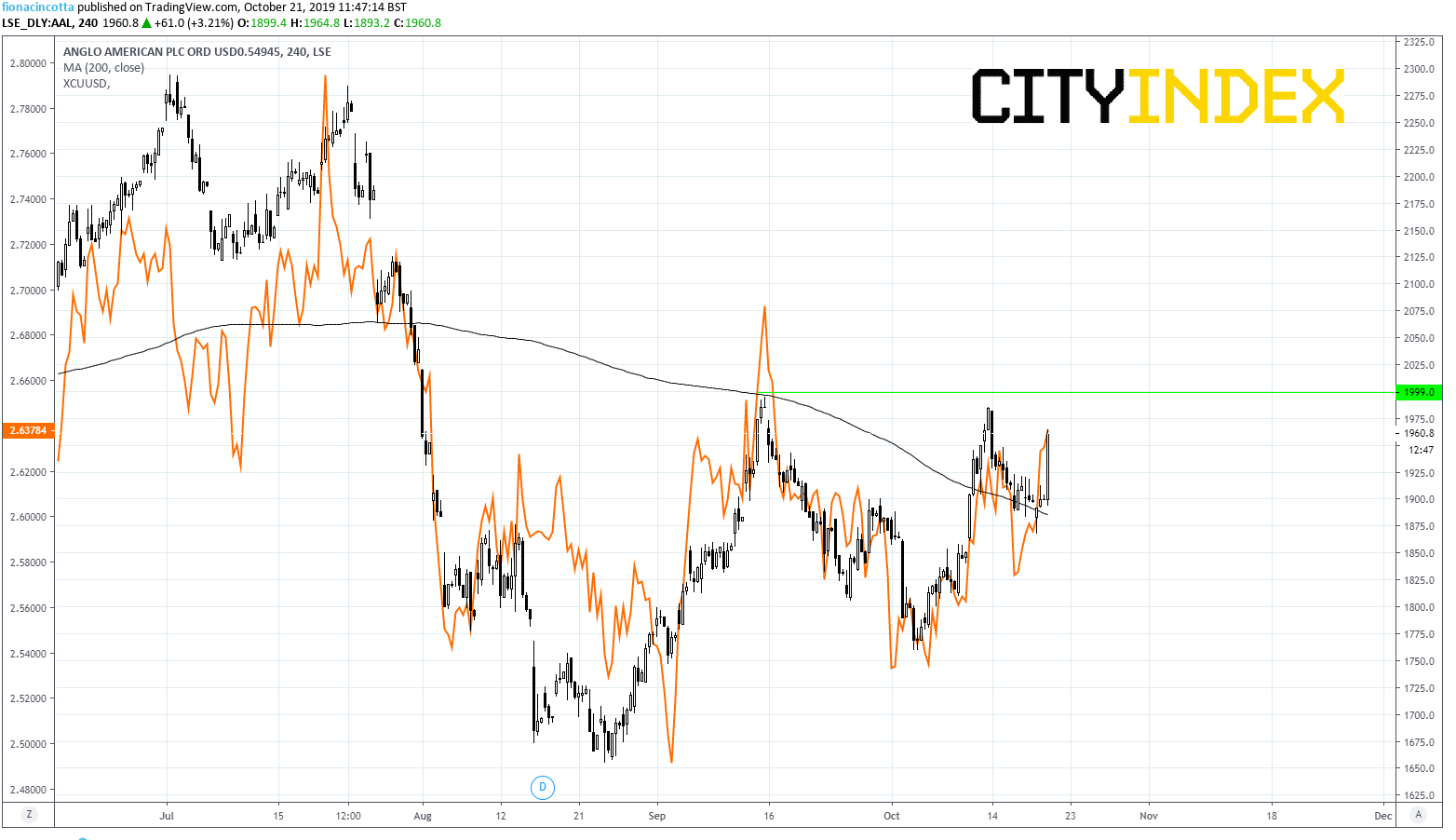

Why? Both firms are prominent miners of copper. Copper prices have been depressed as the world’s two largest economies and major importers of copper remain clinched in the ongoing trade dispute.

The chart clearly shows just how closely Anglo American tracks the price of copper. However, Anglo American could be better positioned now to ride out the volatility in copper thanks to its platinum groups metal division. This division has recently turned a corner so could offer more of a helping hand. This is down to increasing demand for palladium, which is used in batteries and thanks to rising demand for platinum amid a strong precious metals market.

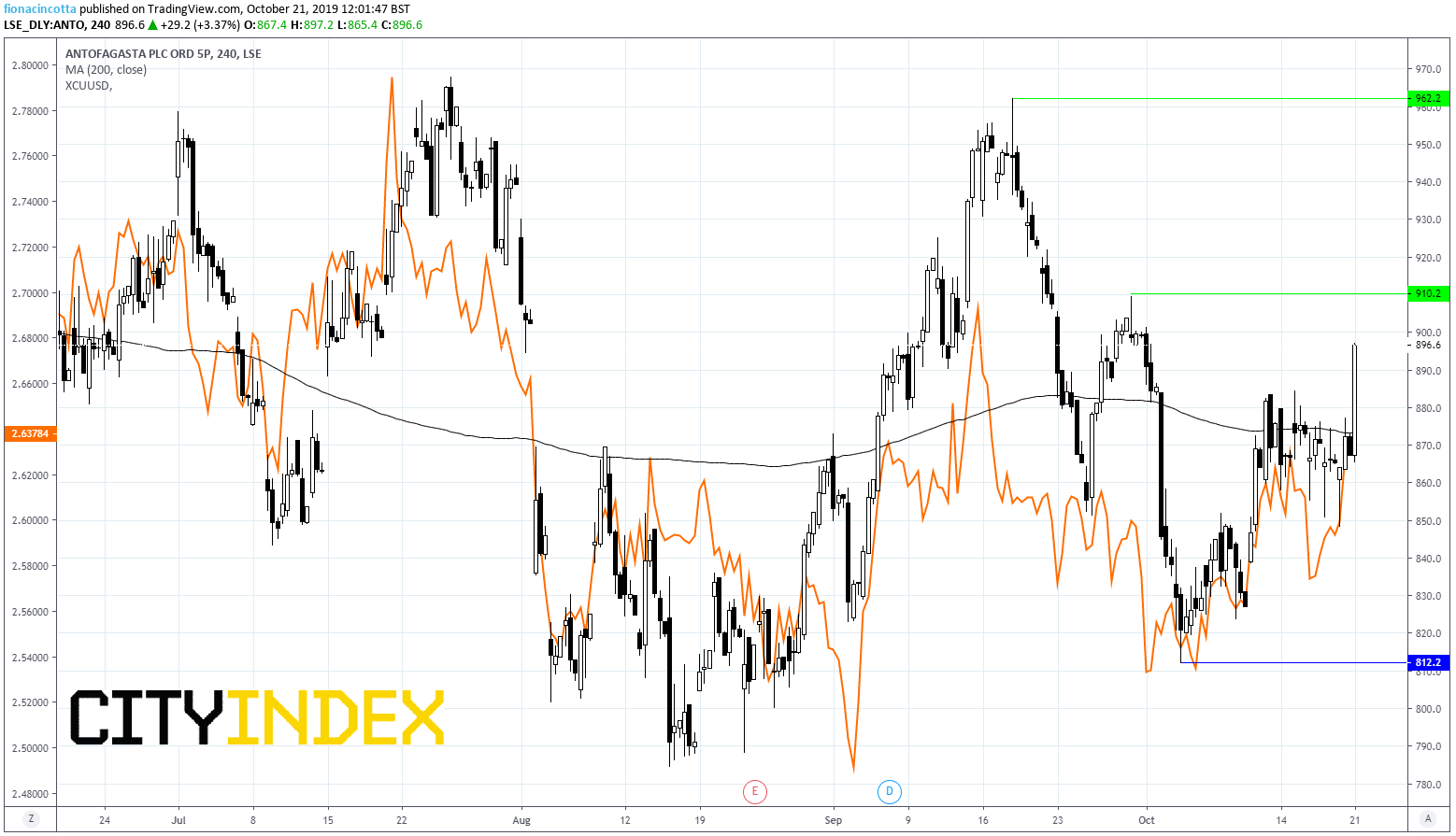

Antofagasta

Antofagasta are expected to record production figures, following 22% growth in the first half of the year. Antofagasta has managed to perform well despite falling copper prices, thanks to increasing its gold output. Unlike copper, gold has been performing very well amid increased geopolitical uncertainty.

However, when Antofagasta releases its update, investors won’t just be scrutinizing the numbers, they will also be looking closely for any indication of improving relations with employees. Antofagasta narrowly avoided a walk out at its mines in Chile after agreeing to increase wages by 1%.

Antofagasta has meaningfully moved through the 200 sma. We are looking for a push above 910 to confirm the bullish trend. On the downside resistance can be seen at 810p.