Medium-term technical outlook on Amazon.com (AMZN)

click to enlarge charts

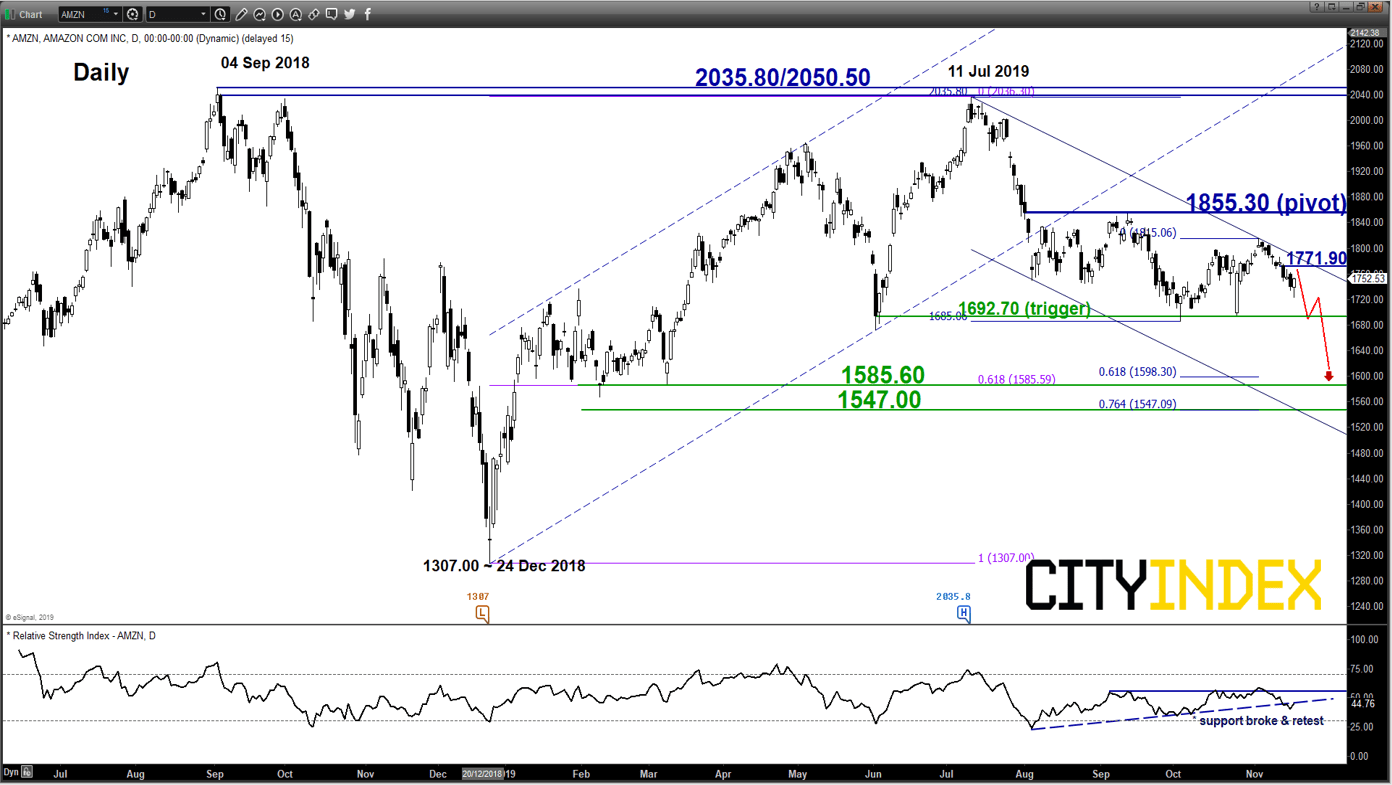

Key Levels (1 to 3 weeks)

Intermediate resistance: 1771.90

Pivot (key resistance): 1855.30

Supports: 1692.70 (trigger) & 1585.60/1547

Next resistance: 2035.80/2050.50

Directional Bias (1 to 3 weeks)

Bearish bias below 1855.30 key medium-term pivotal resistance and a break below 1692.70 may see a further potential down move to target the next support at 1585.60/1547.00 within a major range configuration in place since 24 Dec 2018 low

On the other hand, a clearance with a daily close above 1855.30 invalidates the bearish scenario for a push up to retest its major range resistance/all-time high at 2035.80/2050.50.

Key elements

- Since 11 Jul 2019, the price action of AMZN has started to show signs of weakness as it evolves into a series of “lower highs” within a major range configuration in place since 24 Dec 2018 low.

- Since its 03 June 2019 swing low area of 1692.70, AMZN has managed to hold at this level twice on 03 Oct and 25 Oct 2019 after its prior push down in price action. Interestingly, recent price action’s momentum has started to favour the bears as the daily RSI oscillator has staged a breakdown below a significant corresponding ascending support.

- The next significant medium-term support rests t the 1585.60/1547.00 zone which is defined by the swing low area of 08 Feb/08 Mar 2019, lower boundary of the descending channel from 11 Jul 2019 high and a Fibonacci retracement/expansion cluster.

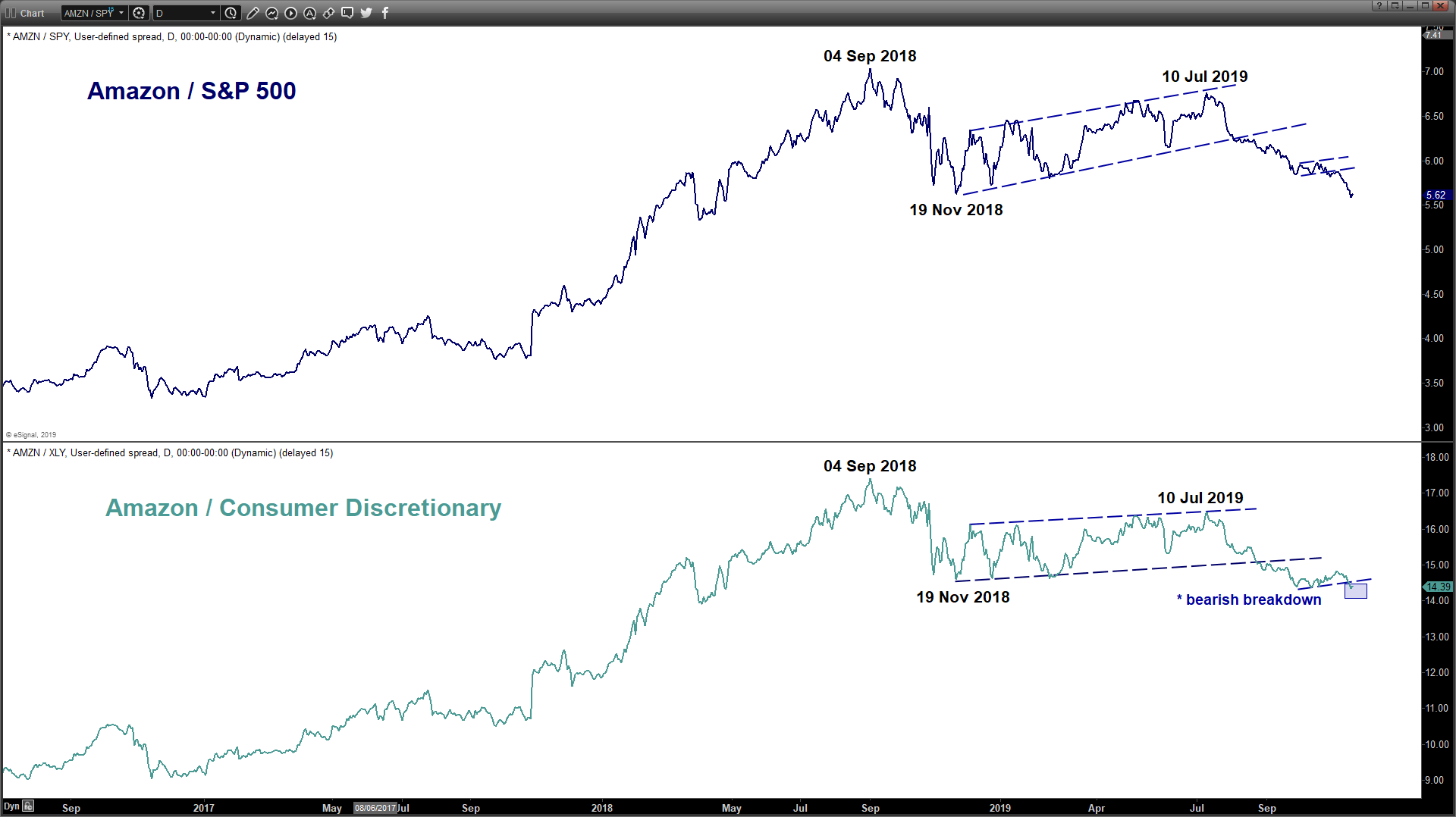

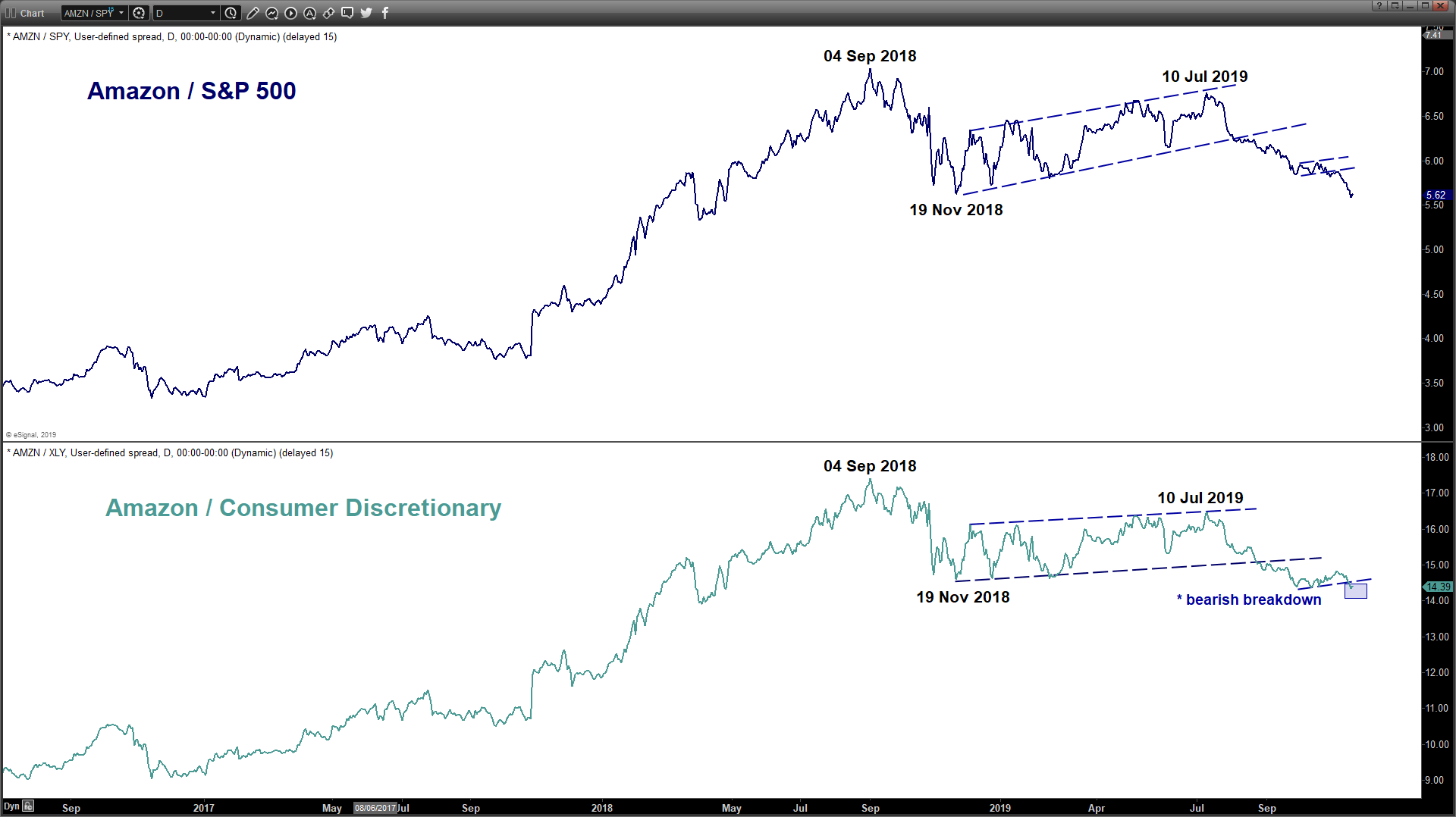

- Relative strength analysis from the ration charts of AMZN against the market (S&P 500) and its sector (Consumer Discretionary) are still advocating underperformance of AMZN.

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM