Listening to the earnings call last night, we often found ourselves disagreeing with Apple CEO Tim Cook’s interpretations of events contributing to its stronger than expected third-quarter results, and slightly better than forecast outlook.

After all, the group had just reported that revenues dropped 14.6% to $42.4bn annually, sales of the still-crucial iPhone slid 15% to 40.4.million, and earnings crashed 23% to $1.42 a share.

Even so, this was a distinctly different Tim Cook than the one on the call after Apple’s prior quarterly figures.

Its boss came across just on the right side of defiance, with a ‘I know-something-you-don’t’-style self-assurance.

More than once he went out of his way to gently but firmly correct or even slightly tell-off analysts who mischaracterised the state of the group’s businesses around the world, for instance pointing out to Goldman’s observer that the ‘impact’ of China having halted iTunes and iBooks services was just $1m.

Time and Time again, Cook stated that he “liked” some or other aspect of his sense of Apple’s outlook that was clearly more abstruse to explain in hard numbers than its Q3 financial and sales performance, and Q4 expectations.

This renewed reassurance even seemed to go somewhat beyond an area of growth which stood in contrast to the group’s reversing hardware product sales.

With iTunes, streaming music, Apple Pay, apps and other sidelines stepping closer to the fore, Cook could justifiably claim Apple’s services/cloud businesses—up 18% to $6bn in Q3—ought to be factored in to investor perceptions more accurately.

Add to those perceptions the iPhone/iPad/iMac installed base, plus, projects Apple aims to market within a couple a few years—e.g. VR, AR—not to mention $69bn cash (at end 2015), and at the very least, Apple’s forward market rating of just 11 times next year’s earnings forecasts becomes more questionable.

Whilst the group didn’t offer anything more definitive than determined and repeated hints, Wednesday trading still reflects the group’s success in re-directing investor perceptions.

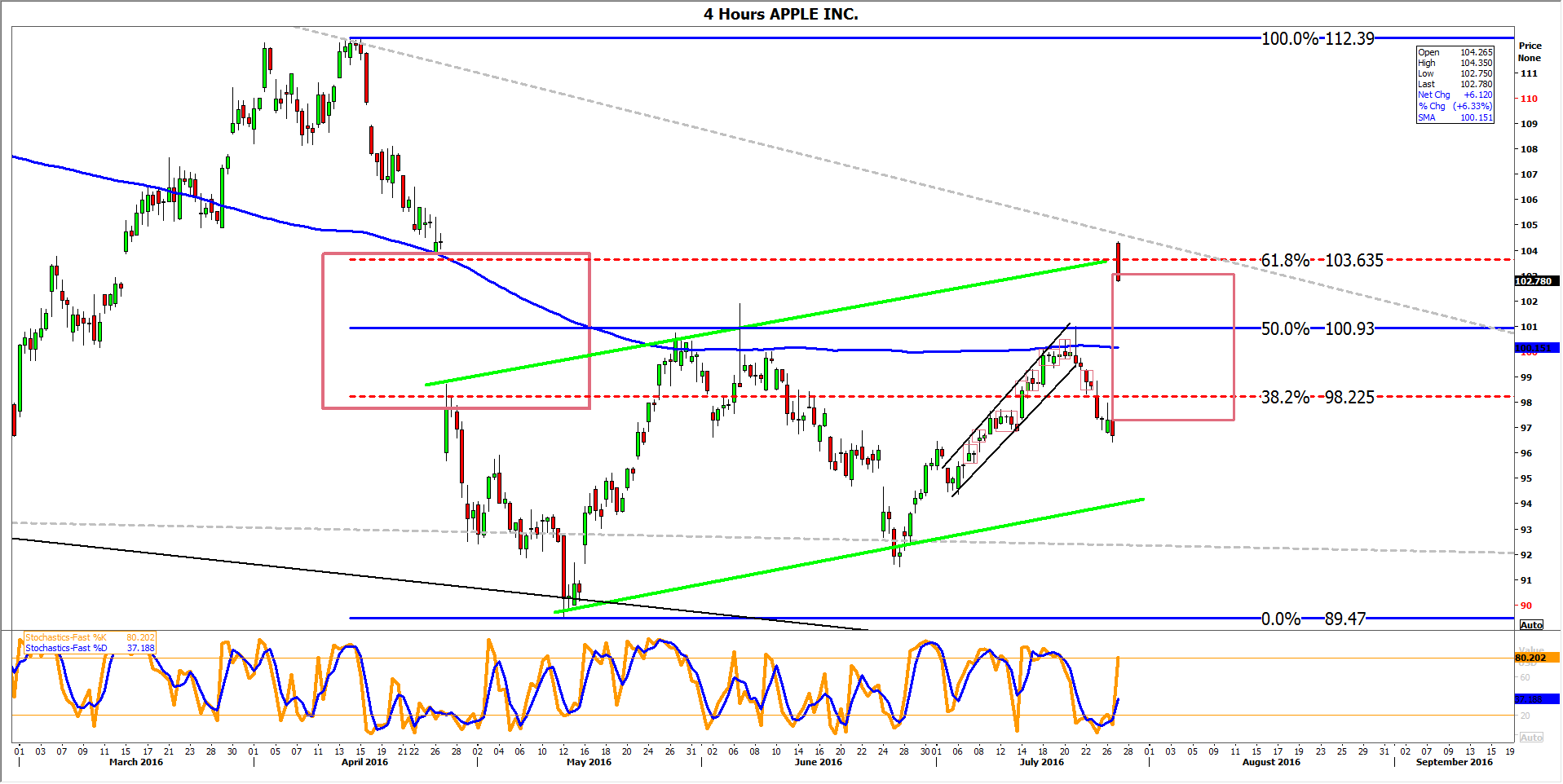

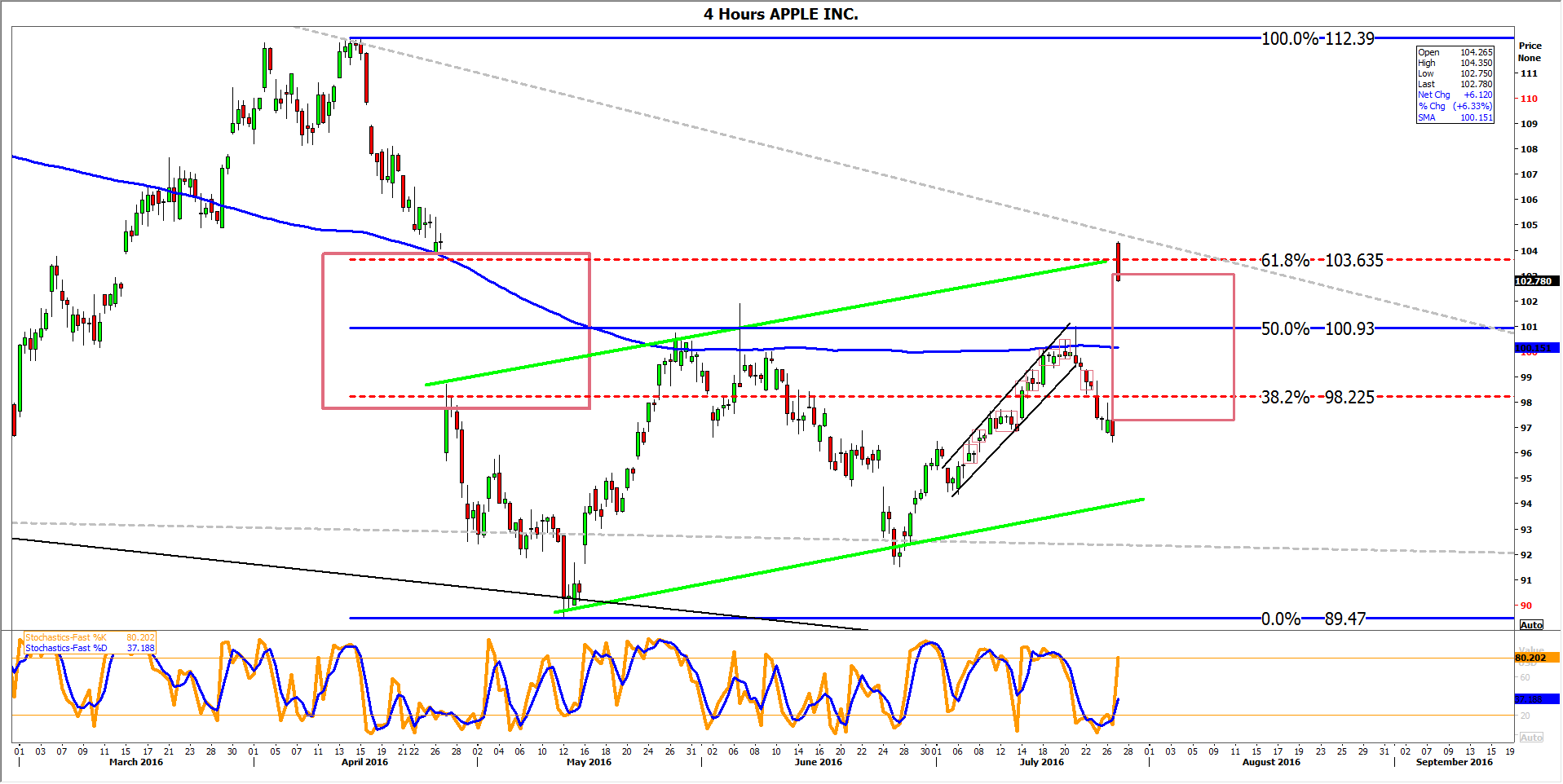

The share has finally crossed the gap opened in the wake of the market’s disappointment with Q2 results, has tagged psychological $100 value, and a 61.8%/103.716 Fibonacci, breaching the wide flag in place since 27th April.

AAPL is now positioning for an attempt on the trend which descends from July last year.

It’s reasonable to assume that a degree of pent-up demand was waiting on the sidelines to reinvest in Apple at the first sign of substantive revenue hardening.

Also that Apple, the most liquid share in the world will, in the short-term, almost certainly be avoided by some of the deepest-pocketed institutions, after having been rediscovered by ‘retail traders’.

Not to mention that ironically, AAPL opened another gap on Wednesday, which itself will have to be ‘closed’. Before then, knowledge that the share will circle lower again to belatedly fill unwanted orders will overhang trading, like the dead air in April did.

In other words, investors might like to prepare for another period of consolidation—albeit relatively short—before the stock sustainably advances further into prices above $100, whether or not Apple’s worm really has turned.