After two straight sessions of gains European markets are heading lower on Thursday. Fiscal stimulus to the tune of just under $3 trillion from Germany and US brought 2 days of blockbuster rallies. However, momentum has faded as traders’ question how quickly the measures can be implemented and as the reality of the economic hit starts to show through in the data.

Singapore has kicked off the rounds of shockingly poor data which is expected in the first half of this year. The GDP contracted at an annualized rate of 10.6% the fastest rate of contraction in over a decade. This is merely giving us a taste of what’s to come.

The job market across the globe is about to turn very ugly. Yesterday in Parliament the surge in unemployment which is expected in the UK was laid bare. Officials warned that over the past 9 days almost half a million people in the UK registered for the main benefit, universal credit.

Brace for record high US initial claims

The biggest concern for investors is the upcoming US initial jobless claims. Investors are bracing themselves for the highest number of claims in the series history, with estimates ranging from 1 million to 4 million, up from 281,000 last week. The magnitude of claims today will be an indication of how extensive the damage to the US economy is amid business closures for coronavirus. Make no mistake, this could hit risk sentiment across the globe.

The biggest concern for investors is the upcoming US initial jobless claims. Investors are bracing themselves for the highest number of claims in the series history, with estimates ranging from 1 million to 4 million, up from 281,000 last week. The magnitude of claims today will be an indication of how extensive the damage to the US economy is amid business closures for coronavirus. Make no mistake, this could hit risk sentiment across the globe.

Confidence plunging

French business confidence plunged at a record pace in March as shutdowns to contain the spread of the virus have left the economy running at 65% of normal activity. German sentiment dived too, dropping at the fastest pace since reunification

French business confidence plunged at a record pace in March as shutdowns to contain the spread of the virus have left the economy running at 65% of normal activity. German sentiment dived too, dropping at the fastest pace since reunification

Dax levels to watch

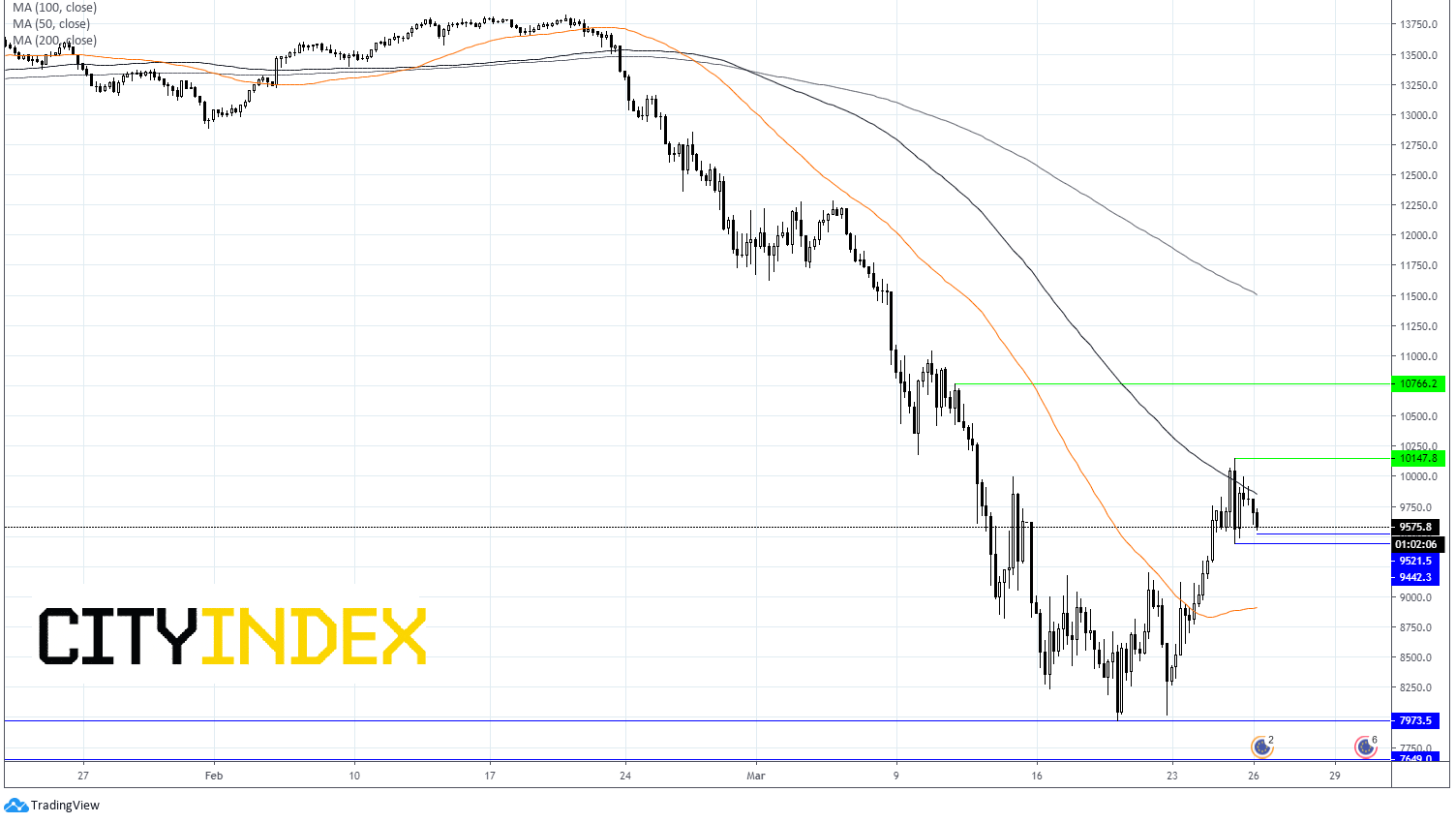

The Dax has dropped 2.6% on the open after gaining 12.7% across the previous 2 sessions. The Dax remains above its 50 sma on the 4-hour chart but has slipped through the 100 sma.

Immediate support can be seen at 9556 (today’s low) prior to 94440 (yesterday’s low) and 8910 (50 sma).

Immediate resistance is at 9850 (100 sma) prior to 10140 (yesterday’s high) and 10766 (high 11th March).

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM