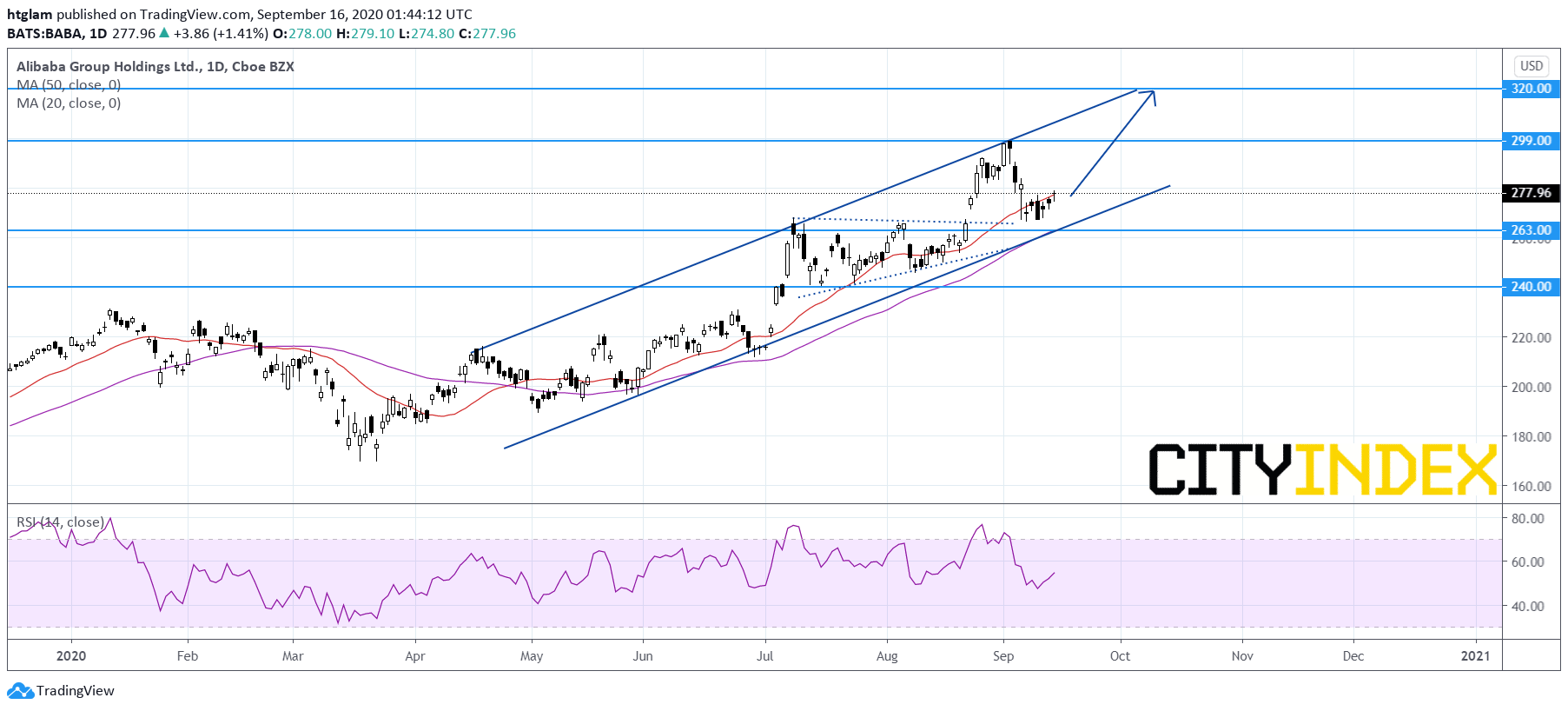

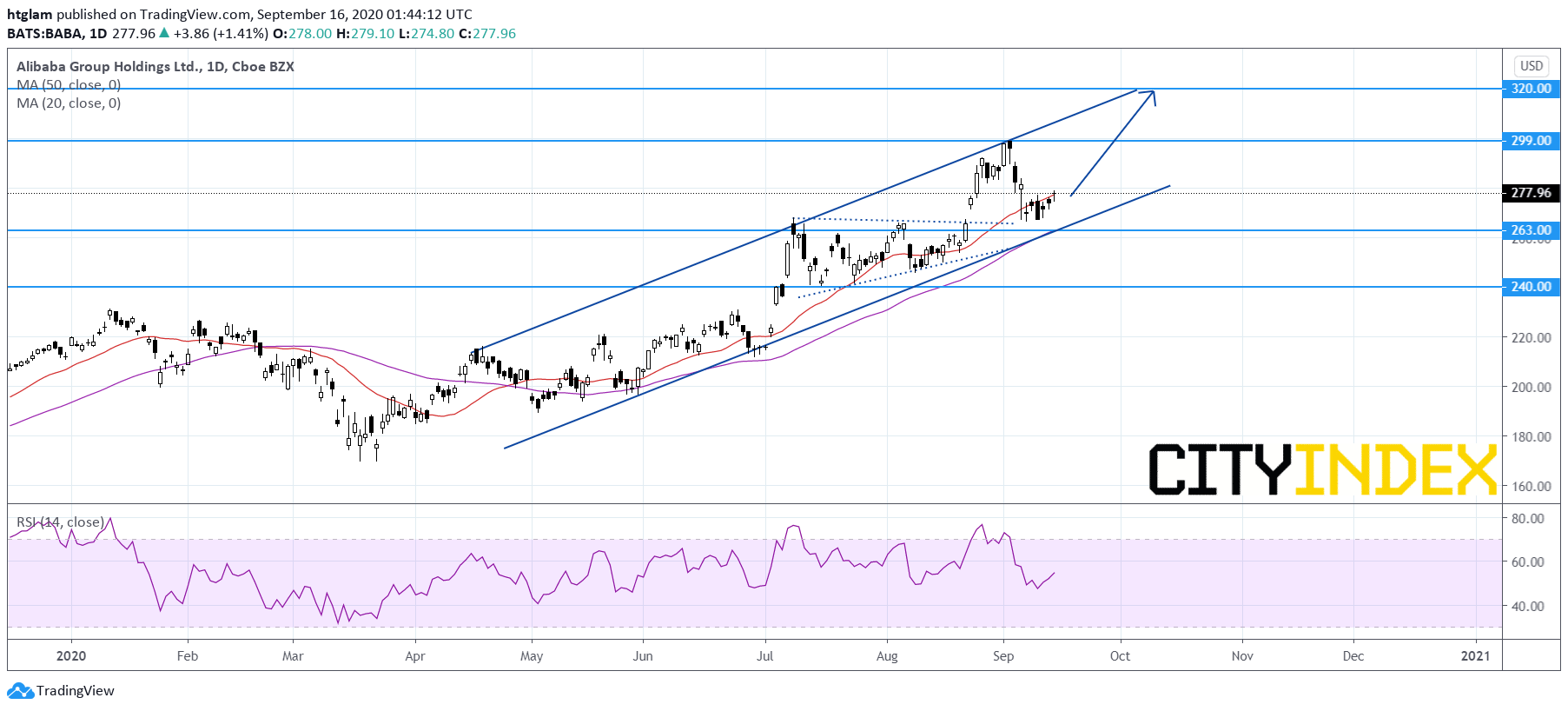

Alibaba Group (BABA): Bullish Channel Intact

Alibaba Group (BABA) continues to expand its footprint globally as Bloomberg reported that the Chinese tech giant is in talks to invest 3 billion dollars in Southeast Asian ride-hailing company Grab. Meanwhile, Alibaba's planned 30 billion dollars dual-listing for its fintech arm Ant Group could come as soon as October, according to Chinese media.

From a technical point of view, Alibaba Group (BABA) maintains its bullish momentum as shown on the daily chart. Despite a modest pull-back, a bullish channel drawn from April remains intact. The level at $263.00 may be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $299.00 and $320.00 respectively.

Source: Gain Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM