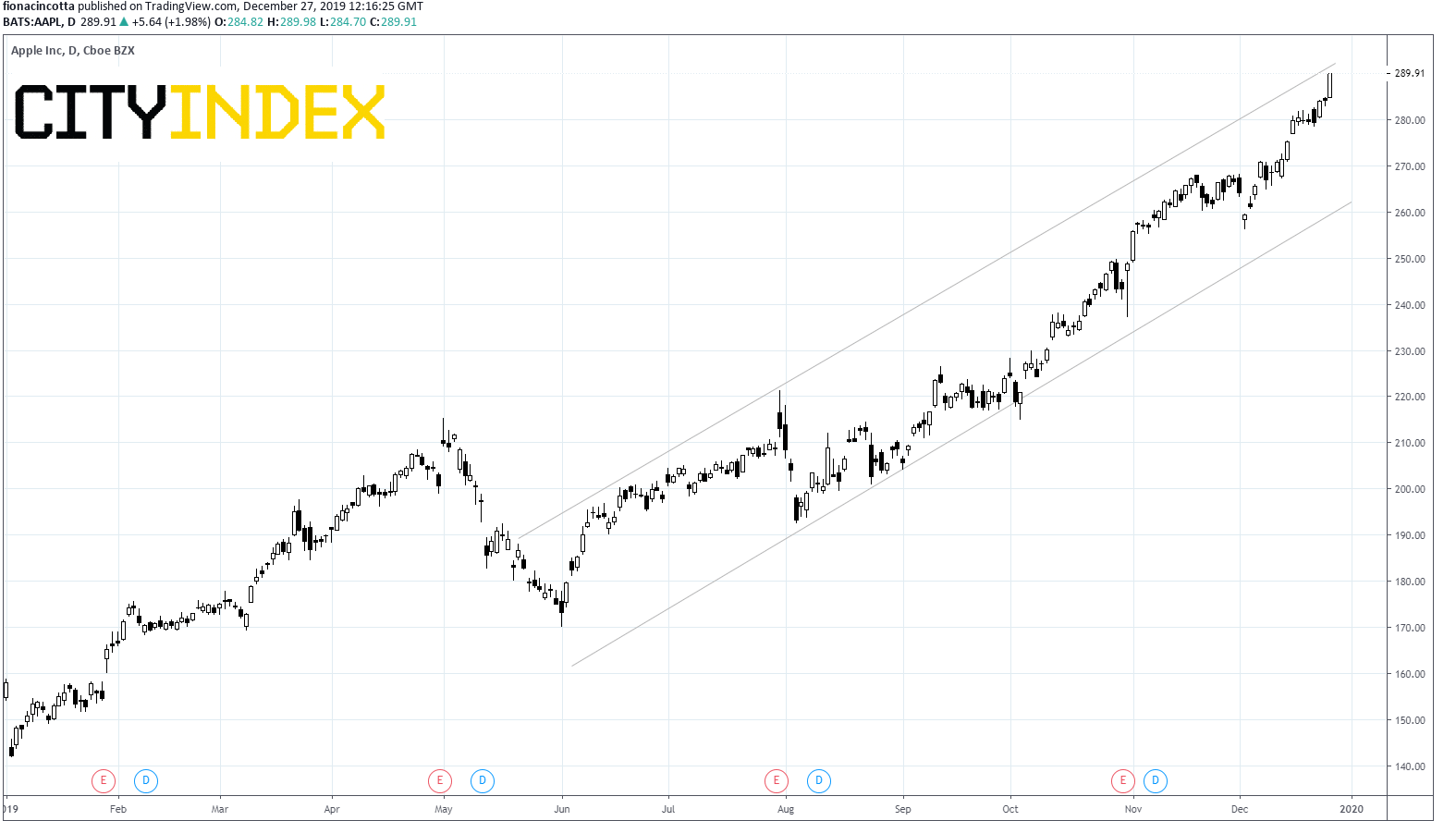

Apple shares rallied on Thursday hitting yet another record high, cementing the best year in a decade. Shares are pushing higher in pre trading on Friday.

Early indications suggest that spending in the holiday period has been strong. Apple products were also widely cited as must have items on Christmas wish lists according to an Evercore ISI survey

The statistics are strong: Apple jumped 1.6% in the first post-Christmas trading session, its third straight session of gains, with December’s month to date gains reaching an impressive 7%, its 10th winning month this year.

Total gains in Apple this year top 80%, compared to the S&P’s almost 30% increase. Gains in Apple are also well ahead of rivals Amazon which is up 23% across 2019 and Microsoft which is up 55% over the year.

A year of 2 halves

Investors would be forgiven for believing that 2019 would be a much weaker year for the stock after Apple cut its revenue outlook for the first time in 20 years in January and the US – China trade dispute dragged on. However, the mood towards Apple turned notably bullish in the second half of the year, thanks to improved sentiment surrounding its services business, including video streaming and subscription video gaming service. Additionally optimism surrounding its 5G iPhone offering expected in 2020 and an easing of trade tensions between the US and China providing a more positive economic backdrop have resulted in many firms upping their price target on Apple.

Analysts’ recommendations

28 firms recommend a buy on Apple,

14 are neutral

7 recommend a sell

Q1 Results

The next challenge for Apple will be its results in January. Expectations are for earnings growth of over 8% and revenue growth above 4.5%. iPhone sales are expected to be in the region of 66.7 million units in Q1. In 2019 iPhone sales accounted for around 55% of Apple’s total revenue.