AIA Group (1299.HK): Challenges the Historical High Level

AIA Group (1299) announced that the value of new business (VONB) was up 22% on quarter to $706 million, down 28% on year. Annualised new premiums (ANP) grew 21% on quarter to $1,359 million, down 6% on year. The stock rises 5% today, lifted by the rally of the global market on the news of the vaccine.

Goldman Sachs said the company's 3Q VONB beat Goldman Sachs forecast of $670 million. The bank added "the group tracked strong revival in ASEAN markets, with more than doubled QoQ VONB in Singapore and Malaysia for 3Q20, notably above 3Q19's level." In addition, the Bank kept the company on Conviction Buy list with a target price at HK$85.

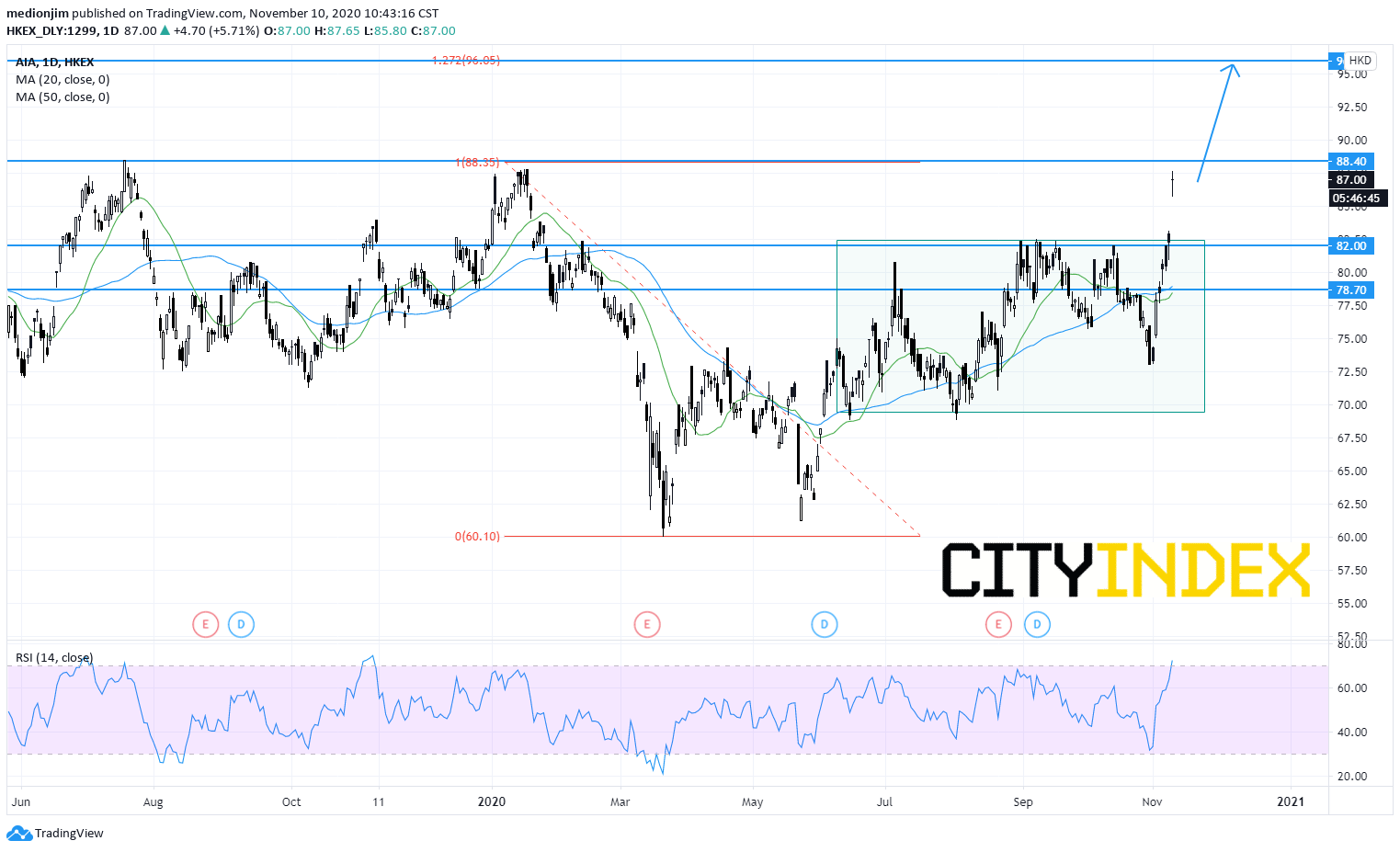

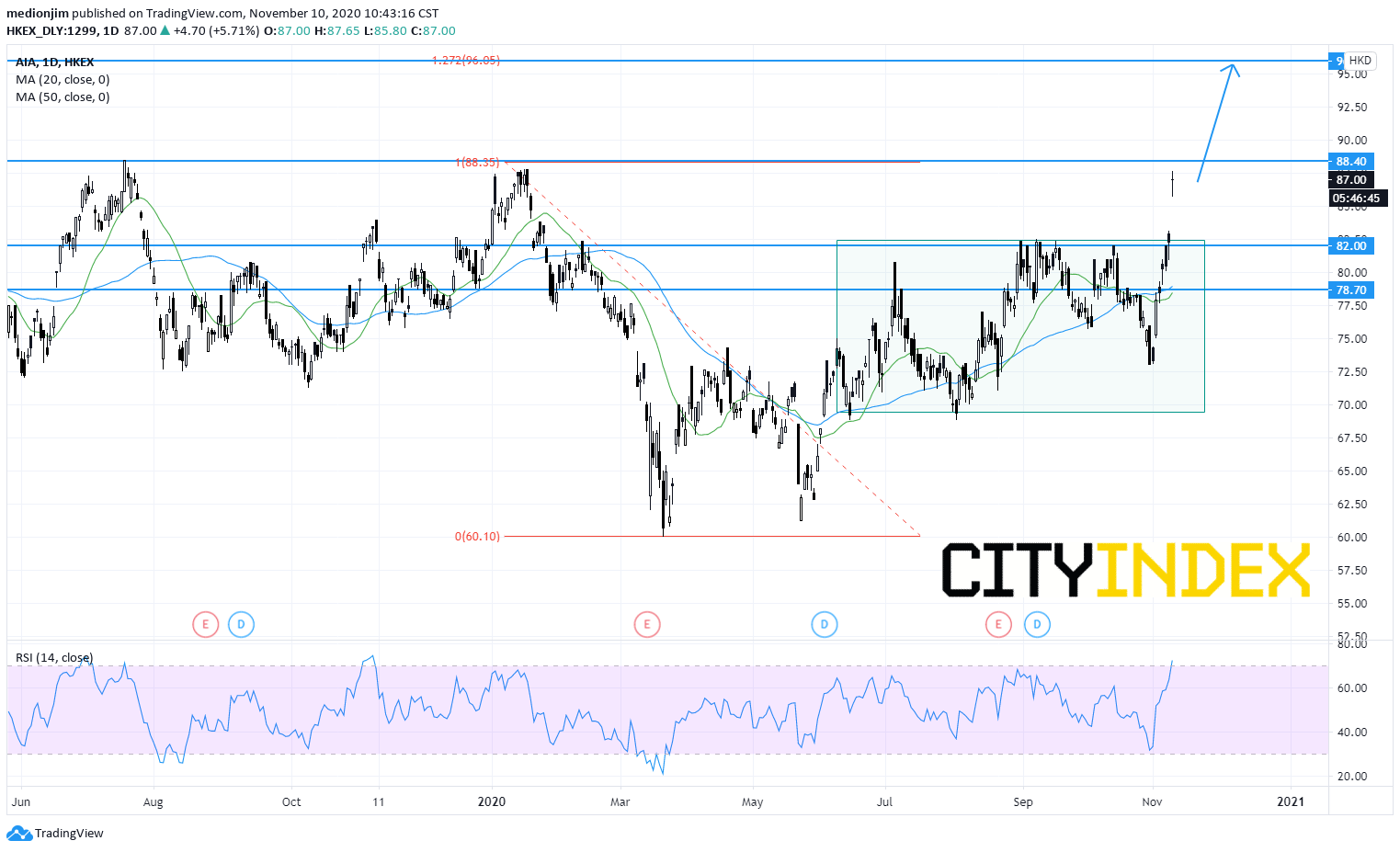

From a technical point of view, the stock posted a bullish gap and broke above the consolidation zone. The RSI is above its overbought level at 70, but has not displayed any reversal signal.

Bullish readers could set the support level at HK$82.00, while resistance levels would be located at HK$88.40 (historical high) and HK$96.00

Source: GAIN Capital, TradingView

Goldman Sachs said the company's 3Q VONB beat Goldman Sachs forecast of $670 million. The bank added "the group tracked strong revival in ASEAN markets, with more than doubled QoQ VONB in Singapore and Malaysia for 3Q20, notably above 3Q19's level." In addition, the Bank kept the company on Conviction Buy list with a target price at HK$85.

From a technical point of view, the stock posted a bullish gap and broke above the consolidation zone. The RSI is above its overbought level at 70, but has not displayed any reversal signal.

Bullish readers could set the support level at HK$82.00, while resistance levels would be located at HK$88.40 (historical high) and HK$96.00

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM