Alibaba Group (9988.HK): Potential Downturn Signals

On Wednesday, the U.S. Senate passed a legislation that require companies to certify that they are not under the control of a foreign government and would be banned from the U.S. exchanges if they fail to do so. Yesterday, House Speaker Nancy Pelosi said the House will review the bill. Alibaba Group (9988.HK), a Chinese tech giant dual-listed on NYSE and HKEX, would be vulnerable to such legislation.

To make things worse, the Hong Kong Hang Seng Index is down by more than 3% during early Asian trading hours today, amid hostile political environment in the city. Chinese Premier Li Keqiang said China "will establish sound legal systems and enforcement mechanisms for safeguarding national security in the two special administrative regions (Hong Kong and Macau)", a move that has been seen as curtailing protests and democratic movements in Hong Kong. Earlier, U.S. President Donald Trump warned that he "will address that issue very strongly".

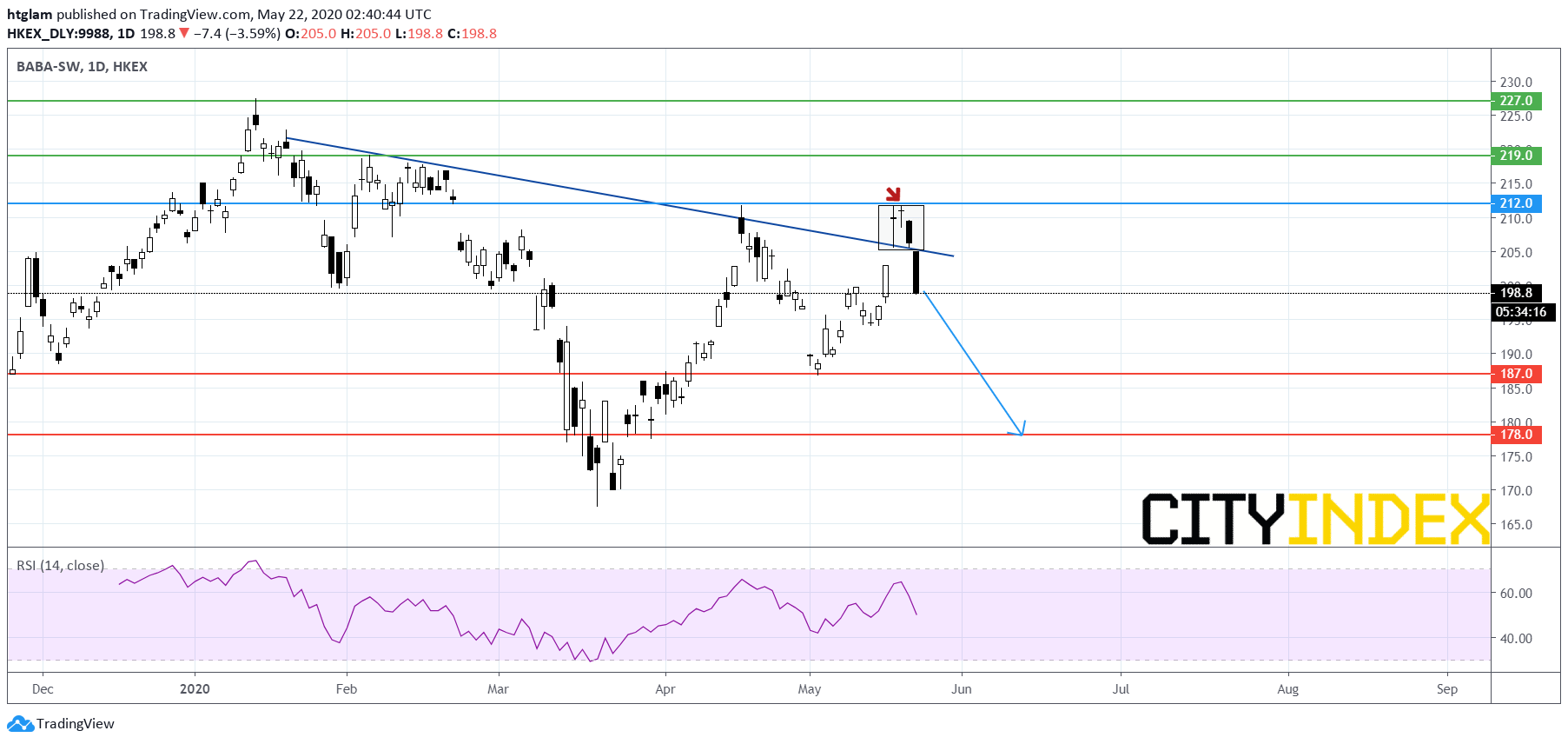

From a technical point of view, Alibaba Group (9988.HK) has shown potential downturn signals on the daily chart. It has possibly formed a double-top pattern, while a bearish evening star candlestick was seen on Wednesday. In addition, it has quickly returned to levels below a declining trend line, probably suggesting a false breakout. The level at $212.0 might be considered as the nearest resistance, with prices likely to test the 1st and 2nd support at $187.0 and $178.0 respectively. Alternatively, a break above $212.0 would open a path to the next resistance at $219.0.

Source: TradingView, Gain Capital