What if China targets Apple?

The stock rose along with resilient U.S. markets earlier, though with a 0.3% gain at best, it was unmistakeably lagging. The $878bn iPhone maker later slipped into the red, together with fellow large-caps, chiefly $204bn Intel, and others. It would be remiss to focus on one specific cause. However, among mega-caps, Apple is the top revenue generator in China, making 20% of total sales there in 2018. Its unique combination of elevated international, consumer, financial, and perhaps, political profiles suggests renewed investor caution. If China decides to retaliate at the corporate level for the U.S.’s proposed ban on Huawei, Apple would be a key candidate.

Earlier this month, the group said sales in China were stabilizing. But if Beijing restricts its ability to manufacture and sell there, a renewed crisis for Apple, Big Tech and markets overall would be likely. Between October and December, Apple shares led markets lower, plunging almost 40% when trade and economic anxieties where acute.

Washington is taking pains to separate the proposed Huawei ban from trade talks, though in practice that is impossible. Commerce Secretary Wilbur Ross hinted on Thursday that negotiations are partly aimed at remediating the type of actions Huawei faces punishment for. All the more reason why China’s response, if or when it comes, could be severe.

Chart thoughts

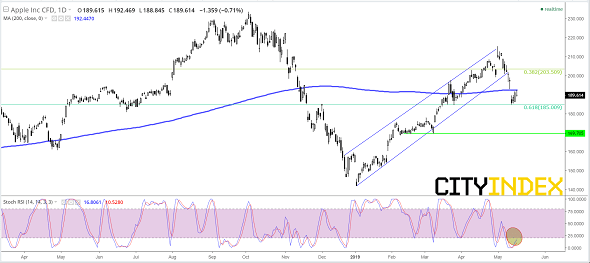

Apple’s chart is marked by a similar retreat of sentiment as the broader market. It has also found solace from recent selling after a pristine price reaction at a 61.8% Fibonacci broke its decline from the year’s highs. But a broken rising channel is still the dominant pattern in view. The stock is also now locked in battle with its 200-day trend, where price gapped last Friday confirming its pivotal significance. The reviving stochastic gauge must now follow through with gains that take price back above its 200-day average soon. If not, sellers will aim for the next likeliest floor: $169.70, the sight of tight consolidation over five straight sessions in February and a confirmatory one in March.

Price chart: Apple Inc. CFD – daily

Source: City Index