Alibaba & Tencent: The Latest Twists and Turns

Alibaba (9988): No Upturn Signal Yet

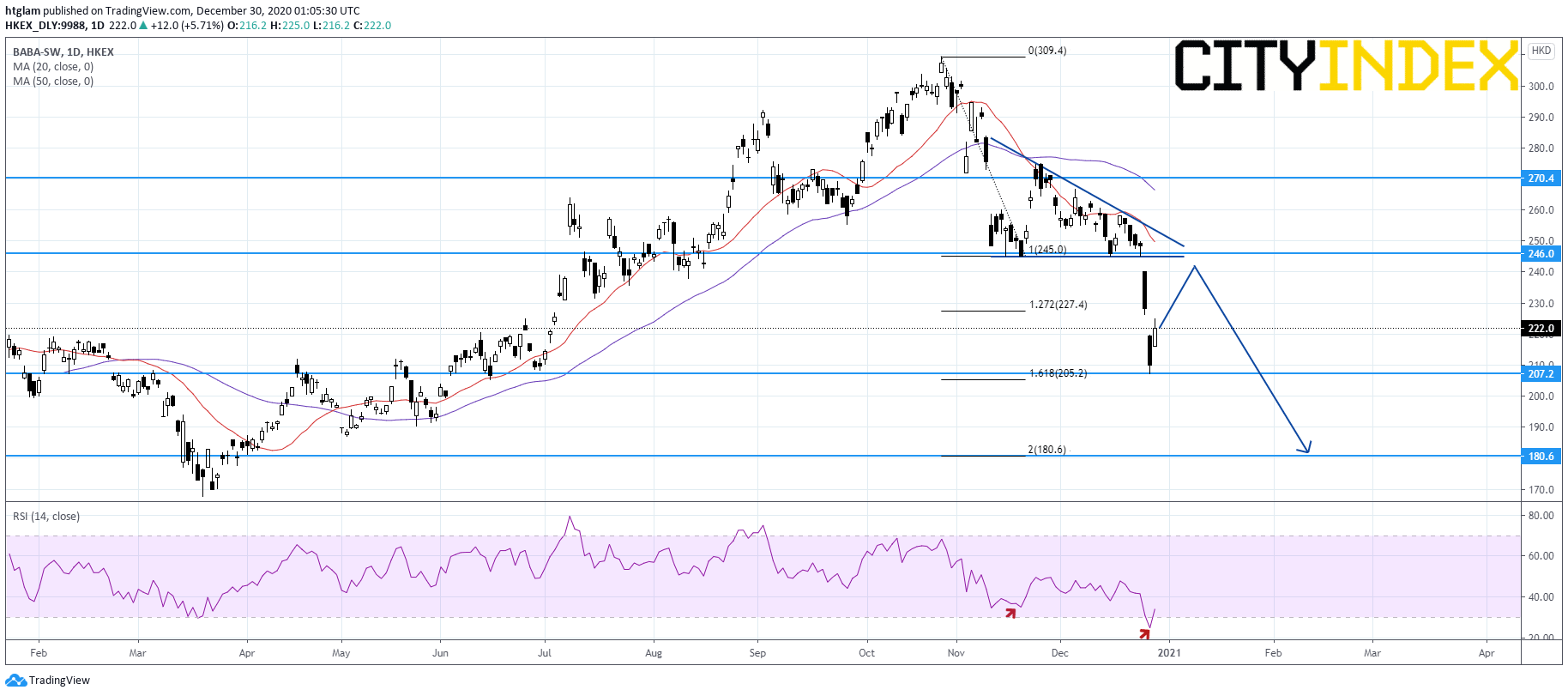

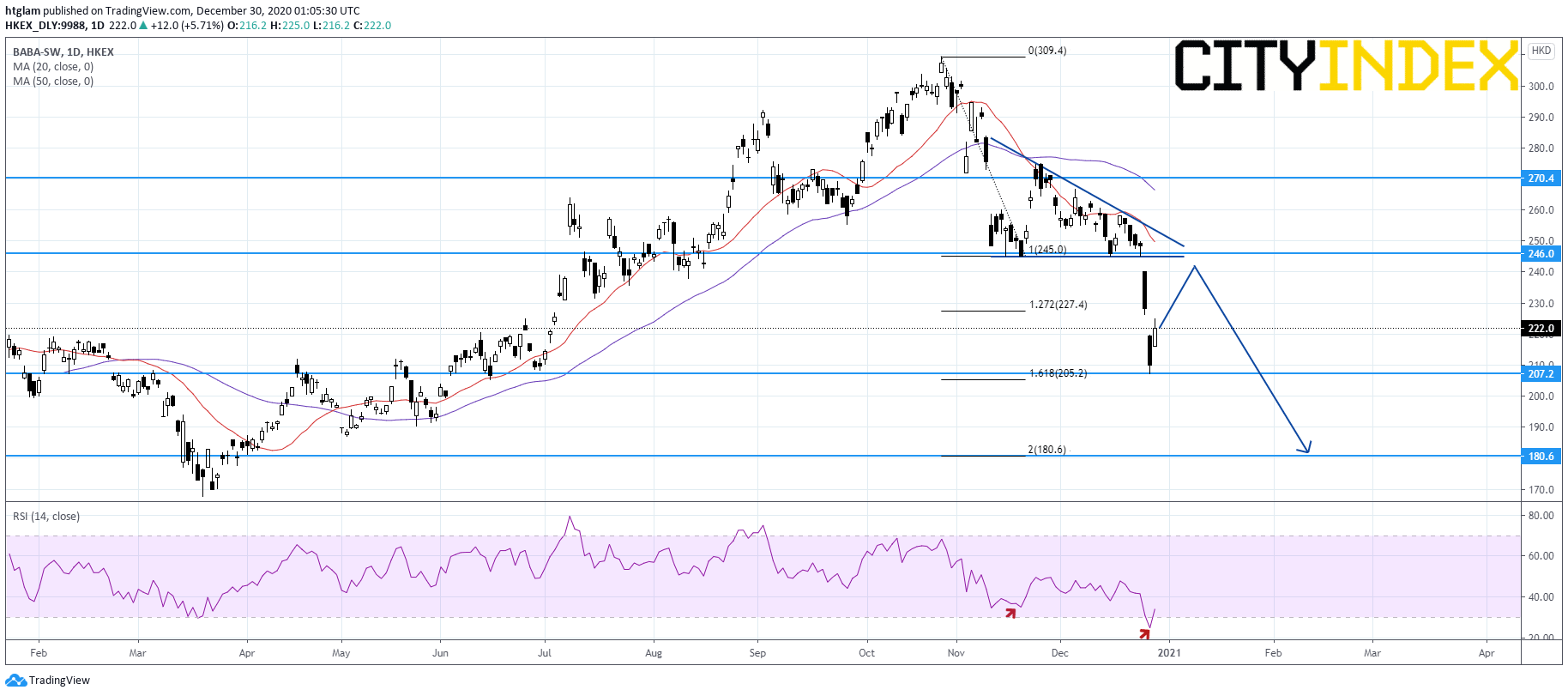

Chinese tech giant Alibaba's (9988) share price plunged 10.7% last week, amid concerns over antitrust scrutiny. The company announced on Monday that its board has authorized to upsize the company's share repurchase program from US$6 billion to US$10 billion through the end of 2022. Its share price has rebounded by more than 7% from Monday's low of HK$207.20.

Source: GAIN Capital, TradingView

Tecent (700): Downside Pressure Intensifies

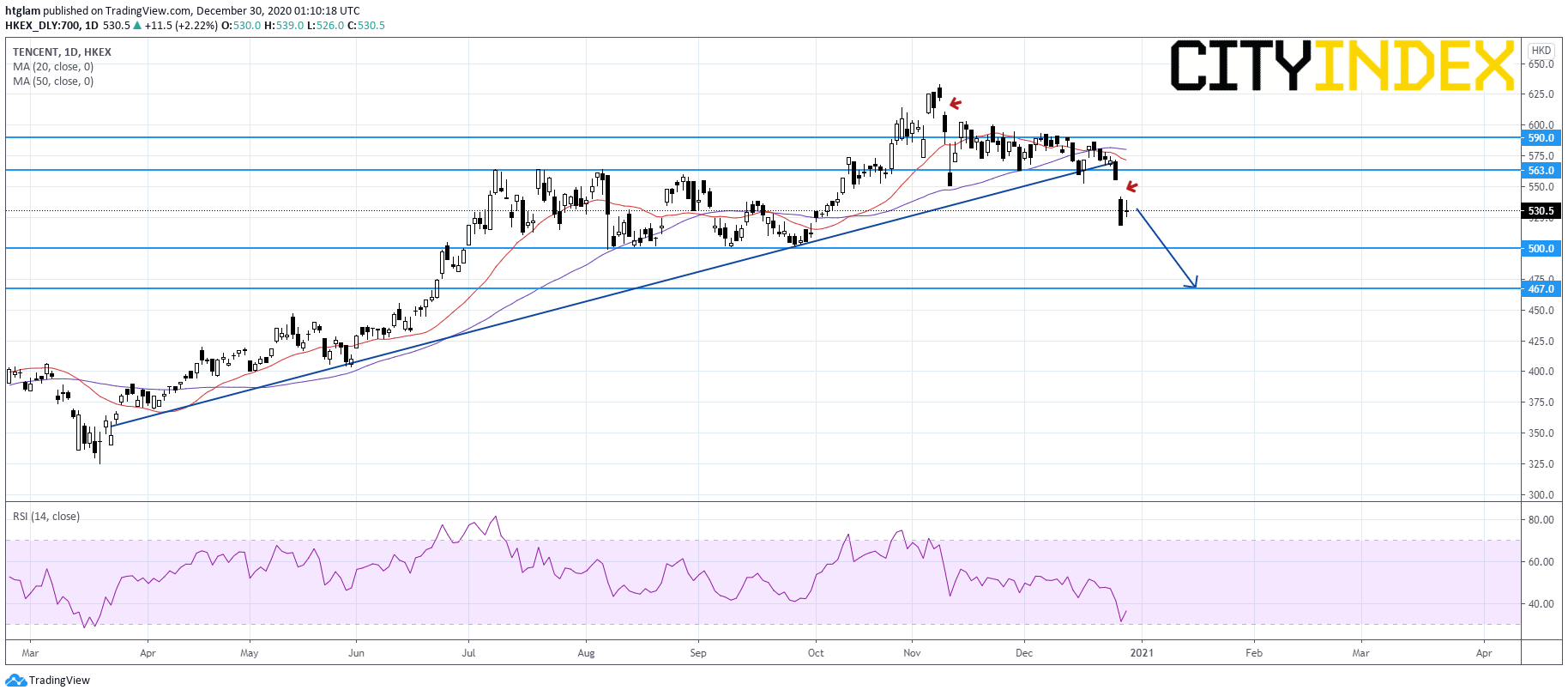

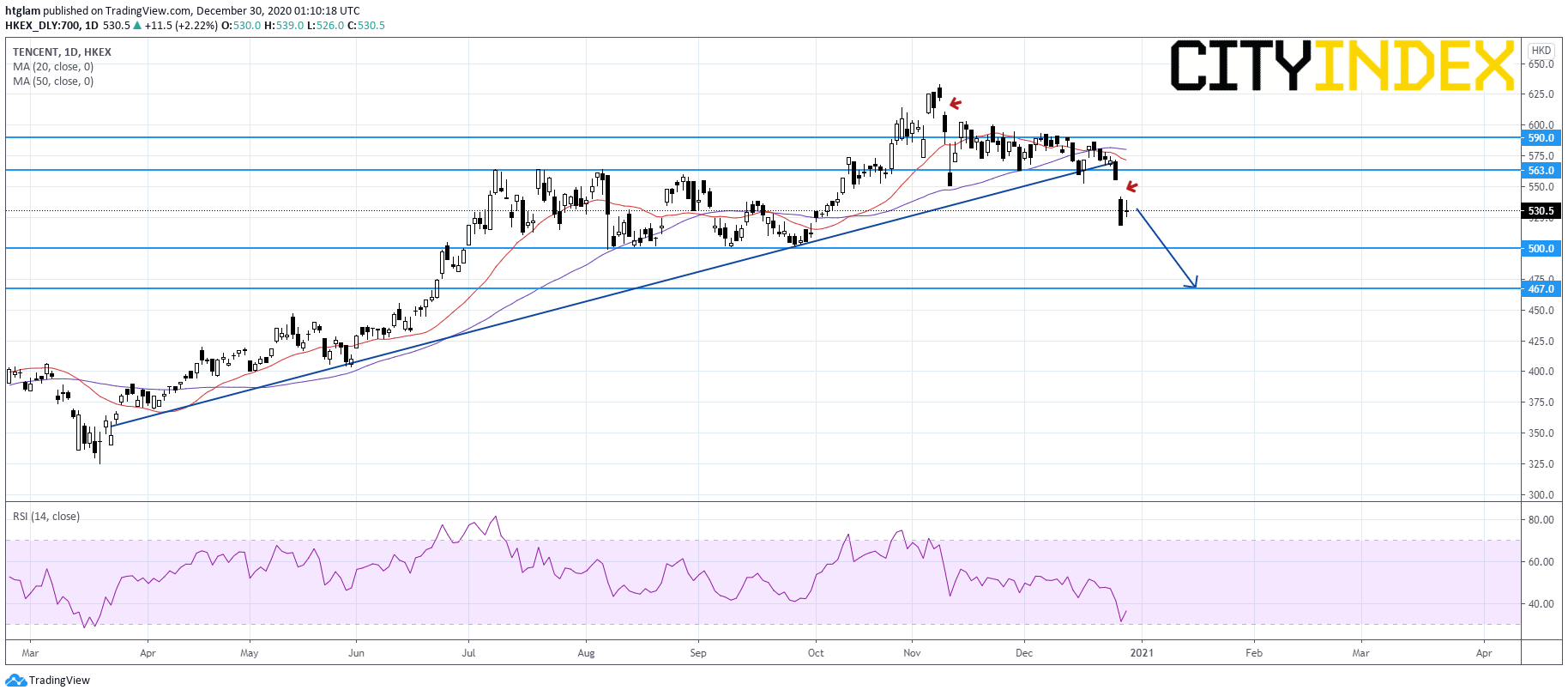

On a daily chart, Tecent (700) remains under pressure after breaking below a rising trend line drawn from March. In fact, it has formed a runaway gap on Monday, suggesting strong bear moves. The level at HK$563 may be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at HK$500 and HK$467 respectively.

Chinese tech giant Alibaba's (9988) share price plunged 10.7% last week, amid concerns over antitrust scrutiny. The company announced on Monday that its board has authorized to upsize the company's share repurchase program from US$6 billion to US$10 billion through the end of 2022. Its share price has rebounded by more than 7% from Monday's low of HK$207.20.

Source: GAIN Capital, TradingView

However on a daily chart, Alibaba (9988) has not yet confirmed an upturn despite the most recent rebound. It has stabilized after approaching the 161.8% Fibonacci extension level, however the relative strength index has not shown bullish divergence and its upside potential could be limited by the bottom of its previous trading range. The level at HK$246.00 might be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at HK$207.20 and HK$180.60 respectively.

Tecent (700): Downside Pressure Intensifies

Source: GAIN Capital, TradingView

Similarly, Tecent (700) has lost 4.1% in the prior week, the largest decline since September, as investors were worried that there might be more antitrust investigations into tech giants by Chinese regulator.

On a daily chart, Tecent (700) remains under pressure after breaking below a rising trend line drawn from March. In fact, it has formed a runaway gap on Monday, suggesting strong bear moves. The level at HK$563 may be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at HK$500 and HK$467 respectively.

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM