AM(a)Z(i)N(g) Amazon Hits Another Record High!

Ahead of next Thursday’s highly-anticipated earnings report, Amazon (AMZN) is almost single-handedly dragging cap-weighted US stock indices higher from the depths of the mid-March coronavirus-driven trough. After holding up better than the broader market amidst the February/March selloff (-22% drawdown for AMZN vs. -35% from the S&P 500), the stock is now leading the way higher and has set fresh record highs on each of the last three days.

The bull case, quite frankly, is so simple that a 5-year-old could comprehend it: There’s nowhere else to shop. Many small brick-and-mortar retailers across the globe have been forced to shutter operations, leaving “The Everything Store” as one of the few places (and certainly the most convenient) where consumers can meet their essential and discretionary needs, all without the need to leave the house and risk infection.

The company has been rapidly ramping up hiring at its warehouses to keep up with demand in recent weeks, its increasingly important Amazon Web Services (AWS) division has seen less disruption than many other businesses, and even Amazon Prime Video, a traditional laggard in the streaming space, is well positioned to capitalize on a populace cooped up inside with few alternative entertainment options.

In other words, Amazon is an amazingly successful business in the perfect position to increase its dominance through the COVID-19 health crisis, however long it ultimately lasts. That said, a great business doesn’t always translate to a great investment opportunity. At a high enough valuation, even the best businesses can see disappointing stock returns. With the company sporting a 103 P/E ratio, and an enterprise multiple (EV/EBITDA) of 30, well above any other so-called FAANG stocks, longer-term concerns about the company’s valuation are as valid as ever.

Of course, the trading graveyard is filled with bears citing AMZN’s elevated valuation figures over the years, so rather than making the same mistake that countless bears have made over the last decade, traders can utilize a trend following approach to take advantage of the current bullish momentum while it lasts and simultaneously seek to limit losses if/when the market becomes more focused on traditional valuation metrics.

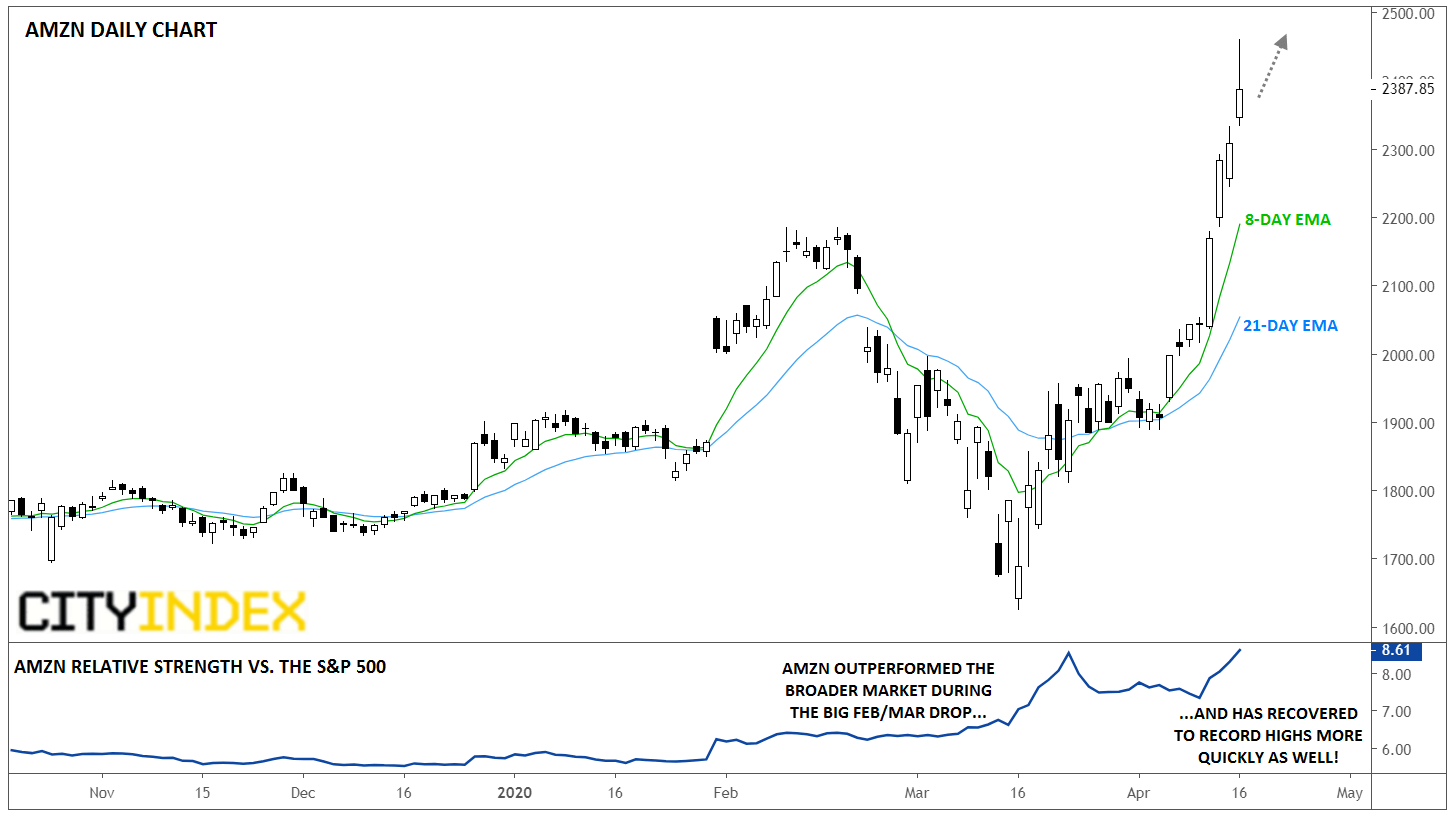

As the chart below shows, the stock is trading above its 8- and 21-day exponential moving averages, signaling that the short-term trend remains to the topside. If price falters in the coming days or weeks, a break below these indicators could signal a shift in trend, meaning that bulls may want to close their positions:

Source: TradingView, GAIN Capital

The specifics of such a strategy vary widely, but as a hypothetical example, current bulls could consider closing a third of their position if AMZN closes below its 8-day EMA, another third if it breaks its 21-day EMA, and the final third if the 8-day EMA crosses below the 21-day EMA.

We’ll have more coverage of AMZN’s critical earnings report in the coming days, but as always, we encourage readers to evaluate different strategies to limit risk while capitalizing on strongly trending markets…after all, there’s a reason that “the trend is your friend” is one of the first pieces of advice that many novice traders learn!