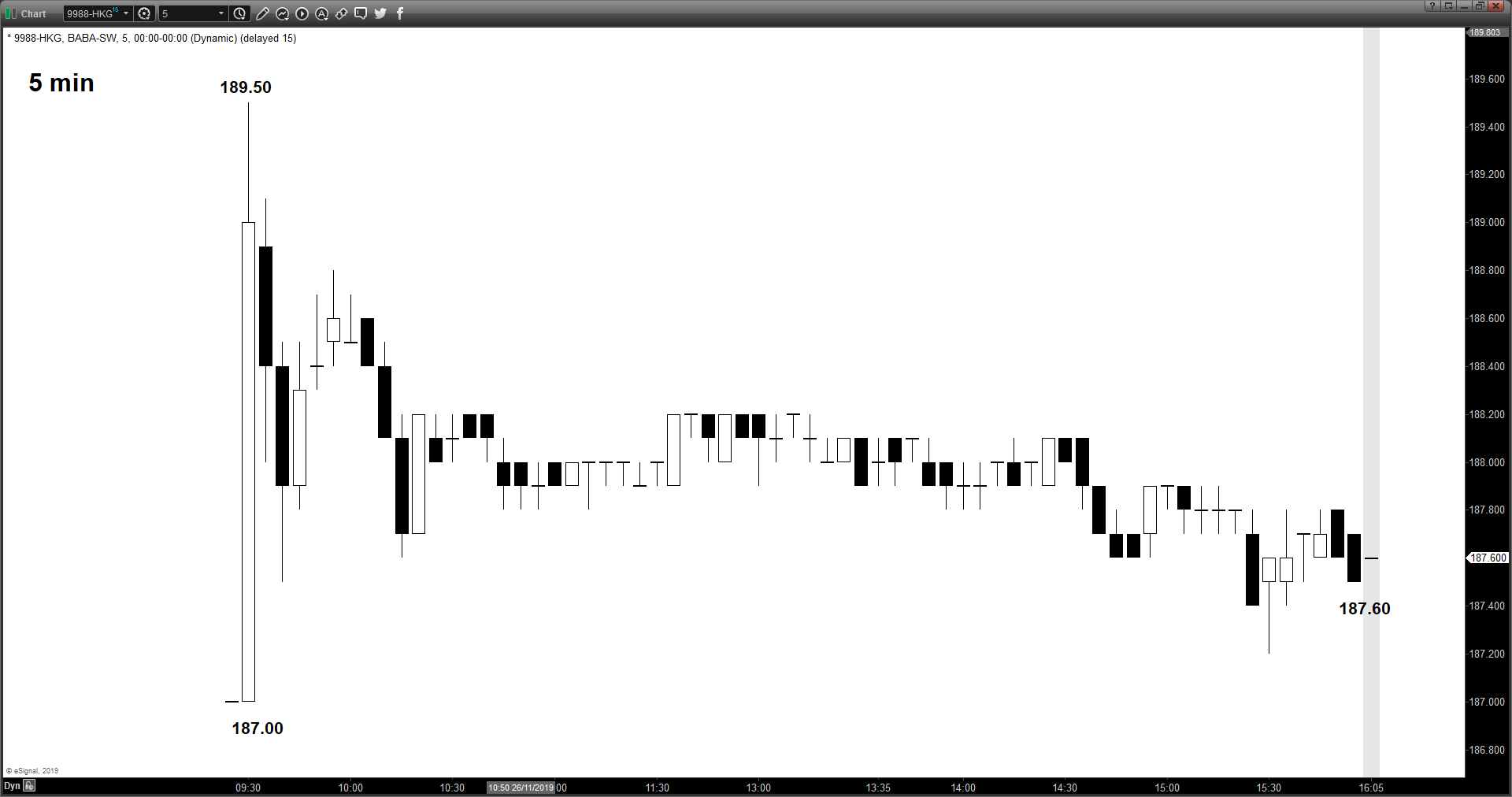

Alibaba’s secondary listing (9988 HKG) in Hong Kong has started out on a strong footing today where it has rallied to a high of HK$189.50 from its listing price of HK176.00; an intraday again of 7.67%.

Its secondary listing on the Hong Kong stock exchange (HKEX) has raised at least HK$ 92 billion (US$11.3 billion), marking it the world’s largest stock sale so far, ahead of Uber’s US$8.1 billion IPO and US$5.7 billion IPO for Anheuser-Busch InBev’s Asian brewing business in Hong Kong. Also, Alibaba’s secondary listing amount could climb to as much as US$12.9 billion if it chooses to exercise an over-allotment option within 30 days of the start of trade.

Interestingly, the “initial pop” has started to sizzle out towards the end of today’s trading session in Hong Kong where it closed at HK$187.60 (still a 6.6% gain from listing price) which also represents a small premium of 0.64% over its U.S. NYSE listed ADR (BABA) based on yesterday closing price of US$190.45 (8 Alibaba’s HK shares = 1 ADR in NYSE).

Alibaba HK (9988 HKG) – Closed near its intraday low

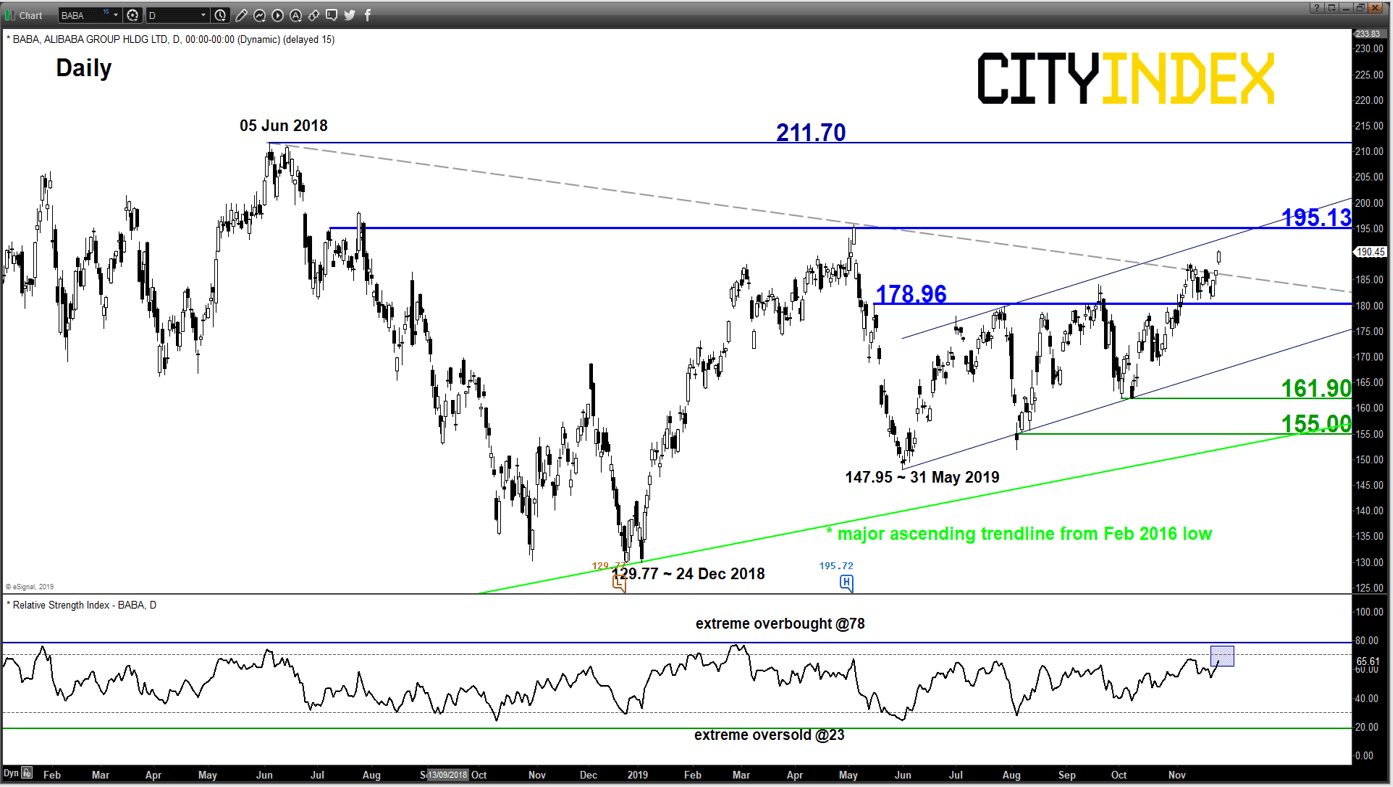

What does it mean for BABA listed in NYSE? (skeptical on the bullish breakout)

click to enlarge charts

- The unique feature of Alibaba’s secondary listing is that both the Hong Kong and New York stocks are fungible where investors can buy and sell the same shares on either exchange. For example, a trader can establish a long position in New York and closed the initial long position in Hong Kong.

- Yesterday’s price action of BABA can be considered as bullish if seen from a price action perspective where it has rallied by 1.96%, outperformed both the S&P 500 (0.75%) and Nasdaq 100 (1.21%) and broke above a descending resistance from its 211.70 all-time high printed on 05 Jun 2018.

- However, it we consider today’s oversubscribed secondary listing in Hong Kong and the fungibility nature of its shares. Yesterday’s push up in BABA may be driven by short-term traders that are eying for an intraday gain by establishing long positions on NYSE and squaring/closed out their overnight U.S. positions when the Alibaba starts trading in Hong Kong today.

- Thus, we are skeptical on yesterday’s bullish breakout seen in BABA where it can be driven by short-term profit-seeking mentality to take advantage of its oversubscribed secondary listing.

- We prefer to have a neutral stance on BABA for now between 195.13 (a medium-term ascending channel resistance from 31 May 2019 low, swing high areas of 09 Jul/03 May 2019 & a Fibonacci expansion cluster) and 178.96. Bears need see a breakdown below 178.96 for a potential multi-week decline to target the major range configuration support zone at 161.90/155.00. On the flipside, a daily close above 195.13 opens up scope for a further rally to retest its all-time high at 211.70.

- On the macro front, U.S-China trade related issues and continuation of social unrest in Hong Kong can also dent the optimism in BABA. In today’s earlier Asia session, repetitive optimistic trade deal headline from one of China official media, Xinhua has muted effect where the Hang Seng Index (HSI) and China A50 have erased earlier intraday gains. The HSI has ended today’s session with a modest loss of -029% while China A50 closed almost unchanged.

Charts are from eSignal

Related analysis:

Alibaba HKD88 billion listing may not be so auspicious for BABA

Why Alibaba’s HK launch dips for victory