The shares are outpacing the market despite missed iPhone and service sales forecasts

Apple is near the centre of the U.S.-China trade dispute yet its shares rose sharply on Wednesday. A day after Beijing-Washington talks came to a mysteriously abrupt end yet again, it’s an endorsement of Apple’s Q3 results.

The group beat top- and bottom-line forecasts. Guidance also topped expectations.

(Consensus forecasts from Bloomberg)

- Q3 revenue: $53.8bn; estimate $52.35bn

- Q3 EPS: $2.18 vs. $2.09 forecast

- Q4 total revenue guidance: $61bn-$64bn, midpoint $62.5bn, vs. Wall St’s $61.04bn average

- Q3 37.6% gross margin near midpoint of Apple’s 37%-38% range

- Q4 gross margin guidance: 37.5%-38.5%

There were two key let-downs.

- Apple missed sharply lowered iPhone revenue forecasts, generating $25.99bn against Wall Street’s $26.54bn view

- An even bigger fail was that services growth fell short, with sales of $11.46bn vs. $11.88bn consensus

Furthermore, the quarter has not removed Apple’s main economic and geopolitical risks. U.S. President Donald Trump made it clear this week he won’t exempt Apple products manufactured in China if the U.S. imposes further tariffs. So far, Apple goods made there aren’t among the $200bn of items taxed at 25%. Tim Cook was cryptic on the topic last night, failing to clarify whether a new Mac Pro would be U.S.-made. That’s indirect pressure on the White House.

Still, executives on the call telegraphed more optimism, including on China, than heard for a while. A more sure-footed Apple, plus signs that its strategic shift is bearing fruit, continues to be applauded by Wall Street tonight. With Q3 misses apparently forgiven, Wall Street’s signal of regained confidence is worth noting.

Chart thoughts

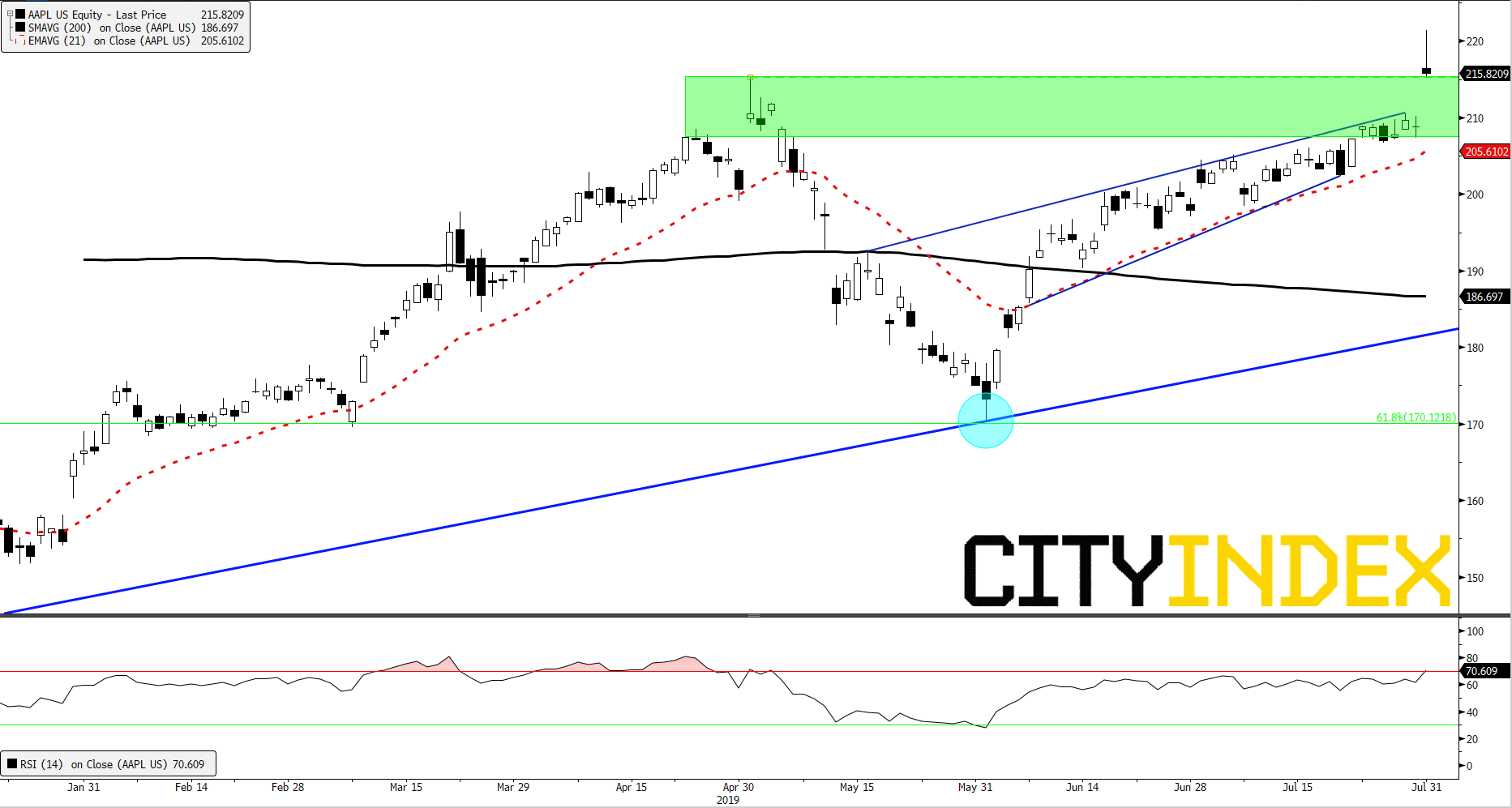

Most positively, Apple is establishing a fresh rising trend for the year after the downshift from 1st May’s high. There is good corroboration from perfect support at 61.8% of the March-to-December decline. With Wednesday’s advance, AAPL gaps and sets a new 2019 peak, breaking out of a two-month wedge. There should be range support beneath the prior year top of $215. Assuming the latest gap is closed, basing at late-April/early June $208 highs would suggest swift resumption of the advance. Below would be more cautionary. Buyers would then need to watch reaction at the key rising trend line.

Apple Inc. – daily [31/07/2019 19:41:21]

Source: Bloomberg/City Index