The latest surge in the iron ore price is on supply concerns after Brazilian miner Vale lowered its production forecast, falling steel inventories and as global demand picks up, the iron ore market is expected to remain tight into 2021.

An imbalance that overnight prompted a large US investment bank to revise higher its price forecast for iron ore, just one week after it upgraded its copper price forecast. All of which are supportive of the AUD.

However, events closer to home have also paved the way for continued strength in the AUD. Yesterday, the Westpac consumer confidence data series rose to its highest level since October 2010. It was the fourth straight monthly rise for the index and indicates that just eight months after the COVID19 slow down, consumer sentiment has completely recovered.

For those who have sympathy for the bullish AUD view though would prefer to sidestep the cross-currents involving the US dollar, AUD/NZD is a cross rate considering. More so given its resilience despite overnight weakness in U.S equity markets.

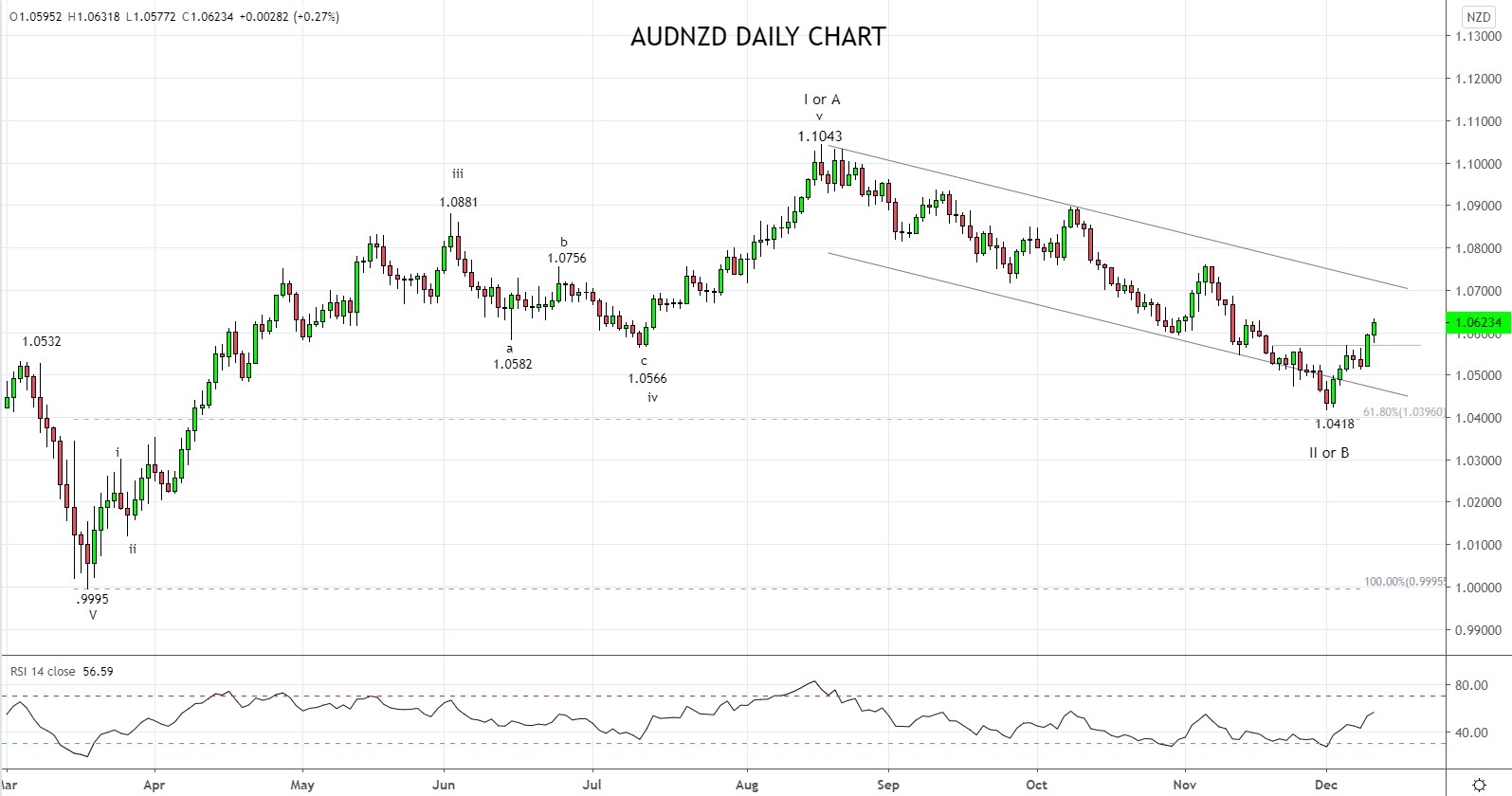

Technically the view is the retracement from the August 1.1043 high has been countertrend and the rebound from just ahead of the 61.8% Fibonacci retracement (of the March to August rally) at 1.0396, has provided initial confirmation a medium-term low is in place at the recent 1.0418 low and the uptrend has resumed.

Further confirmation, would be a break above trend channel resistance 1.0700/20 which would then allow the rally to extend towards 1.1000/50.

In light of this, traders may consider buying dips in AUD/NZD back towards support 1.0580/60 and with a stop loss placed just below 1.0500. The initial target would be 1.0700, before 1.0900, and beyond that 1.1050.

Source Tradingview. The figures stated areas of the 10th of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation