Alibaba’s strong quarterly story left investors cold, raising the bar for upcoming Baidu and Tencent earnings

Alibaba earnings surprised at top and bottom lines, apparently paving the way for a potentially pleasing run of earnings from the giant Chinese technology firms that will report earnings in coming days, but the shares have barely risen on Friday after the group’s quarterly report.

Here are some of the key financial details

Revenue CNY119.02bn vs. CNY116.69bn est., at top end of the range

Adjusted EPS CNY13.10, est. CNY10.66

Adjusted Ebitda CNY37.10bn, est. CNY34.49bn (range CNY28.49bn bn-CNY37.30bn

Cloud rev. CNY9.29bn, estimate CNY9.24bn

The group’s key metric of mobile monthly active users was also firm relative to expectations at 785 million, versus an estimate of 752.4 million.

Key sales themes were also positive, with the quarter buoyed by improved recommendation algos, a revamped grocery service and more appealing content, like live streams.

It looks like investors, who have already bid the stock up some 30% in a year of unprecedented uncertainty, were perturbed by comments made in a BABA’s post-earnings conference call. Vice chair Joe Tsai made clear that the group would double down on a strategy of pushing into what it has dubbed ‘lower-tier’ cities. “We can afford to be aggressive” he said. “We have the luxury”. The comments upended a rally by the stock in U.S. pre-market trading and pushed the shares lower, before they recouped to trade flattish at last look.

‘Lower-tier’ has been interpreted as lower-margin by the market, suggesting all sorts of negative optics amid a trade war that may or may not be about to cool down, depending on which conflicting headline was reported last.

Alibaba also disclosed that a one-time gain of CNY69.2bn (about $9.7bn) flattered these results. It’s linked to an equity interest in Ant Financial, the payment platform launched by co-founder Jack Ma. Elsewhere, though BABA’s cloud computing side, which competes with Microsoft, Amazon, Google and others, surged 64% in Q2, that represented a slowdown relative to prior quarters.

Perhaps the near-50% rise of rival JD.com speaks more volumes. The Beijing headquartered e-commerce group will report earnings in the middle of the month after posting record operating profit in the prior quarter. A strategic partnership with gaming giant Tencent, is also expected to drive mobile referrals via WeChat in ways that BABA has been tardy to match. Both face risks from mutual competitor Tencent, but JD’s ‘upstart’ status is currently playing better in the context of global challenges.

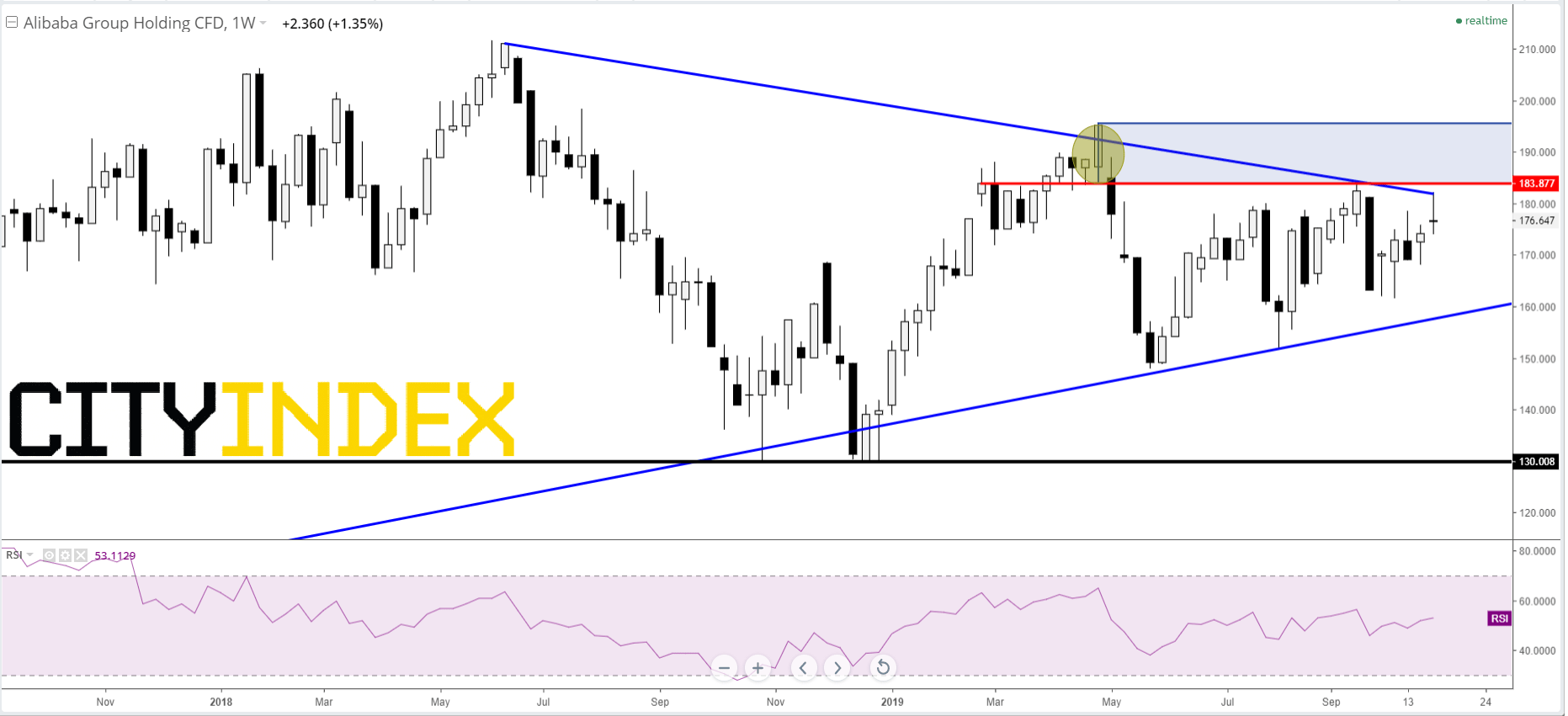

The market’s unimpressed earnings reaction almost certainly means that BABA’s bid to extend the year’s uptrend will continue to be challenged by zonal resistance that capped the year’s best levels in April. The September high of $183 will be the decider in the near term.

Alibaba CFD – Weekly

Source: City Index