In many ways this week has provided a perfect storm for the AUDUSD to mount an upside challenge.

- Volatility has remained subdued as global equities spent the past week consolidating the strong gains of early November.

- The U.S. dollar as measured by the DXY index finally broke below the bottom of its four-month range, trading to a 2 ½ year low.

- Australian Q3 GDP data printed at 3.3%, well above expectations of 2.5% growth, driven by robust consumer spending.

- Upbeat comments from RBA Governor Lowe in a Statement to the House of Representatives including “Since we last met, the economic news has, on balance, been better than we were expecting.”

- Australia's trade surplus rose to A$7,456mn in October, beating expectations driven by a solid rebound in the value of iron ore exports.

Which brings me neatly round to the subject of commodities. Driven by strong demand from China and after Brazilian miner Vale lowered its production forecast, iron ore prices are trading at 6-year highs, near $136. The chart below illustrates the positive correlation between the price of iron ore and the AUDUSD.

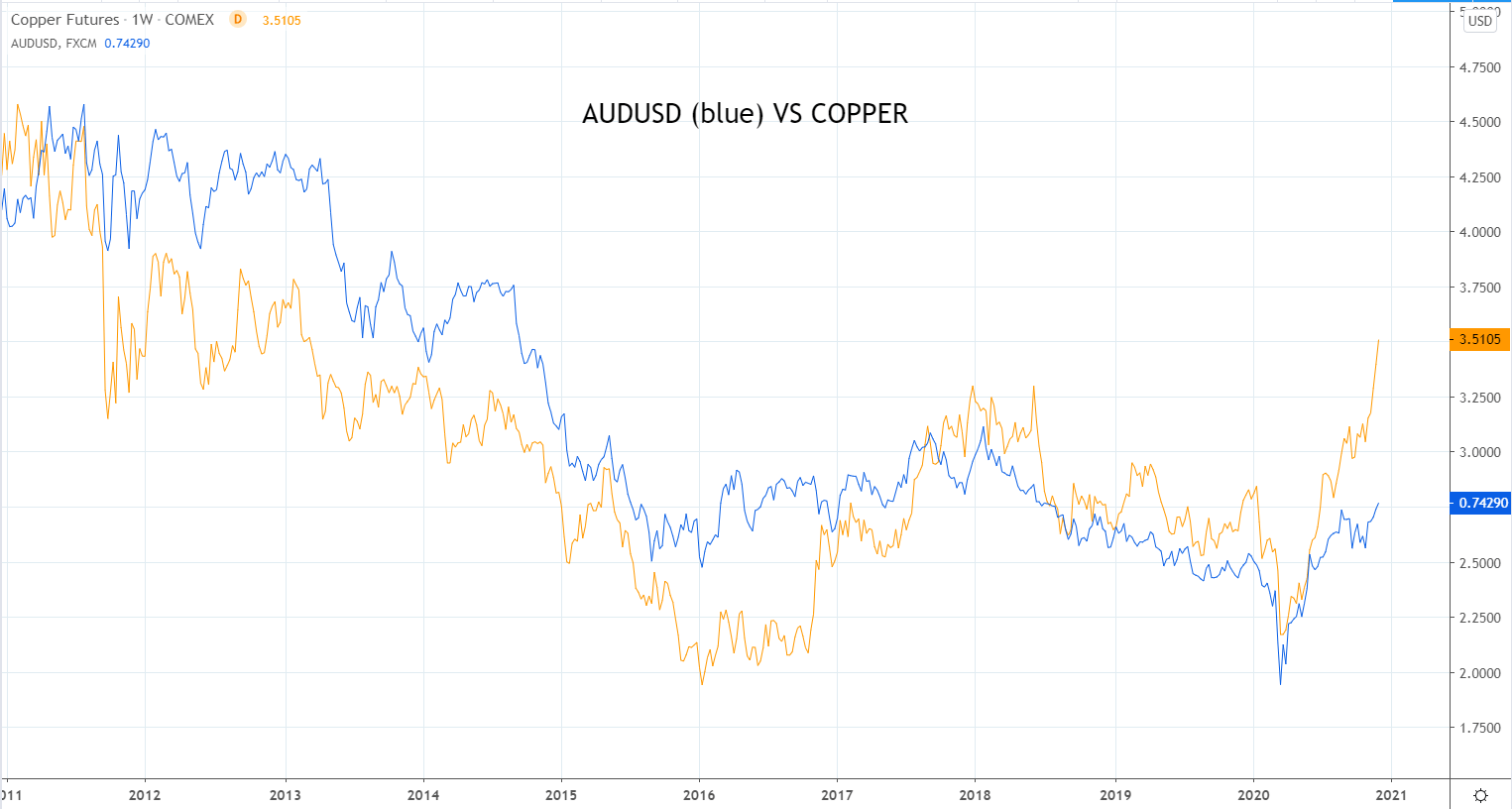

Key base metal, copper is up over 15% since the start of November, also on the back of supply shortages and strong demand. Analysts from Goldman Sachs see scope for the price of copper to rally from $7,700 towards $9,500 over the next 12 months, and highlight the upside risks. The chart below illustrates the positive correlation between the price of copper and the AUDUSD.

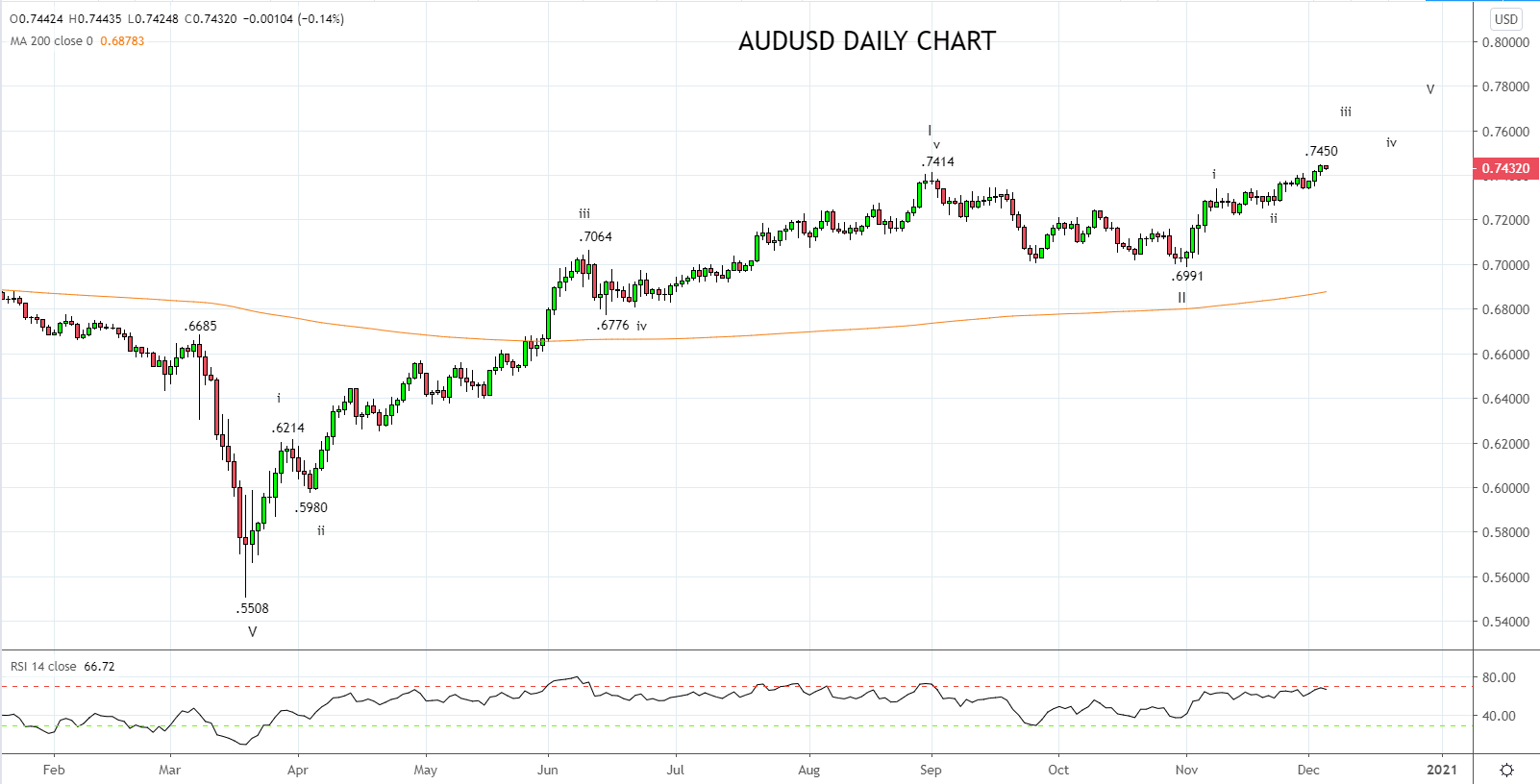

Technically, following the AUDUSD’s prompt recovery from month-end selling and the break above the .7414 high, the expectation is for the AUDUSD to push higher towards .7600c into yearend as part of a Wave iii to the upside.

Dips are likely to find support ahead of .7400c and again at .7360/50, with only a break/daily close below support at .7340/20 negating the positive bias.

Source Tradingview. The figures stated areas of the 4th of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product