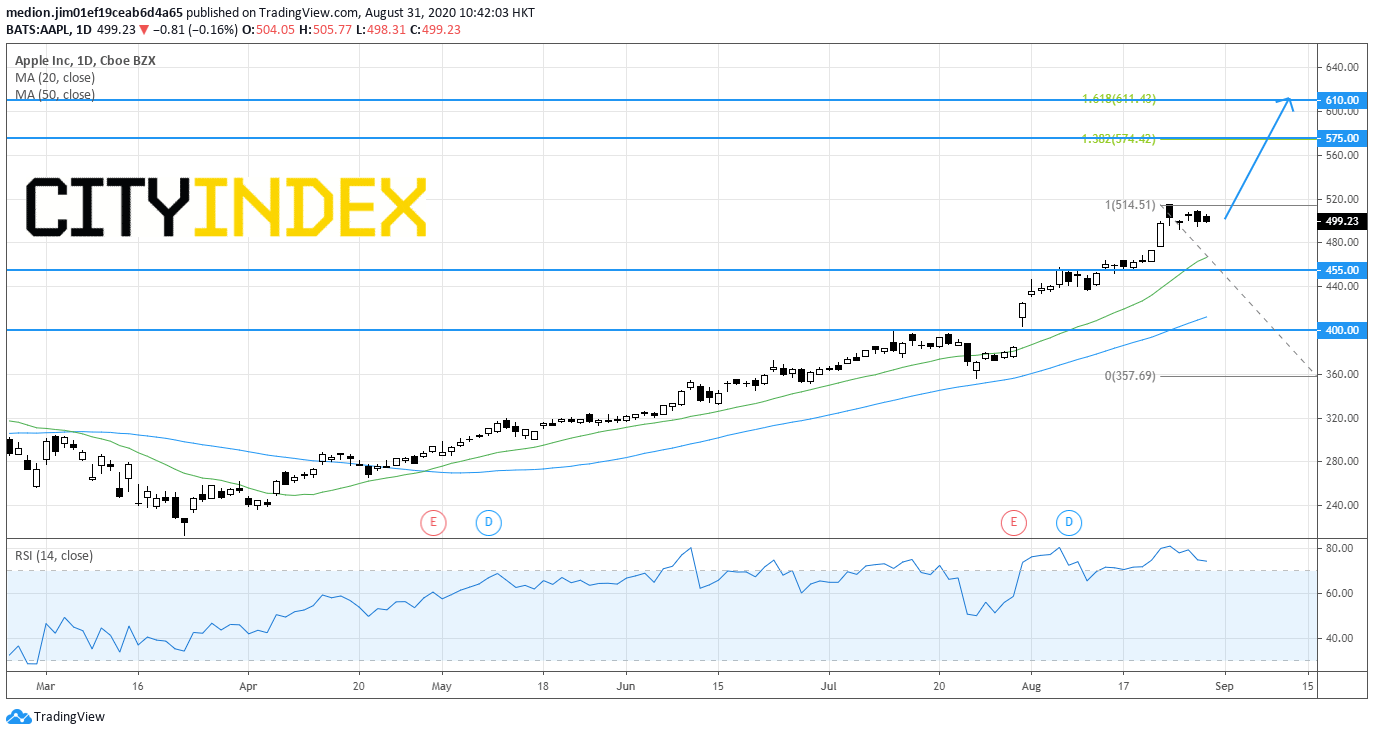

From a technical point of view, the stock is holding around the historical high, suggesting the strong upward momentum for the prices.

Currently, the prices are trading above both 20-day moving and 50-day moving averages.

The bullish readers could set the support level at $455 ($113.75 after stock split), while resistance levels would be located at $575.00 ($143.75 after stock split) and $610.00 ($152.50 after stock split).

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM