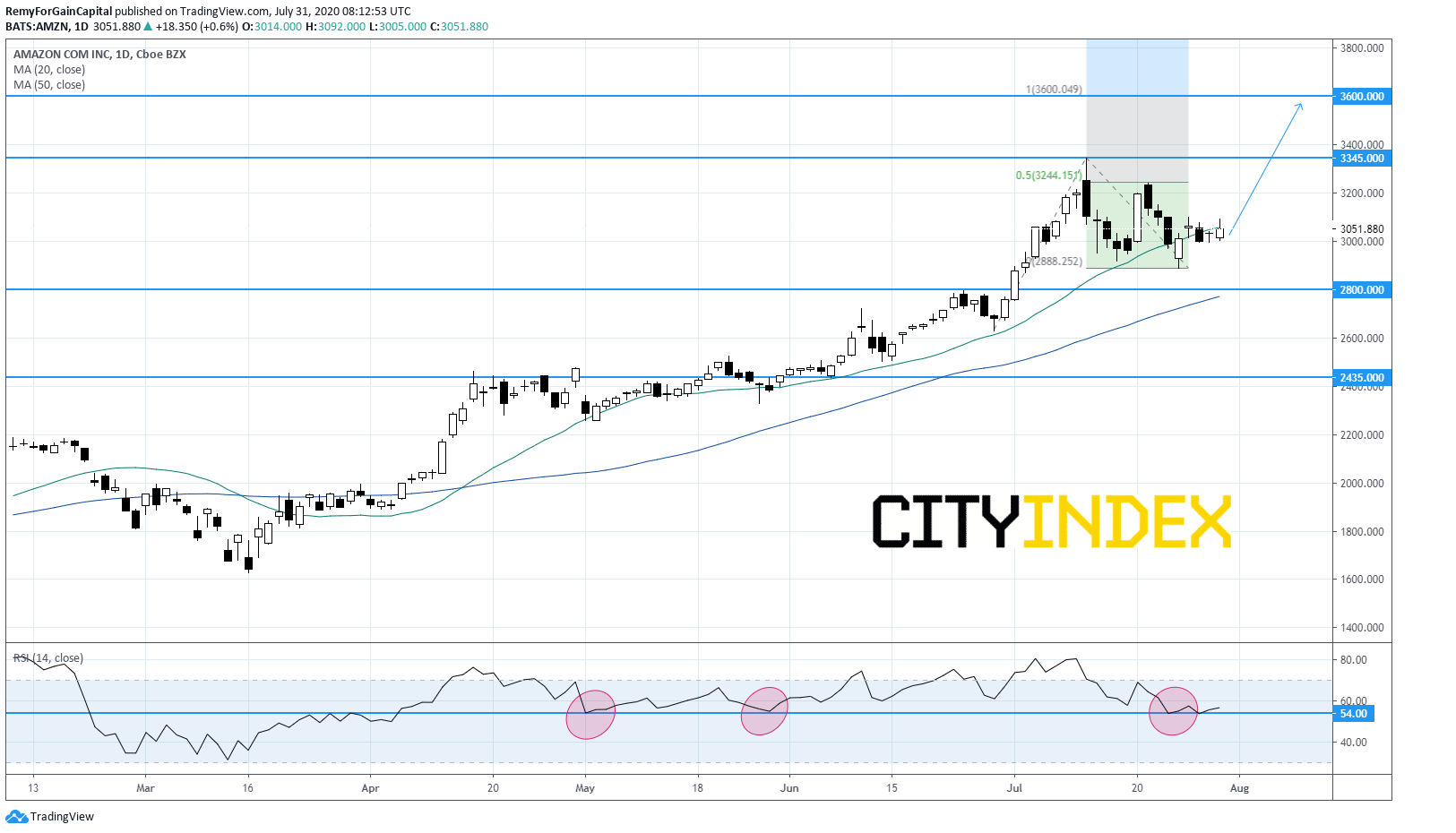

key metrics to look at for managing invalidation level on long position

Amazon.com (AMZN), the world largest online retailer and web services provider, disclosed second quarter EPS of 10.30 dollars, significantly higher than expected, up from 5.22 dollars a year ago on net sales of 88.9 billion dollars, exceeding the consensus, up from 63.4 billion dollars in the year before.

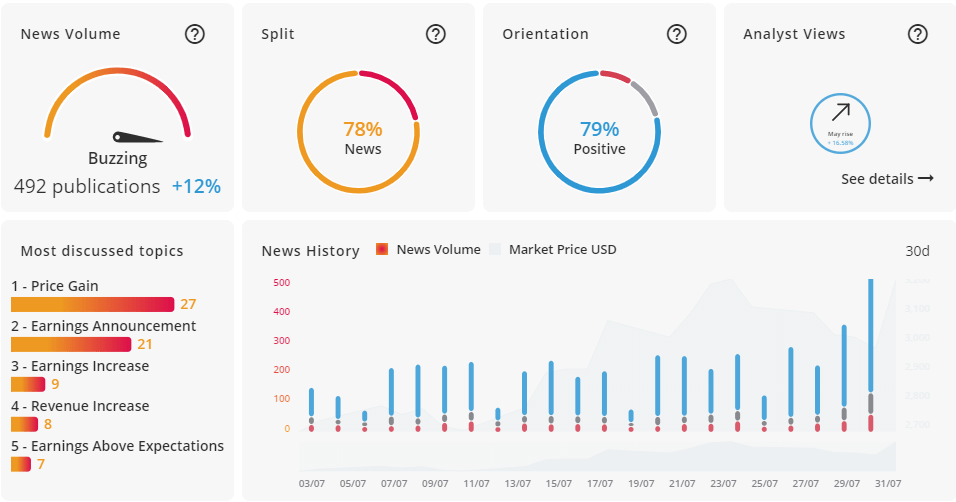

The news flow analyzed with TC Market Buzz, show a 79% positive opinion on the company in the various articles (blogs, social media) tracked by this AI. That 79% ratio is not excessive thus the risk of being on an extreme level likely to favour a downturn sound limited.

The news flow analyzed with TC Market Buzz, show a 79% positive opinion on the company in the various articles (blogs, social media) tracked by this AI. That 79% ratio is not excessive thus the risk of being on an extreme level likely to favour a downturn sound limited.

Source: GAIN Capital, TC Market Buzz

From a technical point of view, the stock price is supported by both its ascending 20 and 50-day moving averages with the 50-day acting as an interesting trailing stop for long positions. Another key metrics to look at for managing invalidation level on long position is the daily RSI which has been regularly bouncing off the 54% area during the past months. As a consequence, traders may consider long position above the 2800 support to target historical high and even the 3600 Fibonacci projection. Alternatively, a downside breakout of 2800 would certainly be a signal for traders to take profit and close long positions.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM