Apple is trading 1.5% higher in pre-market trading, looking to reach a fresh all time high on the open, after earnings and iPhone sales smashed expectations.

Q1 results:- EPS +19% $4.99 vs $4.54 exp.

- Revenue +9% at $91.8 billion vs $88.1 billion exp.

- iPhone revenue +8% at $55.96 billion vs $51.5 billion

- Other products $10 billion vs $9.52 billion exp.

- Q2 guidance $63 - $67 billion.

What’s not to like? Apple reported revenue and profits significantly higher than forecast, in its best quarter of the year. Revenue, a solid 9% higher was partially driven by iPhone revenues which grew an impressive 8%.

Recently, investors have turning more attention towards Apple’s “Other Products” which includes Apple Watch and AirPods. Apple confirmed that demand outstripped supply of these two products during the quarter, boding well for future sales. This category alone achieved $10 billion in sales

Wider guidance

Q2 guidance was wider than usual. This is owing to uncertainty caused by the deadly coronavirus. A $4 billion dollar range indicates that there could well be some issues surrounding the Apple and its links to China.

Apple operates two facilities in the city of Wuhan, the epicentre of the outbreak and currently in lock down while another 69 of its facilities are located in Suzhou, which has for the moment not been cut off, but has prolonged its New Year holiday for another week. It seems that Apple will not be able to avoid economic fallout from the virus.

5G ahead

Whilst the potential impact from coronvirus across the supply chain must be factored in, investors are also looking ahead to the roll out of 5G and the first 5G iPhone in September could see iPhone sales jump as customers have a strong reason to upgrade.

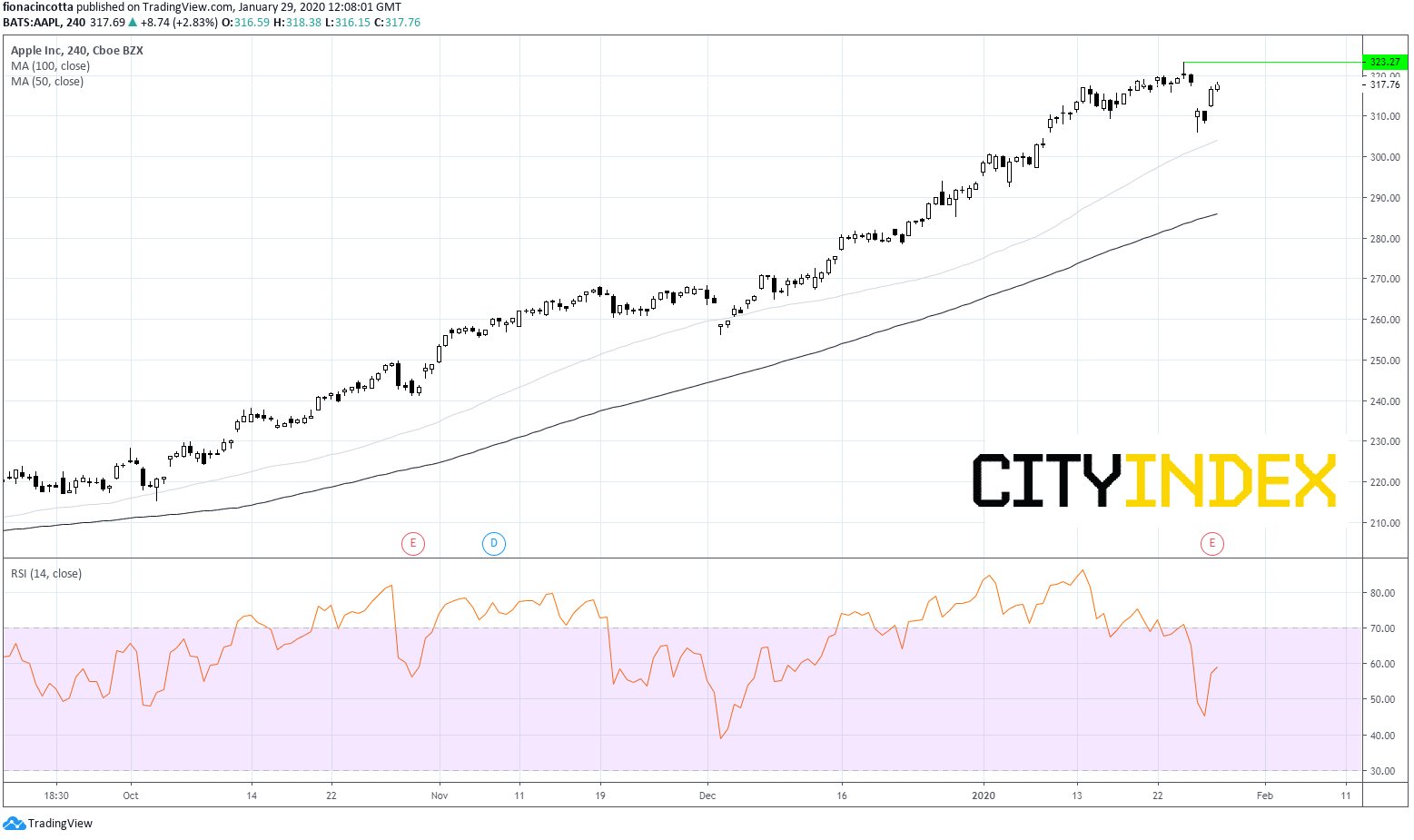

Worth its $1.4 trillion valuation

Top and bottom line figures significantly higher than forecast, one of the biggest quarterly profits from any company, ever and the prospect of a new iPhone “supercycle”, are helping to justify the 100% rally in the stock price over the past year and its $1.4 trillion valuation.