Apple (AAPL) and Amazon (AMAZ) Bullish Ahead of Earnings

Apple will report its 4Q results on October 29 after market close. The U.S. tech giant has not provided guidance for the quarter and thus analysts' forecast range is quite wide. According to Bloomberg, median estimate for EPS is $0.695 (range $0.540-$0.860) and median forecast for revenue is $63.46 billion (range $54.55-$70.55 billion).

On the other hand, investors will keep an eye on Apple's online event next Tuesday (Oct 13), amid expectations on the unveiling of new 5G-capable iPhones.

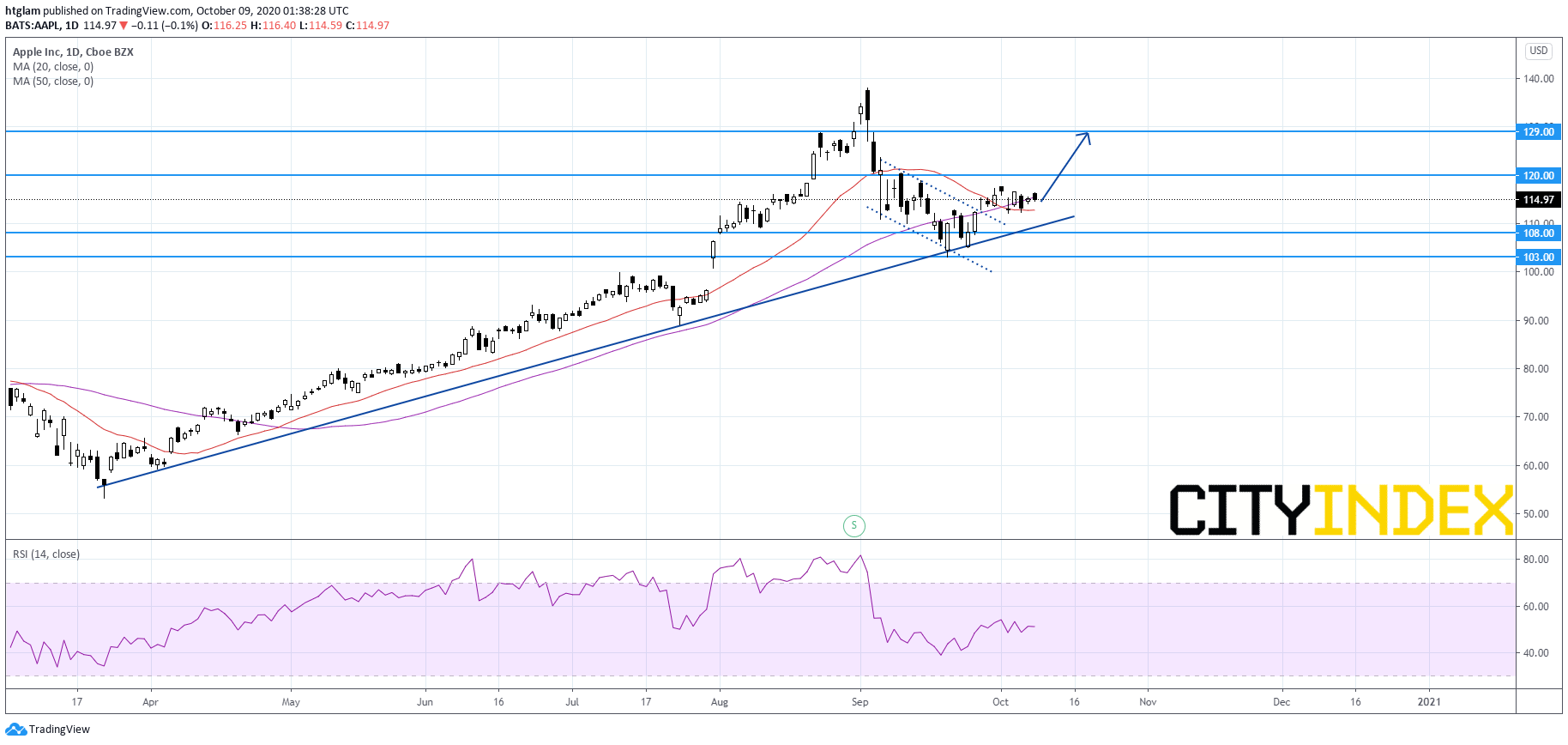

On a daily chart, Apple's technical outlook remains bullish as it is supported by a rising trend line drawn from March. More recently, it has broken above a short-term bearish channel, potentially signaling an end of downside correction. The level at $108 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $120 and $129 respectively.

Amazon.com (AMAZ): Bullish Consolidation

Amazon.com (AMAZ) is expected to report 3Q results on October 23 and it previously provided a 3Q revenue guidance of $87-$93 billion (Bloomberg median forecast $92 billion) and operating income guidance of $2.0-$5.0 billion (Bloomberg median forecast $4.63 billion).

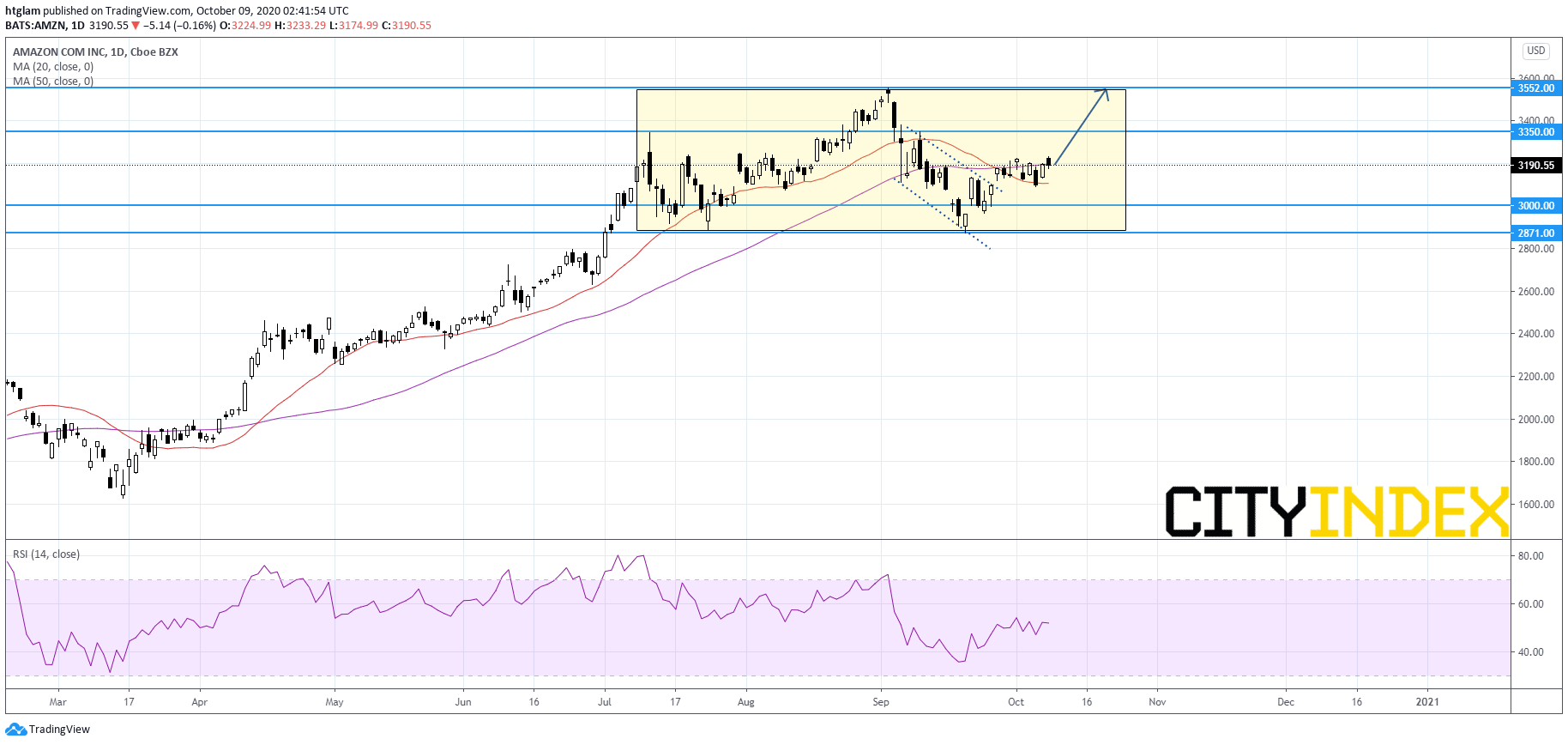

From a technical point of view, Amazon.com is trading within a bullish consolidation range after a rally started from March. Previously, it has broken above a shorter-term declining channel, signaling an end of downside correction. The level at $3000 may be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $3350 and $3552 respectively.

Source: Gain Capital, TradingView