Alibaba (9988.hk): New High with Less Convincing Technical Indicators

On the other hand, Fitch Ratings has affirmed Alibaba Group's "A+" credit rating, outlook "Stable". The rating agency said "the affirmation underscores Alibaba's very strong business profile, large economies of scale, strengths in digital economy, increased revenue diversity, continued robust profitability, high free cash flow generation and conservative capital structure".

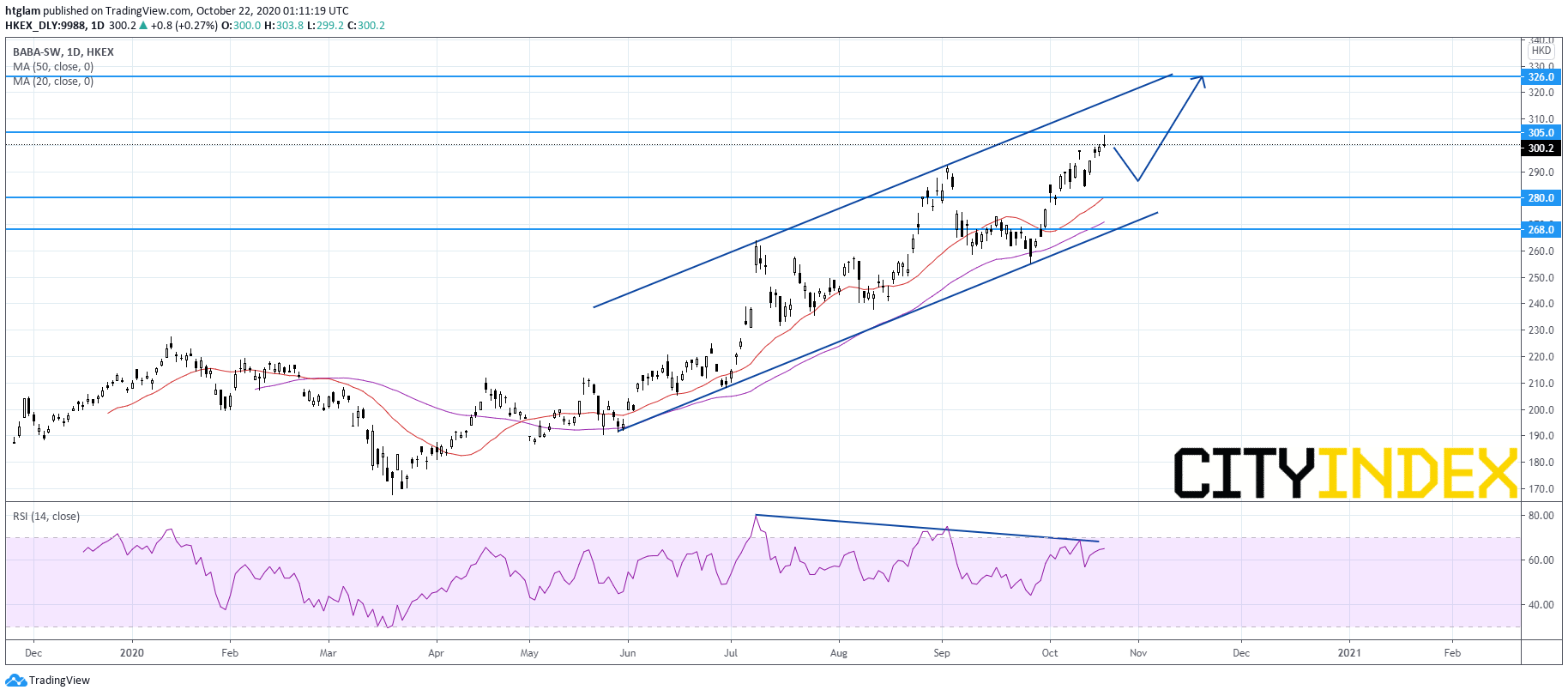

From a technical point of view, Alibaba Group (9988.hk) remains trading within a bullish channel drawn from May as shown on the daily chart. However, it has reached a new high on Wednesday with a less convincing candlestick again, while the relative strength index continues to show bearish divergence. Therefore, investors might have to remain cautious as consolidation might be due before the next rally. The level at $280 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $305 and $326 respectively.

Source: Gain Capital, TradingView