Almost all of Apple Inc.’s quarterly reports have a significant and lasting impact on its shares, but any Apple obsessive analyst worth their salt knows that the group’s most important quarter each year is the ‘holiday’ one ending in December.

For that reason, to gauge the likelihood and magnitude of an Apple share price reaction, we look just as much to guidance the group will offer tonight on its first quarter of 2017 as to results for the September quarter.

For the quarter completed in September, Apple said in July that it expected revenues to be $45.5bn-$47.5bn, somewhat above the common Wall St. forecast at the time around $45.8bn.

We now see the risk that the group will beat its own revenue forecast (and very probably earnings consensus) on the upside.

That assessment is based on agreement with the growing cadre of analysts who expect Apple to have exploited Samsung’s Galaxy Note 7 debacle in combination with the release of the latest iPhone variants.

The iPhone 7 and 7 Plus began shipping in late September and therefore will not move the dial much on fourth-quarter sales.

However, our own rudimentary channel checks and on-the-record comments from T-Mobile and Sprint regarding U.S. iPhone 7 retail suggest widely forecast sales of about 45 million will turn out to be moderately too low.

46-47 million looks more likely, but more than that—representing a bigger jump than the 23% year-on-year rise seen in Q4 2015—is less feasible.

It will be Apple’s first quarter of 2017 when the full measure of current iPhone demand will be seen. A fall to around 70 million units from the 74.8 million sold in the same quarter a year before is now regarded as a conservative call.

Manufacturing kinks have been fairly common following new Apple launches, and could certainly throw a spanner in the sales works.

The other main subplot that investors will watch is Apple’s software & services revenue.

The group’s second-largest revenue stream is unlikely to slip from the 19% year-to-year growth seen in the third quarter, amid Pokémon, ongoing Apple Pay roll-out in numerous third-party apps during the summer and the 15 million paid-subscriber milestone for Music announced in June. These should pick up most of the slack should App Store sales ease off the best-ever levels (according to CEO Tim Cook) seen in Q3. We think any softening would be slight and expect total Software & Services revenues to be at the upper end of the last three quarters’ run rate of $5.98bn-$6.06bn.

Here are (non-GAAP) consensus forecasts compiled by Thomson Reuters for Apple’s fourth quarter with changes from the year ago quarter:

- Revenues: $46.902bn, down 8.9%

- Net income: $8.915bn, down 20%

- Earnings per share: $1.65, down 16%

Share price reaction

The Pavlovian response of Apple shareholders to revenues and earnings which moderately exceed expectations is well documented. Therefore, firm results in the group’s final quarter and pleasing guidance for the holiday quarter will be the best possible combination for the stock in the immediate term.

There is however, evidence that Apple investors are gradually losing their typical habituation.

According to a tally taken before its final quarterly earnings of 2015, Apple stock had built on ‘after-hours’ session gains in its next main market session almost 60% of the time, according to data from MT Newswires.

By July of this year, the chance of a post-earnings share price rise in the next day-time session had fallen to evens, and the average closing gain if a rise was seen had slipped too.

This suggests that the quantum of any ‘beat(s)’ relative to expectations this evening will need to be more than run-of-the-mill to reap a strong stock price jump. On the downside, it might also mean less desirable share price volatility will be contained in the event of mildly disappointing results.

At this point it’s worth noting that the largest open interest in Apple shares expiring over the next few days is in $120 calls. This mildly backs the view that sentiment on the stock is optimistic over the near term.

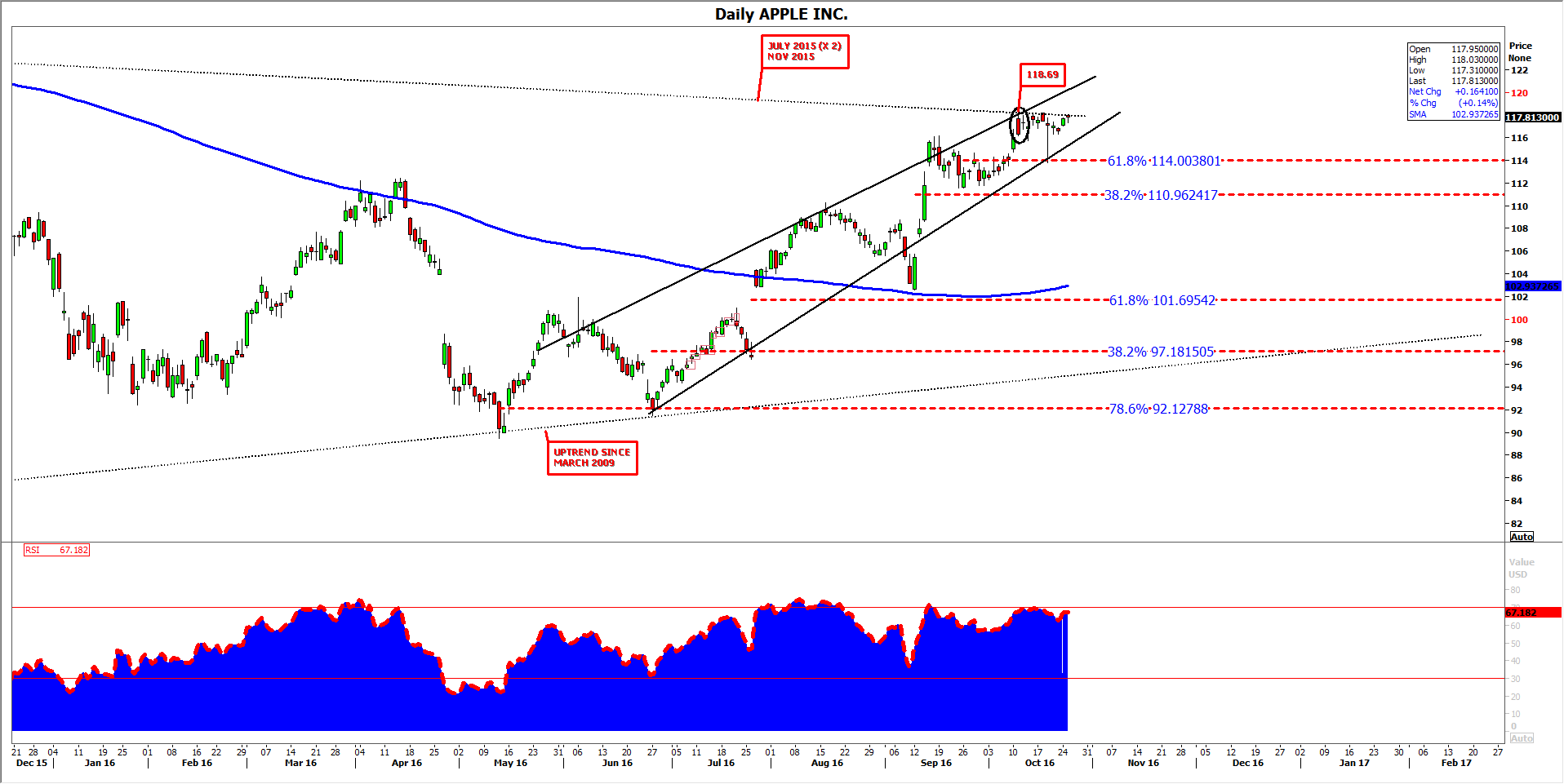

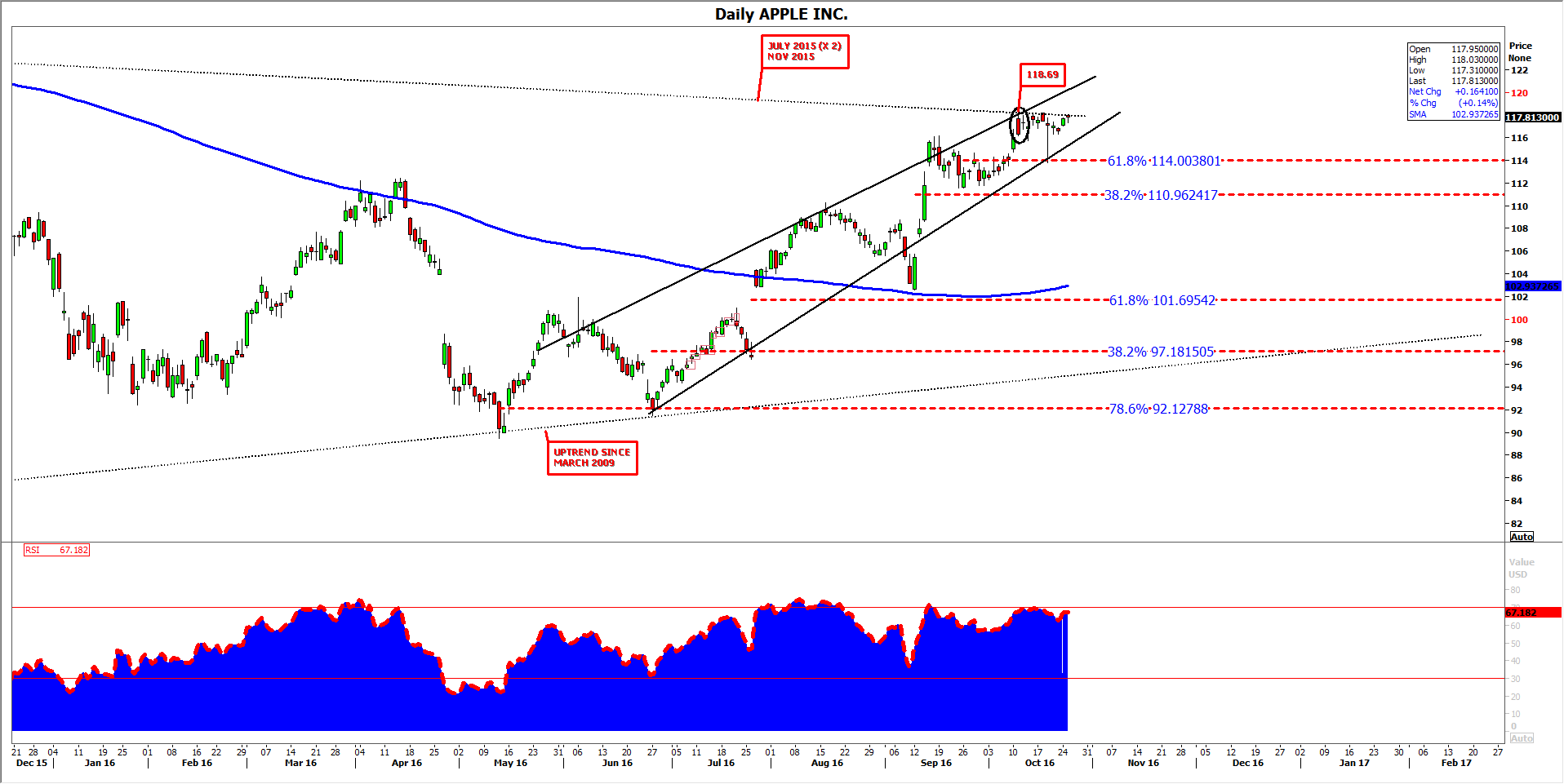

From a technical share price perspective, Apple shares are trending, though not with much subtlety.

DAILY CHART

Please click image to enlarge

- We have not established a satisfactory and coherent harmonic pattern from recent price action.

- However, retracements have been orderly and have largely alternated between 38.2% and 61.2% since late July. This adds confidence that the current uptrend is robust.

- The stock trades well above its 200-day moving average, which itself has recently inverted slightly upwards, confirming the trend further.

- The stock is rising in a mildly converging wedge. However, price violated the lower line last month, albeit it subsequently returned above it.

- Apple shares may currently be capped by the projection of a descending trend that was tagged twice in July 2015, and once in November 2015.

- Admittedly, the probability that the shares will be contained under this line for the medium term seems low.

- Momentum denoted by the Relative Strength Index (RSI) sub-chart is retreating after being nearly ‘overbought’; perhaps it should be treated as a neutral signal in context.

- Conclusion: overall, any lightening by investors will meet support nearby. But the case for a sharp acceleration of the share’s recent ascent is weak.

- That view would bear reconsideration if the stock exceeds this year’s trading high of $118.69 notched earlier this month.