Medium-term technical outlook on Alibaba (BABA)

click to enlarge charts

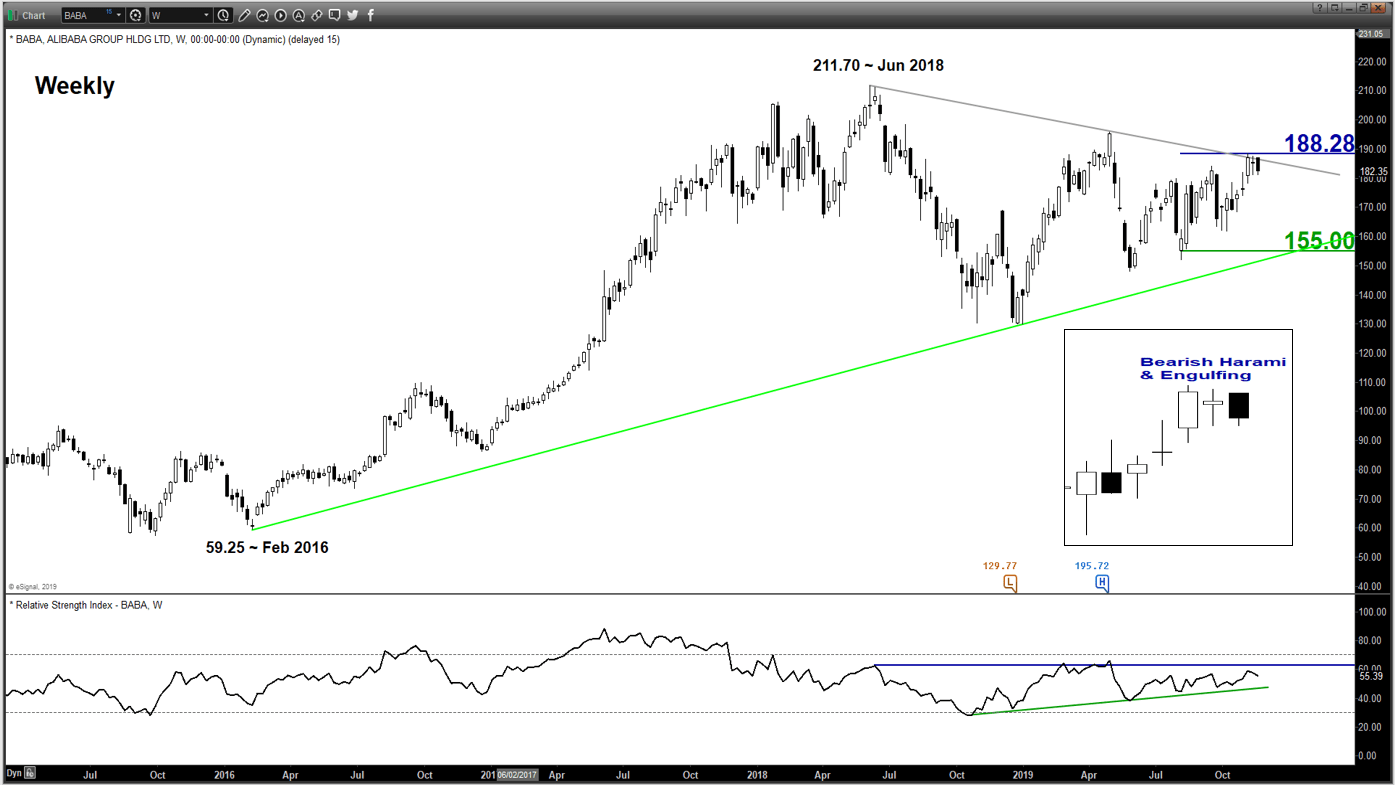

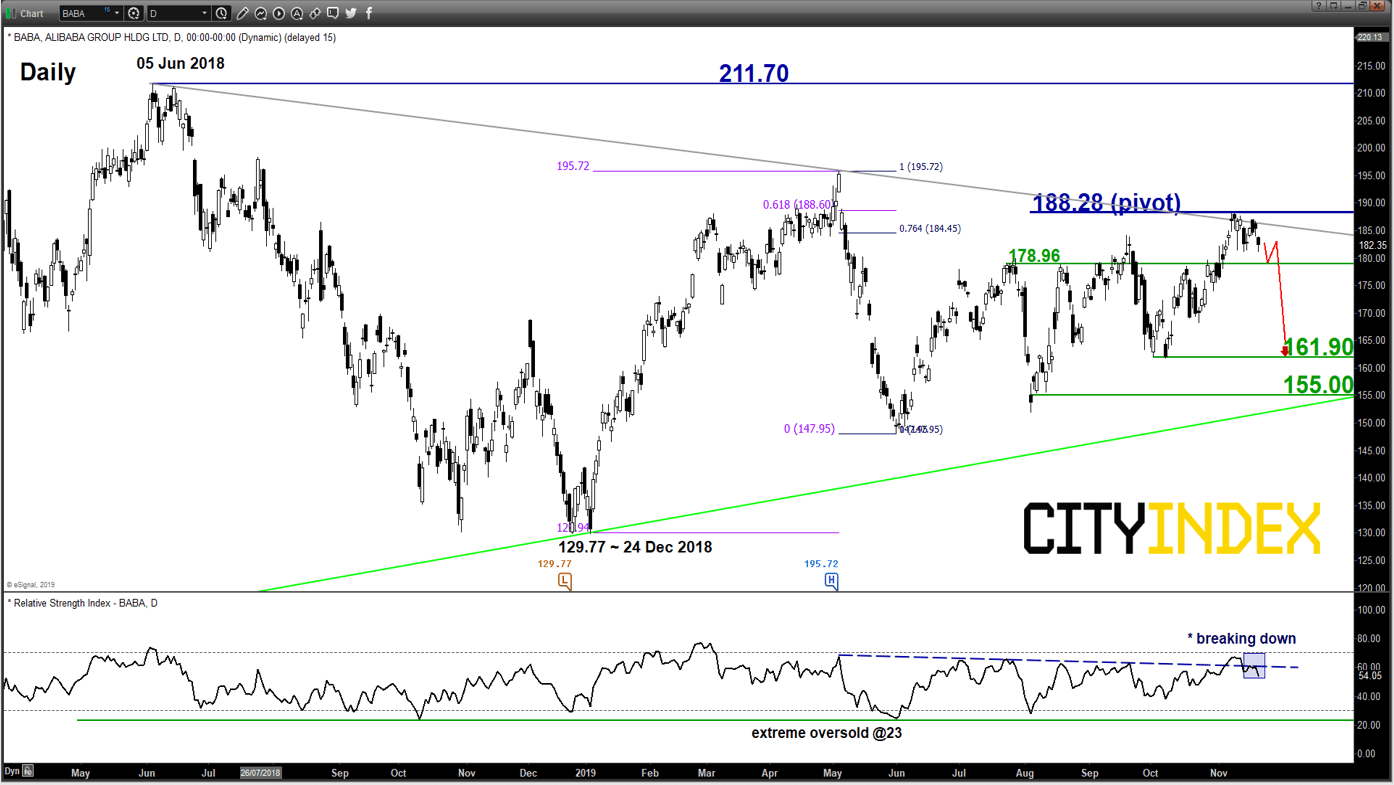

Key Levels (1 to 3 weeks)

Pivot (key resistance): 188.28

Supports: 178.96 (trigger), 161.90 & 155.00

Next resistance: 211.70

Directional Bias (1 to 3 weeks)

BABA is at risk for a corrective decline within a major “Symmetrical Triangle” range configuration in place since 24 Dec 2018 low. 188.28 key medium-term pivotal resistance and a break below 178.96 is likely to reinforce a potential drop to target the next support at 161.90 max 155.00.

However, a clearance with a daily close above 188.28 invalidates the medium-term bearish scenario for a bullish breakout to retest its current all-time high at 211.70.

Key elements

- Since its all-time of 211.70 printed in Jun 2018, further advances of BABA have been capped by a major descending trendline resistance where its price action has been rejected last week, the 2nd time since Apr 2019.

- Last week’s price action has formed a weekly “Bearish Harami” candlestick pattern with an impending follow through weekly “Bearish Engulfing” candlestick based on yesterday, 20 Nov closing price (2 more days before the end of this week). These observations suggest a potential bearish reversal in price action after a multi-week up move.

- The 188.28 key medium-term resistance is defined by a confluence of elements; the major descending trendline from Jun 2018, the gapped down formed on 06 May 2019 and a Fibonacci retracement/expansion cluster.

- The daily RSI oscillator has reintegrated back below a significant corresponding resistance at the 60 level which indicates the recent upside momentum of price action has started to wane.

Charts are from eSignal

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM