Apple stock price momentum continues on Wednesday after a classic-hours ‘pop’ the night before, as investors shrug off cautionary exec comments and looming technical challenges, and keep focusing on its best quarterly results for almost two years.

- The most eye-catching win was a surprising bounce in iPhone sales— 78.29 million in the first quarter ending in December, up from 74.78 million the year before. Analysts on average had expected 77.42 million, according to research firm FactSet StreetAccount. The result means Apple sold more phones than arch-rival Samsung over the all-important holiday season, an internal and external boost to sentiment

- Higher than forecast sales enabled better than expected revenues and earnings per share (EPS)—at $78.35bn, up 3.3%, vs. Wall St’s $77.25bn view and $3.36, up 2.4%, better than even the high end of consensus at $3.22

- Services revenues rose 18.4% to $7.17bn, keeping up the rapid pace of growth seen for at least a year in line with the group having made these products a big focus, as handset sales, still Apple’s biggest revenue generator, become more difficult to grow

- Altogether, investors’ reaction reflects fulfilment of hopes on the previous quarter and building anticipation of a comeback year for Apple, particularly with a likely ‘anniversary edition’ iPhone that is expected to bring some of the most innovative features in the series

- Optimistic market projections, however, are at the crux of risks to the outlook which Apple itself spotlighted on Tuesday. It sees earnings and sales for the current quarter weaker than widely held investor forecasts. The stock barely reflects Apple’s caution on Wednesday though. It surged almost 11% as Wall St. trading got underway

Investors have shrugged off consideration that Apple’s Q1 2017, which includes the typically faster holiday retail season, was the first full quarter of iPhone 7 sales, raising the possibility that sales of the model may already have peaked. In fact Apple’s Q2 revenue outlook sees $51.5bn-$53.5bn compared with Thomson Reuters consensus before last night at $53.79bn.

Furthermore, whilst the group accentuated the positives on China, it was the worst-performing major region in Q1, down 11.6% to $16.23bn. It largely accounts for the expected soft Q2. Cheaper android devices, strengthening regional competition from the likes of Huawei as well as the ever-present threat of Samsung (which will soon lose its fire-prone Galaxy 7 handicap) are still Apple’s biggest risks.

Another challenge mentioned by top execs like CFO Luca Maestri is the strength of the dollar, which forced price rises of 40% in some markets.

Corporate tax changes in the offing, which might enable Apple to repatriate upwards of $200bn, may be well-timed in context: CEO Tim Cook said his conversations with politicians in Washington left him “optimistic”. We suspect some of Wednesday’s AAPL ebullience also signals expectations about potential M&A—Cook declined the chance to rule out acquisitions. These can, of course, turn out to be value-destructive or accretive.

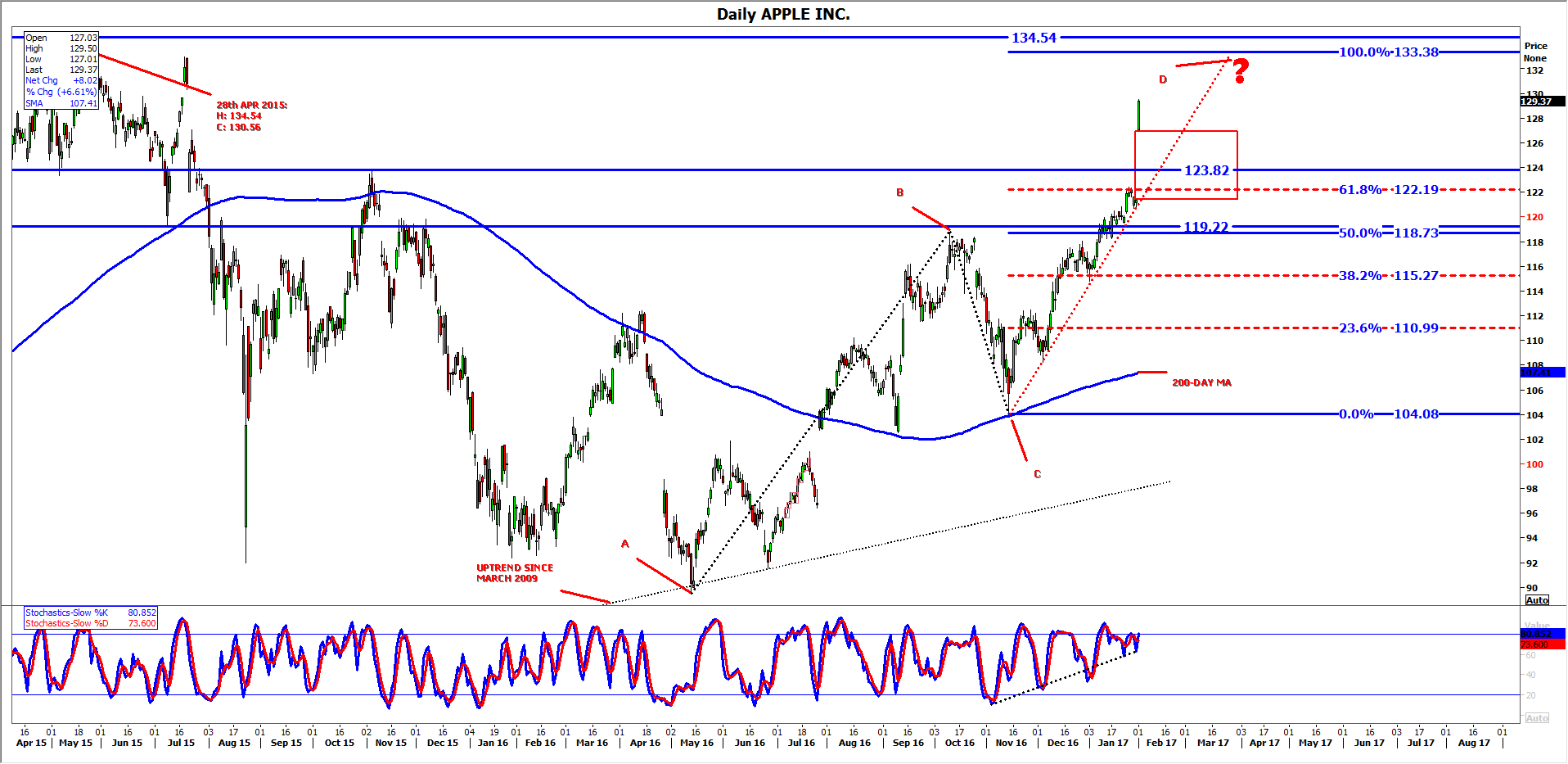

Like the fundamentals, AAPL price action scans largely positive for short-term momentum, with cautions just a little further out.

- Post-earnings Apple gaps are quite common and don’t always turn out to be hazardous whipsaws. However the vacuum that opened up on Wednesday between $121.39 and $127.03 would—like the orphaned offers it represents—typically be filled, and soon

- Even if the price falters here, support from resistance along $123.82, which capped the stock for more than two years, is likely. That’s before 61.8% of C-D in a potential AB-CD pattern comes in. If the latter scenario works, highs close to April 2015’s record $134.54 peak would be targeted

- Stochastic momentum is supportive: the oscillator is ‘coiling’—that is tightening in range with successively higher lows. Whilst prices are trending higher, bound oscillators don’t negate the underlying trend even when overbought. Instead, increasingly constricted movement suggests pent up upside demand. That doesn’t mean corrections can’t happen. We’re just talking about the balance of risks

- Downside risks are inherent in the above positives, particularly if AAPL overshoots expected support between $123.8-$122.2

- Remember, volatile Apple shares sold off 12% in 14 sessions to test their 200-day moving average (MA) after the group’s previous quarterly report, though that one was obviously a lot more negative

DAILY CHART

source: Thomson Reuters; please click image to enlarge